17 March 2025

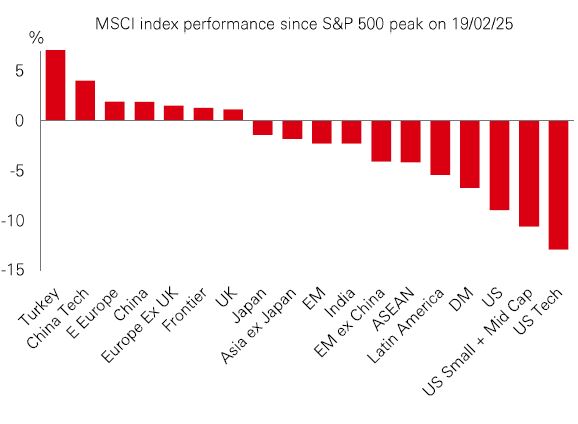

US stock markets have fallen sharply in recent weeks, with tech sector shares leading the decline. It’s the latest of several episodic waves of market volatility that investors have endured already in 2025.

The latest moves come amid elevated uncertainty over trade and economic policy. Investors are concerned about the growth outlook for US GDP and corporate earnings. And that’s jarring against stretched US stock valuations. It also comes as events outside the US are forcing a reassessment of TINA – “there is no alternative” to US stocks. Plans for fiscal stimulus in Germany have caused a reassessment of Europe’s long-term growth and earnings prospects. Tech sector advancements in China are also catching investor attention.

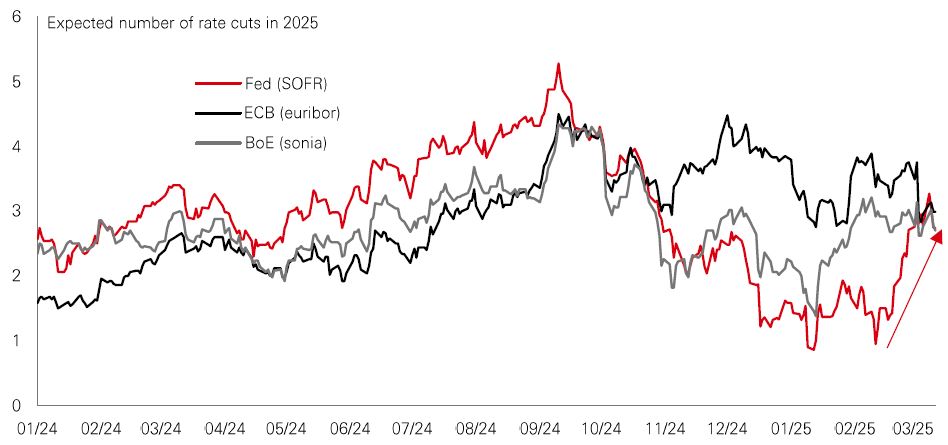

Arguably, the latest sell-off would have been worse without the recent fall in government bond yields, and the rise in 2025 Fed rate cut expectations, to 3-4. But a key question now is where is the “Fed put”? If the Fed stays in wait-and-see mode amid tariff uncertainty and sticky inflation, while growth continues to slide, then markets have a problem. But if inflation can stay low, the Fed has a lot of policy space and could cut rates hard, if needed. So far, inflation progress looks good, with core inflation excluding shelter and used cars now running close to 2%.

We think a broadening out of returns can continue across sectors, styles and regions. But the probability that growth “topples over” has clearly risen. So, it could pay to consider which asset classes – like private and securitised credits – can hedge against volatility. It will also be important to remain agile and dynamic in investment portfolios given today’s complex macro reality.

There were signs of growing confidence in the Asia-Pacific real estate market last year. Industry data from JLL shows that regional investment volumes grew by 23% year-on-year to USD131.3bn. In Q4 2024 alone, volumes were up by 10% year-on-year, marking the fifth consecutive quarter of annualised growth.

Japan set the pace overall, with a second consecutive year of record-breaking deal volumes propelled by the relatively weak yen and low borrowing costs. Developments in mainland China were also notable – where there was further guidance on policy stimulus and early signs of improving demand in some markets, like Shenzhen, hinting at a pick-up in investor interest. There were also signs of recovery in Hong Kong’s office leasing volumes.

But sector risks remain. If policy and geopolitical uncertainty prove to be inflationary, it could disrupt the global rate cutting cycle. And with some Chinese property developers in the headlines over default risk concerns, the country’s property market still faces headwinds. Despite that, there are potential grounds for cautious optimism for a continuing revival in Asian real estate in 2025. While the path to recovery is likely to be patchy, regional supply overhang is easing, leasing markets are improving, and global rate cuts should be a benefit.

The value of investments and any income from them can go down as well as up and investors may not get back the amount originally invested. Past performance does not predict future returns. The level of yield is not guaranteed and may rise or fall in the future. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector, or security Any views expressed were held at the time of preparation and are subject to change without notice. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way. Source: HSBC Asset Management. Macrobond, Bloomberg. Data as at 7.30am UK time 14 March 2025.

