23 December 2024

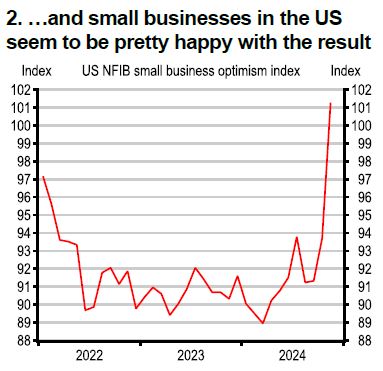

2025 promises to be an eventful year for politics, geopolitics, economics and policy. Since the US election in November, a still-robust US economy, expectations of corporate tax cuts, a broad deregulatory agenda and, seemingly, a view that the worst outcomes for global trade will be avoided, have pushed up US stocks. China has also suggested looser monetary and fiscal policy to support growth.

While there is a great deal of uncertainty ahead, we have taken a view on the likely sequencing of US government policy. We expect talks of tax cuts and quick action on trade tariffs and immigration soon after the US presidential inauguration on 20 Jan but investors may hope the new administration treads a little more cautiously than feared on fiscal, immigration and trade-related measures that could reignite inflation.

Source: Macrobond

Source: Macrobond

Consumer spending is likely to remain the major growth engine next year. We think consumers in Europe and mainland China may finally open their pockets a little wider, on the back of improving real wages and falling interest rates in the former and government-led stimulus in the latter. Improving job prospects and property prices will be needed to sustain any consumer spending uplift in China.

Any meaningful improvement in investment in much of the world seemingly hinges either on the public sector directly – for infrastructure and defence spending – and/or indirectly through more active industrial policy. Could 2025 finally be the year that the enormous IRA and CHIPS act-fuelled manufacturing investment boom in the US sees a positive payback in a revival in industrial production and productivity?

The global industrial cycle, even for areas of electronics, looks to be softening. Our trade forecasts are the main areas that we have trimmed given the prospect of an escalation in tariffs. We recently lowered our world export volume forecast for 2025 from 3.5% to 1.9%, although trade may not soften immediately as shipments are frontloaded ahead of new tariffs.

It is clear that Trump intends to use tariffs as a means of addressing not just trade imbalances but a range of other policy priorities, from drugs to immigration control. So while we cannot know the precise timing or magnitude, tariffs on some economies and products appear inevitable, impacting on profits and inflation in the US (and in trading partners if there is retaliation) and weighing on global trade flows and sentiment.

Major trading economies are, therefore, looking to strengthen relationships elsewhere. In the past, big stimulus in China offered opportunities for European manufacturing exporters. But this time it appears China’s policy support will target consumption and many firms are fearful that higher US tariffs on China could result in more trade-diversion towards Europe, Asia and elsewhere, triggering further trade restrictions between third countries and an additional hit to world trade growth.

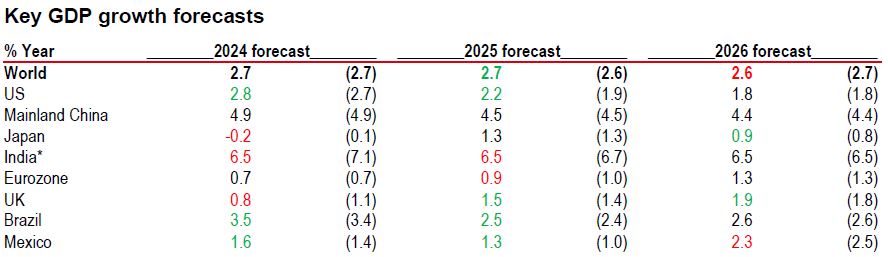

The revisions to our global growth forecasts are small at this point and the biggest country revisions are upwards to Spain and downwards to Poland. In some regions like mainland China, the reduction in our export growth forecast should be offset by the impact of forthcoming fiscal stimulus.

Note: *India data is calendar year forecast here for comparability. Previous forecasts are shown in parenthesis and are from the Macro Monthly dated 11 July 2024.

Green indicates an upward revision, red indicates a downward revision.

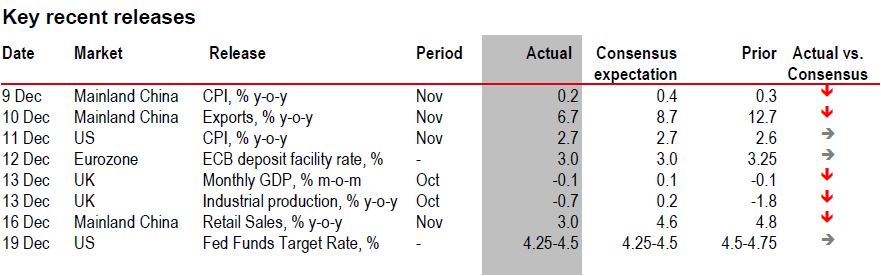

Source: Bloomberg, HSBC Economics

Changes to our global inflation forecasts are also modest but they are higher. Our 2025 projection rose from 3.3% to 3.4%, all explained by the developed world which increased from 2.3% to 2.5% with a notable rise in Japan. The lack of an upward revision to the emerging market aggregate of 4% is only because of a reduction in our forecast for China from 1.1% to 0.6% which more than offsets an increase in our Brazil inflation forecast.

