3 April 2025

Over the course of the next few days, the US will enforce sweeping tariffs with a wide global reach. Dubbed as “Liberation Day” Trump signed executive orders for a baseline 10% tariff on all goods, as well as reciprocal tariffs that range between 10-49%. President Trump brandished a poster listing 50 countries, along with the US administration’s calculation of total tariffs charged on US goods imports.

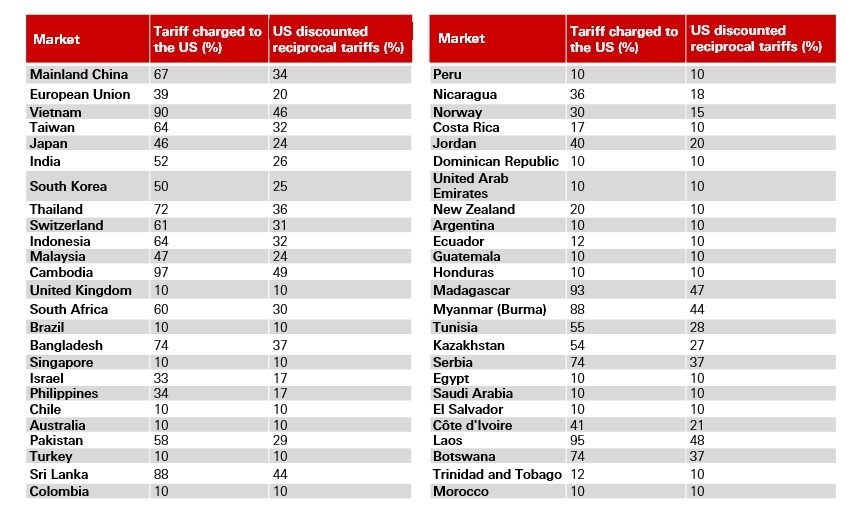

These tariffs figures aren’t simply the headline tariff rate charged. They also include VAT, as well as an additional figure derived from non-tariff trade barriers. Non-tariff barriers include extra burdens for US exporters in checks on food, or technical hurdles, such as certification, testing or compliance with local standards. Rather than an absolute figure the impact of these non-tariff barriers must be estimated. Compared to estimates ahead of Trump’s Rose Garden address, the numbers were clearly at the higher end. The total tariff estimate for China was 67%; for the EU at 39%; Taiwan at 64%. As a whole Asia was badly hit with Cambodia tariff highest of all at 97%.

Source: Bloomberg

Trump’s reciprocal response was to halve this total tariff figure and apply that to goods being imported to the US. For China the reciprocal tariff was 34%, the EU 20%; Taiwan 32%. For countries where the calculation of the tariff charged to the US was 20% or less, such as the UK, the baseline of 10% kicked in. UK PM Kier Starmer must be a little relieved. The only countries seemingly spared were Canada and Mexico, although in an interview soon after, Scott Bessent, the US Treasury Secretary, was unsure as to their omission. Bessent added that “as long as you don’t retaliate this is the higher end of the number”. This implies there is room for negotiation, while also warning against retaliation. The baseline tariffs will start on April 5th, while the reciprocal tariffs will start on April 9th.

Markets didn’t take the announcement well. US S&P 500 futures fell by over 3% in after-hours trading, with US companies that import heavily from Asia particularly badly hit. Nike, for example, was down over 6%, while Apple was plummeting toward an 8% loss, at the time of writing. China was also badly hit, with Bloomberg reporting that the 34% would be on top of the 20% already announced. US Treasuries and the USD rates oscillated as traders weighed up the balance of risks to growth alongside the risks to higher inflation. Given the falls in equities and the impact this will have on economic sentiment, rates would have typically fallen; the fact they pushed back against falls indicates that markets expect the tariffs to add some material impact in inflation.

World leaders will get a slither of comfort that the slight delay leaves the door slightly ajar for negotiations ahead of April 9th. This may cushion a fraction of the blow for now, but only Asian markets are still set to open with heavy losses. The attention will now turn to the global policy reaction. If the EU reacts, the suggestion is that Trump will then double down on tariffs. Therefore, while we do now have some clarity, uncertainty overshadows markets. For many businesses, the value in delaying investment has more value than acting quickly. While some will be rapidly drawing plans together for onshoring manufacturing.

We dialled down our risk to US markets in our last Global Investment Committee meeting. Also, at the start of the year, we stressed the need to “Expect the Unexpected”. This translated to an overweight in gold, a call to diversify in multi-asset portfolios, while also taking advantage of active management, to help manage risks and build portfolio resilience. For those looking for a silver lining, there will be some winners in the drive to onshoring in the US.

The Trump administration no doubt has one eye on the cliff drop in CEO confidence, as are pushing hard for tax cuts to take a piece of the market narrative. Perhaps this will yield some off-setting positives for some consumer driven stocks, but for now it is hard for markets to see past the overarching uncertainty. If this sell-off in equities sticks, valuations are at least braced for US earnings growth closer to 5% than the 15% estimated at the start of the year. Not quite enough to look through the turbulence and to buy the dip, but also not time to sell now that we are approaching the worst-case scenario.

We’re not trying to sell you any products or services, we’re just sharing information. This information isn’t tailored for you. It’s important you consider a range of factors when making investment decisions, and if you need help, speak to a financial adviser.

As with all investments, historical data shouldn’t be taken as an indication of future performance. We can’t be held responsible for any financial decisions you make because of this information. Investing comes with risks, and there’s a chance you might not get back as much as you put in.

This document provides you with information about markets or economic events. We use publicly available information, which we believe is reliable but we haven’t verified the information so we can’t guarantee its accuracy.

This document belongs to HSBC. You shouldn’t copy, store or share any information in it unless you have written permission from us.

We’ll never share this document in a country where it’s illegal.

This document is prepared by, or on behalf of, HSBC UK Bank Plc, which is owned by HSBC Holdings plc. HSBC’s corporate address is 1 Centenary Square, Birmingham BI IHQ United Kingdom. HSBC UK is governed by the laws of England and Wales. We’re authorised by the Prudential Regulation Authority (PRA) and regulated by the Financial Conduct Authority (FCA) and the PRA. Our firm reference number is 765112 and our company registration number is 9928412.

We use cookies to help keep our website and services working properly. These cookies are necessary and are set automatically.

We'd also like to use some optional cookies that:

You can either 'Accept' or 'Decline' these cookies or choose what cookies to accept in 'Manage cookies'.

To learn more about how we use cookies, visit our Cookie Notice.