Chinese equities have delivered one of the strongest performances in global markets in 2025, helped by surging momentum in technology stocks. The pick-up has come just as US markets have weakened – led by a slump in ‘big tech’ names, with Magnificent Seven stocks down a combined 15% this year. So, why are Chinese tech stocks doing so well? Recent industry developments – like the emergence of AI start-up DeepSeek and its R1 model – have reset investor assumptions about Chinese tech’s ability to compete for supremacy in fields like AI and robotics. Chinese authorities have also redoubled their support for the sector. This month’s NPC meetings saw plans to accelerate AI adoption and digital tech, with an expansion of the PBoC’s tech industry re-lending programme and a new bond platform to support innovation funding. |

For investors, evidence of Chinese tech leadership, government support, and sector valuations that remain at a deep discount to the US, have been enough to fire-up optimism. Evidence of new AI and tech advancements benefitting China’s tech sector and other industries could drive a further re-rating for the sector, and the wider market.

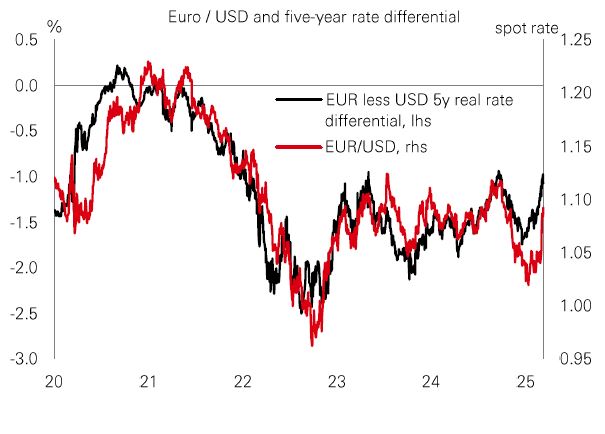

There has been a sudden shift in the market mood music surrounding the euro of late. Until recently, the dominant narrative for the single currency was based on weak growth that prevailed for much of last year even as inflation remained high. Yet, the euro has found a base in recent weeks amid a story of fading US exceptionalism and divergent macro momentum relative to the US, where some recent data has been soft. Perhaps more importantly, there is now excitement in FX markets regarding a significant increase in eurozone government spending on energy, climate and, most recently, defence and infrastructure. In places, it’s reignited speculative talk of more fiscal and strategic cohesion across the bloc. These positives for the euro have shielded it from the impact of global trade policy uncertainty which, until recently, had been holding the euro back from strengthening in line with interest-rate differentials. |

While escalating trade tensions could complicate the story, those rate differentials should remain supportive of further euro strength as the business cycle outlook for the eurozone and the US is re-assessed. The softening in US CPI inflation last week adds further impetus to this divergence story.

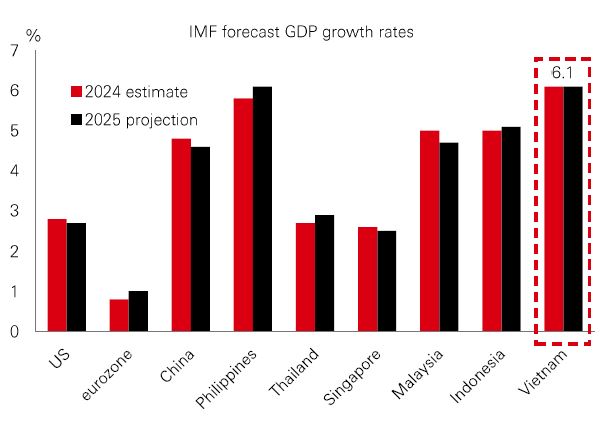

Frontier markets have been impressively resilient to global volatility this year, with Vietnam stocks – which account for around a quarter of the MSCI Frontier Markets index – advancing 6% in Q1 so far. A re-routing of global supply chains in recent years has transformed Vietnam into a major manufacturing hub and a global exporter. Government efforts to simplify regulations, cut red tape, and attract foreign investment have paid off, and the country is now gaining a foothold in more advanced industries like semiconductors and AI. While trade policy uncertainty remains a risk, the latest forecasts from the IMF expect Vietnam’s 6% GDP growth last year to be matched in 2025 – outpacing its ASEAN peers. Its moderate debt-to-GDP ratio of roughly 34% in 2024 is also lower than many regional neighbours. |

In terms of valuations, Vietnamese stocks command a premium to broader frontier markets – with a PE ratio of 16x for MSCI Vietnam versus 11x for MSCI Frontier Markets.

Past performance does not predict future returns. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector, or security Any views expressed were held at the time of preparation and are subject to change without notice. Any forecast, projection or target where provided is Vindicative only and is not guaranteed in any way. Source: HSBC Asset Management. Macrobond, Bloomberg, Datastream, IMF World Economic Outlook. Data as at 7.30am UK time 14 March 2025.

Source: HSBC Asset Management. Data as at 7.30am UK time 14 March 2025. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector or security. Any views expressed were held at the time of preparation and are subject to change without notice.

