14 April 2025

A week after announcing ‘reciprocal tariffs’ on trade partners, the US administration has applied the brakes. A 90-day pause sees universal tariffs of 10% for all countries, except China. Higher tariffs for certain sectors remain in place. After days of market declines there has been a big relief rally for stocks. So, what happens next?

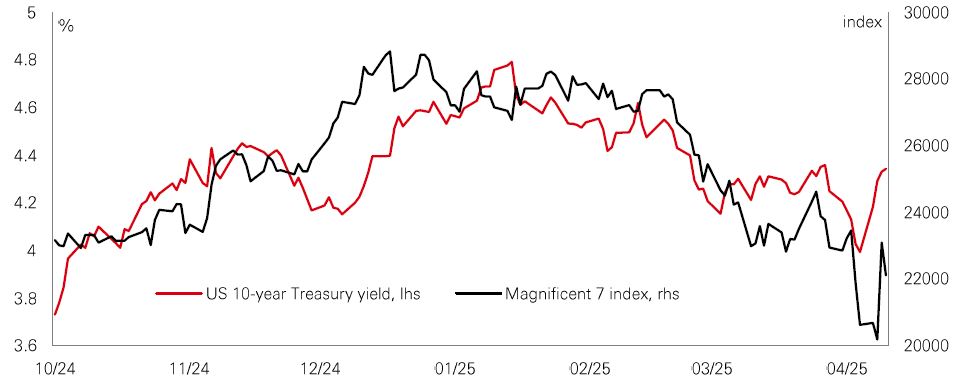

Markets are still spinning around, with ultra-high policy uncertainty meaning that volatility will remain elevated. Last week’s initial sell-off saw a combination of falling stocks and sticky bond yields, with the market factoring in a ‘stagflation lite’ situation. Specifically, the bigger-than-expected ‘tariff shock’ dragged the growth outlook lower and pushed short-term inflation expectations higher. Recession risk rose materially.

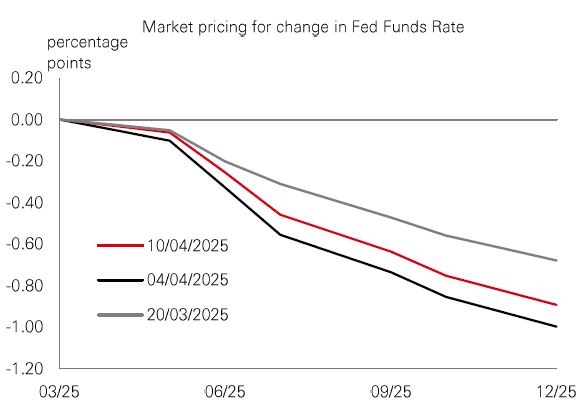

Despite the interim reprieve, uncertainty still reigns. US growth continues to slow and trade policy will still raise inflation. For now, the Fed remains in reactive mode – waiting for bad news on the economy. For markets, it means that bond yields are still sticky, and the term premium is elevated.

Meanwhile, international stocks are still outperforming year-to-date. With ‘policy puts’ more evident in Europe and China, the case for global investors to rotate to Europe, Australia, Asia, and the Far East (EAFE) and to emerging markets still looks good.

Uncertainty and volatility are set to be a feature, not a bug, of investment markets in the near term. For investors considering ways of building portfolio resilience without sacrificing growth, one strategy is to focus on ‘quality’.

Quality is a stock market factor – and a proven long-term portfolio diversifier – that can defend against downside risk but still benefit from market upswings. Under the hood, it captures exposure to firms with strong profitability, consistent financial performance, and the safety of robust financial health. These traits help it deliver through-the-cycle performance. It pays off because quality stocks tend to be undervalued by the market. Meanwhile, investors often bid up the prices of lower quality firms that promise lottery-like returns, but which have a habit of underperforming in a downturn.

Some multi-asset insights show that quality delivers its strongest active returns when the economic outlook begins to cool – making it a potentially useful defensive strategy in portfolios. Faced with elevated volatility, investors should pay attention to diversification and selectivity in asset allocation.