In 2025 the impact of potential US tariffs and retaliation risks adding to inflation (and hurting growth) while in some countries the bigger threat to inflation comes from the rise in food prices, which can also hit growth and raise inflation perceptions. Surging coffee and cocoa prices are grabbing the headlines, but domestic harvests played the major role in lifting prices in India, where food makes up nearly half of the CPI basket.

Despite those uncertainties on inflation, which in some countries will be exacerbated by currency depreciation, we still see scope for rate cuts in many economies in 2025, with the key exceptions of Brazil, set to deliver further hefty rate rises in the early months of the year, and the Bank of Japan on track for more gradual modest ones. In Asia, we forecast short and/or shallow easing cycles, that would likely be even shallower if the Federal Reserve cuts by less than we forecast.

We see the US slowing the pace of easing in 2025, lowering the Fed funds rate to 3.5-3.75% by end-2025, then staying on hold. We expect the European Central Bank to cut policy rates to a trough of 2.25%, which means an earlier halt to the easing cycle than current market pricing implies, while the Bank of England looks set to lag other G10 central banks which have been cutting more rapidly.

Source: Bloomberg, HSBC

⬆Positive surprise – actual is higher than consensus, ⬇ Negative surprise – actual is lower than consensus, ➡ Actual is in line with consensus

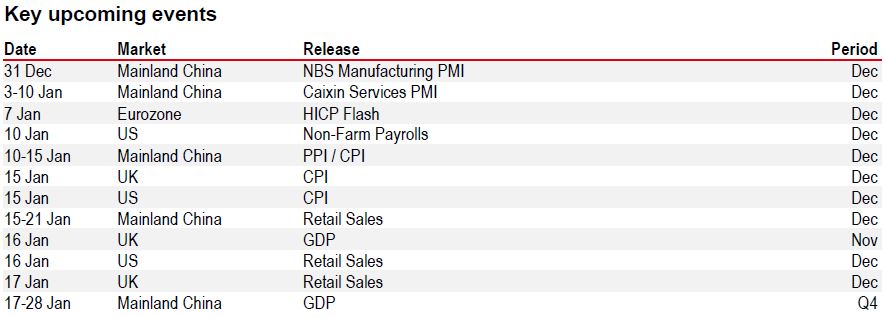

Source: Refinitiv Eikon, HSBC

Additional disclosures

1. This report is dated as at 20 December 2024.

2. All market data included in this report are dated as at close 19 December 2024, unless a different date and/or a specific time of day is indicated in the report.

3. HSBC has procedures in place to identify and manage any potential conflicts of interest that arise in connection with its Research business. HSBC's analysts and its other staff who are involved in the preparation and dissemination of Research operate and have a management reporting line independent of HSBC's Investment Banking business.Information Barrier procedures are in place between the Investment Banking, Principal Trading, and Research businesses to ensure that any confidential and/or price sensitive information is handled in an appropriate manner.

4. You are not permitted to use, for reference, any data in this document for the purpose of (i) determining the interest payable, or other sums due, under loan agreements or under other financial contracts or instruments, (ii) determining the price at which a financial instrument may be bought or sold or traded or redeemed, or the value of a financial instrument, and/or (iii) measuring the performance of a financial instrument or of an investment fund.

This document is prepared by The Hongkong and Shanghai Banking Corporation Limited (‘HBAP’), 1 Queen’s Road Central, Hong Kong. HBAP is incorporated in Hong Kong and is part of the HSBC Group. This document is distributed by HSBC Continental Europe, HBAP, HSBC Bank (Singapore) Limited, HSBC Bank (Taiwan) Limited, HSBC Bank Malaysia Berhad (198401015221 (127776-V))/HSBC Amanah Malaysia Berhad (200801006421 (807705-X)), The Hongkong and Shanghai Banking Corporation Limited, India (HSBC India), HSBC Bank Middle East Limited, HSBC UK Bank plc, HSBC Bank plc, Jersey Branch, and HSBC Bank plc, Guernsey Branch, HSBC Private Bank (Suisse) SA, HSBC Private Bank (Suisse) SA DIFC Branch, HSBC Private Bank Suisse SA, South Africa Representative Office, HSBC Financial Services (Lebanon) SAL, HSBC Private banking (Luxembourg) SA and The Hongkong and Shanghai Banking Corporation Limited (collectively, the “Distributors”) to their respective clients. This document is for general circulation and information purposes only. This document is not prepared with any particular customers or purposes in mind and does not take into account any investment objectives, financial situation or personal circumstances or needs of any particular customer. HBAP has prepared this document based on publicly available information at the time of preparation from sources it believes to be reliable but it has not independently verified such information. The contents of this document are subject to change without notice. HBAP and the Distributors are not responsible for any loss, damage or other consequences of any kind that you may incur or suffer as a result of, arising from or relating to your use of or reliance on this document. HBAP and the Distributors give no guarantee, representation or warranty as to the accuracy, timeliness or completeness of this document. This document is not investment advice or recommendation nor is it intended to sell investments or services or solicit purchases or subscriptions for them. You should not use or rely on this document in making any investment decision. HBAP and the Distributors are not responsible for such use or reliance by you. You should consult your professional advisor in your jurisdiction if you have any questions regarding the contents of this document. You should not reproduce or further distribute the contents of this document to any person or entity, whether in whole or in part, for any purpose. This document may not be distributed to any jurisdiction where its distribution is unlawful.

