11 April 2025

Jonathan Sparks

Chief Investment Officer, UK, HSBC Global Private Banking and Wealth

A ferocious bounce back in equities markets on Wednesday meant that the US S&P 500 burst away from entering an official “bear” market – that’s a greater than 20% fall in value. Following a surprise 90-day pause on reciprocal tariffs from President Trump, the Nasdaq logged a 12% surge on April 9, making it the second-largest single-day gain in its history.

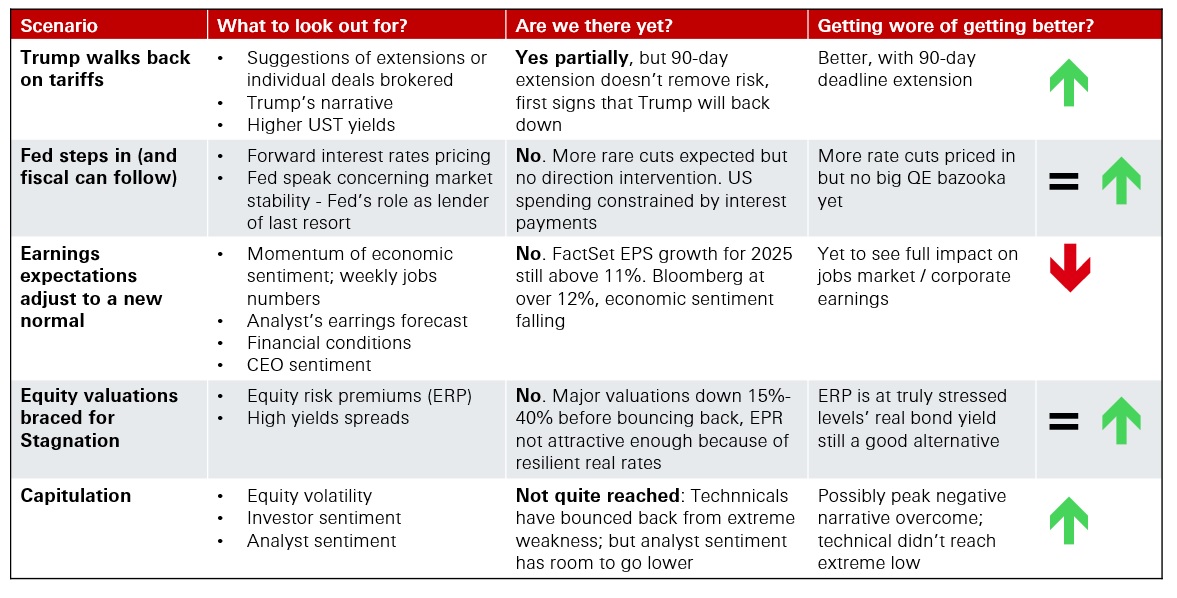

Of the five scenarios that we had called out for a sign of equities bottoming, we had “Trump walks back on tariffs” as the top of the list. Yesterday wasn’t quite the full monty in walking back, but there is now an indication that Trump will blink under the right circumstances.

Trump announced the 90-day tariff delay because “75 countries” had called to negotiate without reciprocating in tariffs on US goods. This, Trump argued, was a sign of good faith. China, on the other hand, did retaliate so Trump doubled down on tariffs, rising them to 125%. The fact that 30-year US Treasuries spiked above 5% while the USD declined wouldn’t have gone unnoticed. Instead of turning to US Treasuries as a safe-haven, this was a sign that investors were weighing up global alternatives and the US may have to start paying an unwelcome premium on yields. The narrative was given more credence because the USD weakened, implying investors were fleeing the US market. If investors were to close confidence in the US Treasury market it would make it very difficult for Trump to cut taxes and provide the fiscal boost to offset the tariff impact.

Therefore, Trump’s announcement was very timely, and lines will be drawn between the volatility in the bond market and the ultimate tariff extension. If the market does associate the climb down on the market volatility, that a positive because it implies there is an eventual backstop to very severe volatility. Taking another look at our scenarios table, we can see than while no scenario has been triggered, the market is stepping back in the right direction for a couple. What stops us short seeing now as an opportunity to buy into US equites is the continued uncertainty around tariffs and the economic impact. For sure, the market almost reached a “capitulation” in sentiment, but has since improved – the same goes with equity valuations. The walk back on tariffs is only a partial reprieve for now too. The market has rightly surged to reflect the lack of severe tariffs; but this also means that there isn’t enough of an attractive premium to go more heavily into equity, while higher quality assets like government or investment grade bonds are a very viable alternative.

In our updated scenario table, we’ve upgraded the first scenario — “Trump Walks Back on Tariffs” — to positive.

Source: HSBC, 10 April 2025

The short-term implications of this policy shift are clean enough: it has provided a reprieve for markets, allowed bond yields to stabilize, and improved sentiment. But structurally, risks remain.

Here’s what we’re focusing on:

Importantly, we’re not chasing rallies. We’re using them to reposition, rebalance, and re-underwrite risk — because this market remains headline-sensitive and narrative-driven.

We’re not trying to sell you any products or services, we’re just sharing information. This information isn’t tailored for you. It’s important you consider a range of factors when making investment decisions, and if you need help, speak to a financial adviser.

As with all investments, historical data shouldn’t be taken as an indication of future performance. We can’t be held responsible for any financial decisions you make because of this information. Investing comes with risks, and there’s a chance you might not get back as much as you put in.

This document provides you with information about markets or economic events. We use publicly available information, which we believe is reliable but we haven’t verified the information so we can’t guarantee its accuracy.

This document belongs to HSBC. You shouldn’t copy, store or share any information in it unless you have written permission from us.

We’ll never share this document in a country where it’s illegal.

This document is prepared by, or on behalf of, HSBC UK Bank Plc, which is owned by HSBC Holdings plc. HSBC’s corporate address is 1 Centenary Square, Birmingham BI IHQ United Kingdom. HSBC UK is governed by the laws of England and Wales. We’re authorised by the Prudential Regulation Authority (PRA) and regulated by the Financial Conduct Authority (FCA) and the PRA. Our firm reference number is 765112 and our company registration number is 9928412.