The value of investments and any income from them can go down as well as up and investors may not get back the amount originally invested. Past performance does not predict future returns. The level of yield is not guaranteed and may rise or fall in the future. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector, or security Diversification does not ensure a profit or protect against loss. Any views expressed were held at the time of preparation and are subject to change without notice. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way. Source: HSBC Asset Management, Bloomberg. Data as at 7.30am UK time 11 April 2025.

Central banking is not the easiest of jobs even in relatively stable times. And the current environment is anything but stable. Market volatility has jumped in recent weeks as investors struggle to assess the impact of the US administration’s trade policies. The Fed must consider not only the impact of the trade policies themselves but also the resulting market volatility on the economy. However, to do this, it must also consider the starting point. |

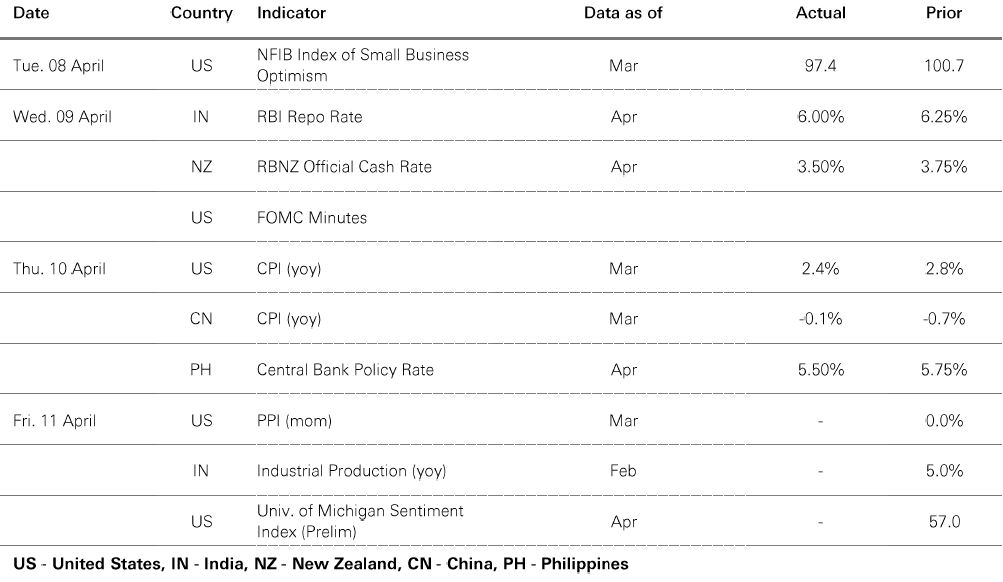

Recent data show the economy ended Q1 with the labour market in relatively good health while the downtrend in inflation has been slow and bumpy. This favours the Fed biding its time and seeing where trade policy settles. However, it doesn’t mean the Fed will sit on its hands indefinitely. Continued uncertainty around trade policy, current market volatility and recent survey and consumer data point to a slowdown. Given slowdowns can intensify rapidly, we see the Fed reacting to softer activity data and easing policy gradually from mid-year.

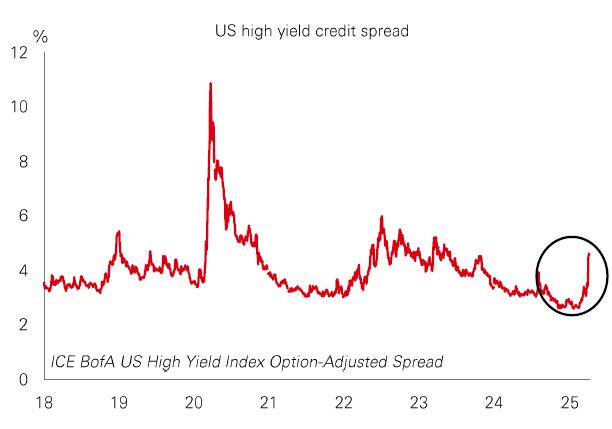

Credit spreads are an important leading indicator for the macro cycle, and perhaps the best single variable to give investors a handle on recession risk. That’s important given that policy uncertainty and tariffs have raised worries over the prospect of stagflation and recession. Spreads have risen sharply recently – with US high yield seeing the most significant price adjustment. But they are not extreme versus long run history. That makes sense. The ingredients for a dramatic rise in default rates aren’t present today, even if defaults are likely to creep up. That’s because private sector’s balance sheets remain strong, corporate profits look fine for now, and the maturity wall isn’t too steep. |