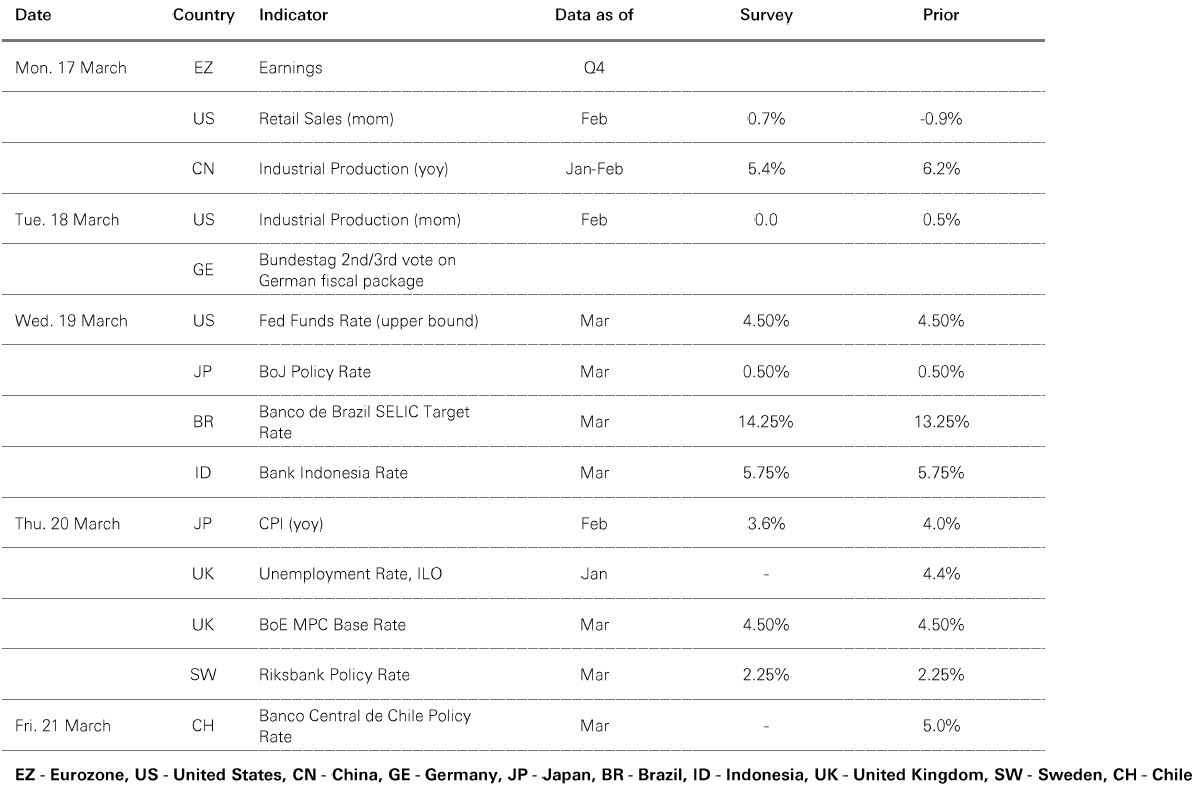

Risk appetite remained weak amid continued trade policy uncertainty, with the US dollar index trading sideways. US Treasuries edged higher as investors digested the latest US CPI data in the run-up to the March FOMC meeting, while European government bonds were range-bound. US investment grade and high-yield corporate bond spreads widened significantly, driven by rising worries over US growth. Among stock markets, US indices weakened across the board, led by a sell-off in tech stocks in volatile trading as negative market sentiment persisted. The Euro Stoxx 50 index fell alongside the German DAX index, while Japan’s Nikkei 225 index rebounded after declines in previous weeks ahead of the upcoming BoJ meeting. In other Asian markets, the retreat in tech stocks weighed on the Hang Seng, whereas China’s Shanghai Composite rose. India’s Sensex index fell, as South Korea’s Kospi index ended barely changed. In commodities, oil prices were stable, with gold and copper extending their gains.

We’re not trying to sell you any products or services, we’re just sharing information. This information isn’t tailored for you. It’s important you consider a range of factors when making investment decisions, and if you need help, speak to a financial adviser.

As with all investments, historical data shouldn’t be taken as an indication of future performance. We can’t be held responsible for any financial decisions you make because of this information. Investing comes with risks, and there’s a chance you might not get back as much as you put in.

This document provides you with information about markets or economic events. We use publicly available information, which we believe is reliable but we haven’t verified the information so we can’t guarantee its accuracy.

This document belongs to HSBC. You shouldn’t copy, store or share any information in it unless you have written permission from us.

We’ll never share this document in a country where it’s illegal.

This document is prepared by, or on behalf of, HSBC UK Bank Plc, which is owned by HSBC Holdings plc. HSBC’s corporate address is 1 Centenary Square, Birmingham BI IHQ United Kingdom. HSBC UK is governed by the laws of England and Wales. We’re authorised by the Prudential Regulation Authority (PRA) and regulated by the Financial Conduct Authority (FCA) and the PRA. Our firm reference number is 765112 and our company registration number is 9928412.