The following statement is only applicable to HSBC Bank (Taiwan) Limited with regard to how the publication is distributed to its customers: HSBC Bank (Taiwan) Limited (“the Bank”) shall fulfill the fiduciary duty act as a reasonable person once in exercising offering/conducting ordinary care in offering trust services/business. However, the Bank disclaims any guaranty on the management or operation performance of the trust business.

The following statement is only applicable to by HSBC Bank Australia with regard to how the publication is distributed to its customers: This document is distributed by HSBC Bank Australia Limited ABN 48 006 434 162, AFSL/ACL 232595 (HBAU). HBAP has a Sydney Branch ARBN 117 925 970 AFSL 301737.The statements contained in this document are general in nature and do not constitute investment research or a recommendation, or a statement of opinion (financial product advice) to buy or sell investments. This document has not taken into account your personal objectives, financial situation and needs. Because of that, before acting on the document you should consider its appropriateness to you, with regard to your objectives, financial situation, and needs.

Important Information about the Hongkong and Shanghai Banking Corporation Limited, India (“HSBC India”)

HSBC India is a branch of The Hongkong and Shanghai Banking Corporation Limited. HSBC India is a distributor of mutual funds and referrer of investment products from third party entities registered and regulated in India. HSBC India does not distribute investment products to those persons who are either the citizens or residents of United States of America (USA), Canada or New Zealand or any other jurisdiction where such distribution would be contrary to law or regulation.

Mainland China

In mainland China, this document is distributed by HSBC Bank (China) Company Limited (“HBCN”) and HSBC FinTech Services (Shanghai) Company Limited to its customers for general reference only. This document is not, and is not intended to be, for the purpose of providing securities and futures investment advisory services or financial information services, or promoting or selling any wealth management product. This document provides all content and information solely on an "as-is/as-available" basis. You SHOULD consult your own professional adviser if you have any questions regarding this document.

The material contained in this document is for general information purposes only and does not constitute investment research or advice or a recommendation to buy or sell investments. Some of the statements contained in this document may be considered forward looking statements which provide current expectations or forecasts of future events. Such forward looking statements are not guarantees of future performance or events and involve risks and uncertainties. Actual results may differ materially from those described in such forward-looking statements as a result of various factors. HSBC India does not undertake any obligation to update the forward-looking statements contained herein, or to update the reasons why actual results could differ from those projected in the forward-looking statements. Investments are subject to market risk, read all investment related documents carefully.

© Copyright 2025. The Hongkong and Shanghai Banking Corporation Limited, ALL RIGHTS RESERVED.

No part of this document may be reproduced, stored in a retrieval system, or transmitted, on any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior written permission of The Hongkong and Shanghai Banking Corporation Limited.

Important information on sustainable investing

“Sustainable investments” include investment approaches or instruments which consider environmental, social, governance and/o r other sustainability factors (collectively, “sustainability”) to varying degrees. Certain instruments we include within this category may be in the process of changing to deliver sustainability outcomes.

There is no guarantee that sustainable investments will produce returns similar to those which don’t consider these factors. Sustainable investments may diverge from traditional market benchmarks.

In addition, there is no standard definition of, or measurement criteria for sustainable investments, or the impact of sustainable investments (“sustainability impact”). Sustainable investment and sustainability impact measurement criteria are (a) highly subjective and (b) may vary significantly across and within sectors.

HSBC may rely on measurement criteria devised and/or reported by third party providers or issuers. HSBC does not always conduct its own specific due diligence in relation to measurement criteria. There is no guarantee: (a) that the nature of the sustainability impact or measurement criteria of an investment will be aligned with any particular investor’s sustainability goals; or (b) that the stated level or target level of sustainability impact will be achieved.

Sustainable investing is an evolving area and new regulations may come into effect which may affect how an investment is categorised or labelled. An investment which is considered to fulfil sustainable criteria today may not meet those criteria at some point in the future.