Some credit specialists note that the absolute repricing at this stage is in line with what we have seen in recent event-driven corrections that are normally caused by a shock. Among them the tariff-driven growth scare in 2018/19, rate hikes in 2022, and the regional bank crisis in 2023 – none of which led to a recession.

Asian stock markets sold off sharply last week but pared some losses following the US administration’s partial tariff reprieve. Export-oriented markets like Taiwan, Korea, and Japan have faced a particularly choppy time. In mainland China, initial price declines were followed by a mild rebound supported by sentiment that the market is still underpinned by a ‘policy put’. In India, which cut rates by 0.25% last week, the impact on stocks was more moderate given its more limited foreign trade exposure. |

Near-term, some Asia investment specialists think heightened trade uncertainty and the unpredictable impact on the macro outlook will weigh on sentiment. While Asian consensus profit forecasts have trended higher since mid-Q1, the implementation of tariffs could cause downgrade pressure once their impact is clearer. Those with higher overseas trade and revenue exposure to tariffs and counter-tariffs could be particularly vulnerable. Despite this, Asian markets continue to trade at a material discount to developed markets. And while FX volatility and growth concerns have risen, many EM Asian central banks look well-positioned to ease policy amid a benign inflation outlook.

Past performance does not predict future returns. The level of yield is not guaranteed and may rise or fall in the future. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector, or security Any views expressed were held at the time of preparation and are subject to change without notice. Index returns assume reinvestment of all distributions and do not reflect fees or expenses. You cannot invest directly in an index. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way. Source: HSBC Asset Management. Macrobond, Bloomberg. Data as at 7.30am UK time 11 April 2025.

Source: HSBC Asset Management. Data as at 7.30am UK time 11 April 2025. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector or security. Any views expressed were held at the time of preparation and are subject to change without notice.

Risk assets traded in a volatile fashion amid continued global trade uncertainty, with the US dollar falling against major currencies. US Treasuries weakened, and the US yield curve “bear steepened” following benign US core CPI data. Meanwhile, US IG and HY corporate spreads continued to widen. Among developed markets, US equities rebounded in choppy trading, while the Russell 2000 underperformed. European stock markets experienced broad-based weakness, as Japan’s Nikkei 225 pared losses after heavy sell-offs earlier last week. EM equities lagged developed markets. Other Asian stock markets remained on the defensive, with the Hang Seng leading the losses upon returning from a holiday-shortened week. In Latin America, equity market movements in Brazil and Mexico were more moderate. In commodities, oil fell, while copper and gold rallied.

We’re not trying to sell you any products or services, we’re just sharing information. This information isn’t tailored for you. It’s important you consider a range of factors when making investment decisions, and if you need help, speak to a financial adviser.

As with all investments, historical data shouldn’t be taken as an indication of future performance. We can’t be held responsible for any financial decisions you make because of this information. Investing comes with risks, and there’s a chance you might not get back as much as you put in.

This document provides you with information about markets or economic events. We use publicly available information, which we believe is reliable but we haven’t verified the information so we can’t guarantee its accuracy.

This document belongs to HSBC. You shouldn’t copy, store or share any information in it unless you have written permission from us.

We’ll never share this document in a country where it’s illegal.

This document is prepared by, or on behalf of, HSBC UK Bank Plc, which is owned by HSBC Holdings plc. HSBC’s corporate address is 1 Centenary Square, Birmingham BI IHQ United Kingdom. HSBC UK is governed by the laws of England and Wales. We’re authorised by the Prudential Regulation Authority (PRA) and regulated by the Financial Conduct Authority (FCA) and the PRA. Our firm reference number is 765112 and our company registration number is 9928412.