17 April 2025

Jonathan Sparks

Chief Investment Officer, UK, HSBC Global Private Banking and Wealth

In recent weeks, UK equities have started garnering fresh attention from global investors, with some pointing to their compelling valuation and relative resilience amid global uncertainty. Yet, while there are reasons to appreciate the FTSE 100’s defensiveness and deep value traits, we believe the current macro and micro signals warrant a neutral stance.

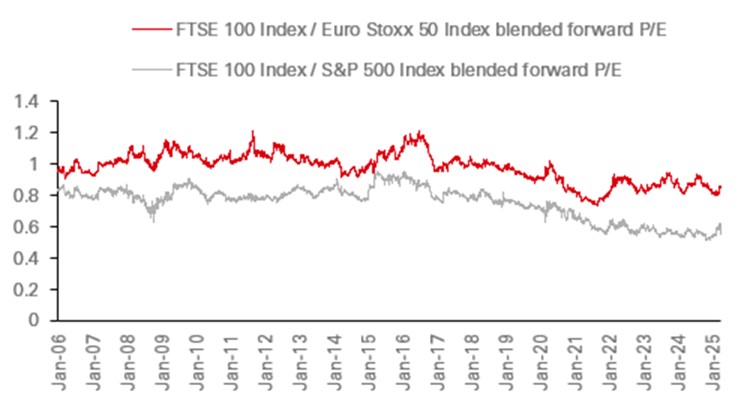

At first glance, UK large caps look incredibly cheap. The below chart highlights that the FTSE 100 trades at a 45% discount to US peers and 15% to euro-area stocks. The FTSE’s heavy exposure to energy, commodities, and defensives like consumer staples should, in theory, act as a safe harbour in uncertain times. But this valuation gap is not a new story – and hasn’t led to sustained outperformance historically. The discount reflects structural limitations: the FTSE 100 is light on growth sectors like tech, with underrepresentation in innovation-heavy industries that command premium multiples elsewhere. It’s also heavily reliant on overseas earnings, particularly from commodities and the US dollar, making it more a global macro play than a direct UK economic proxy.

Source: Bloomberg

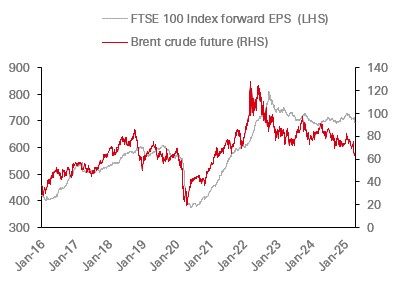

Also, FTSE 100 earnings are closely tied to oil, given the energy-heavy index composition. However, Brent prices have softened recently, weighing on earnings momentum. Chart 2 below shows a close correlation – and the recent fall in crude adds another layer of risk to forecasts. This leaves the FTSE in a tricky position: while valuations look cheap, they are tethered to a volatile macro commodity and global growth picture.

Source: Bloomberg

We think that the trade policy uncertainty is another overhang. The UK is now caught in the crossfire of escalating US tariffs. UK car exports to the US are facing 25% duties, and pharmaceuticals – another key export – may be next. Domestically, the government is trying to mitigate these impacts by suspending tariffs on 89 products, from EV batteries to syrup, but this doesn’t erase the near-term uncertainty for corporate profits and cross-border flows. On the positive side, UK GDP surprised strongly in February, rising 0.5% month-on-month – well above our expectations. That was largely driven by manufacturing, which could be the result of pre-tariff frontloading rather than sustainable strength. If we analyze the jobs data, the labour market signals look murky. PAYE data shows falling employment and softening wage growth, with annual median pay slowing to 4.8% – the weakest pace since 2024. Although the unemployment rate has remained stable at 4.4%, the underlying message is clear: job postings are down 39% from 2022 peaks, and the labour market is cooling. That might sound like good news for inflation – and it is – but from an equity lens, it raises concerns about household consumption, services demand, and corporate earnings resilience. Disinflation is clearly gaining traction as UK CPI fell from 2.8% to 2.6% in March, with a notable drop in services inflation from 5.0% to 4.7%. We expect the Bank of England to continue cutting rates gradually (25bps per quarter), possibly hitting 3.00% by Q3 2026.

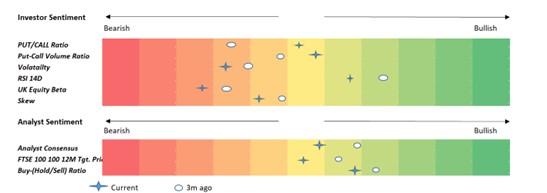

Our heatmap of investor and analyst indicators shows modest improvement across metrics like RSI, volatility, and analyst targets – but positioning remains cautiously balanced, not euphoric. Investor mood has recovered from bearish extremes, but tariffs and global demand concerns continue to cap bullish conviction. The path forward still looks choppy.

Source: Bloomberg

We see plenty of reasons to be neutral on UK equities. Their valuation support, defensive tilt, and softening inflation backdrop make them a reasonable portfolio anchor in uncertain times. But the trade headwinds, fragile macro recovery, labour market weakness, and EPS risks prevent us from getting aggressive.

We’re not trying to sell you any products or services, we’re just sharing information. This information isn’t tailored for you. It’s important you consider a range of factors when making investment decisions, and if you need help, speak to a financial adviser.

As with all investments, historical data shouldn’t be taken as an indication of future performance. We can’t be held responsible for any financial decisions you make because of this information. Investing comes with risks, and there’s a chance you might not get back as much as you put in.

This document provides you with information about markets or economic events. We use publicly available information, which we believe is reliable but we haven’t verified the information so we can’t guarantee its accuracy.

This document belongs to HSBC. You shouldn’t copy, store or share any information in it unless you have written permission from us.

We’ll never share this document in a country where it’s illegal.

This document is prepared by, or on behalf of, HSBC UK Bank Plc, which is owned by HSBC Holdings plc. HSBC’s corporate address is 1 Centenary Square, Birmingham BI IHQ United Kingdom. HSBC UK is governed by the laws of England and Wales. We’re authorised by the Prudential Regulation Authority (PRA) and regulated by the Financial Conduct Authority (FCA) and the PRA. Our firm reference number is 765112 and our company registration number is 9928412.