3 March 2025

A mini growth scare has rippled through US markets over the past week or so. Equities are down, so too is the ‘Dixie’ dollar index, and Treasuries have rallied, with the yield curve flattening despite short-term rate expectations declining. Corporate spreads have widened a bit too, but remain tight. Bitcoin – notoriously sensitive to risk sentiment – gapped lower by more than 10% in a matter of days. And the AAII survey confirmed the shift lower in investor confidence. Bullish less bearish sentiment hit its weakest level since September 2022, with the pace of decline over the past four weeks, the quickest since 2013. That move looks excessive relative to market developments and may reflect an additional headwind from much-increased policy uncertainty.

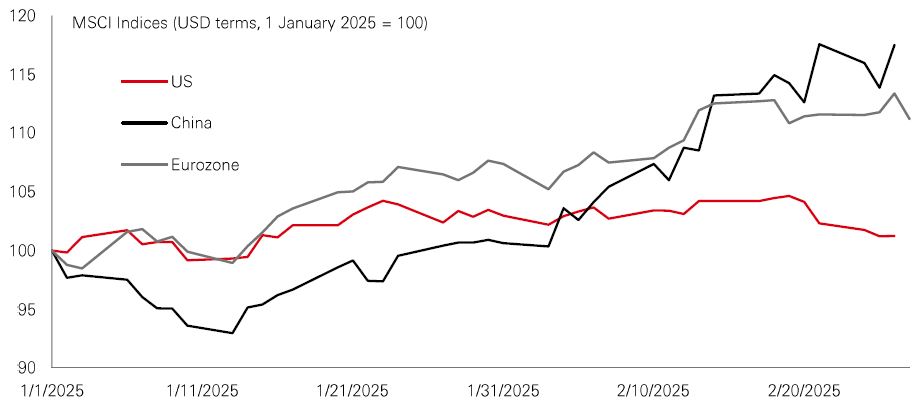

What do we make of all this? Recent downside surprises to US macro data and analyst earnings revisions becoming less positive (see Page 2) mean the bullish growth narrative of “US exceptionalism” has been challenged. Investors are understandably nervous given stretched valuations in some parts of the US market. Moderating US growth and frothy valuations in some equity sectors have led to a rotation into markets where expectations still leave room for upside surprises and where valuations are closer to historic norms. This is playing out in the outperformance of Chinese and European stocks relative to the US since the start of 2025.

Warren Buffett, the legendary investor and CEO of Berkshire Hathaway, has published his annual shareholder letter recently – a traditional ‘must-read’ for market-watchers. In it, the Sage of Omaha discusses Berkshire’s US Treasury holdings, Japanese investments, and America’s economic “miracle”.

Buffett forged his early career as a deep value investor, buying unloved ‘cigar butt’ stocks close to collapse but still capable of delivering pure investment profit. These days he prefers to buy quality – without overpaying for it. But in the current growth-driven market environment, that has made outperformance tricky. Last year, Berkshire stock and the S&P 500 delivered near neck-and-neck returns of around 25%.

Against that backdrop, it’s notable that in the past Buffett has advocated for indexing to the S&P 500. But with current high levels of ‘big tech’ concentration and valuation risk in the market cap-weighted S&P, even he might find the index a bit rich. A more value-driven strategy might be to pursue the equal-weight version. Long-term, the S&P e/w has tended to outperform its market-cap-weighted sibling – and could potentially offer more balanced exposure if market performance continues to broaden out.

The value of investments and any income from them can go down as well as up and investors may not get back the amount originally invested. Past performance does not predict future returns. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector, or security. Any views expressed were held at the time of preparation and are subject to change without notice. Source: HSBC Asset Management. Macrobond, Bloomberg. Data as at 7.30am UK time 28 February 2025.

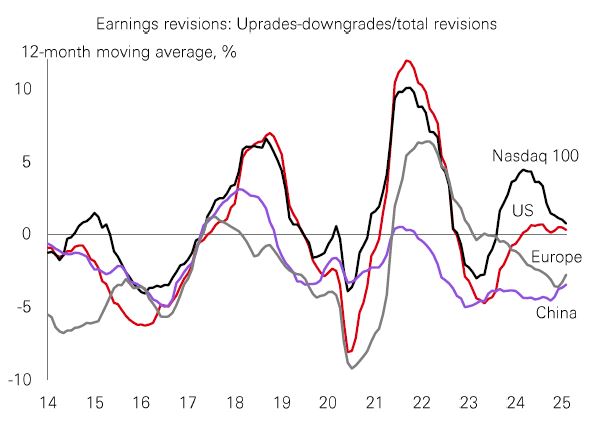

With Q4 2024 earnings season well under way, the broad picture for US stocks is positive, with profits on track to grow by 16% year-on-year – up from a forecast 11% at the start of January. Last week saw the last – and largest – of the Magnificent Seven tech giants reporting, with sales and profits beating expectations but the market offering a mixed reaction. Despite the upbeat Q4 performance, there are signs that stretched valuations and global policy uncertainty are taking the shine off the 2025 US profits outlook. While analyst earnings revisions are still in positive territory, they have been trending down in recent weeks, especially among the biggest tech stocks in the Nasdaq 100. |

By contrast, revisions for European and Chinese stocks – while currently still negative – are turning higher. Q424 earnings have been strong in Europe so far, and prices have rallied, helped by expectations that now look too low and the fact that stocks there have been trading at a deep discount to the US. It’s a similar story in China, where technology stocks have led a market rally in February. This could be more evidence of a broadening out of market performance.

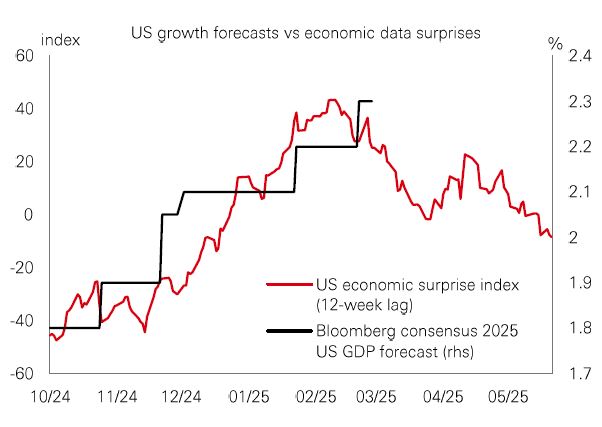

Recent macro data have come in softer than expected, leading investors to question the bullish US growth narrative that had built up since late 2024. While growth expectations for many other economies have remained stable or been revised down in recent months, the Bloomberg consensus for US 2025 growth has pushed higher to 2.3% from 1.9% in November. This has left room for disappointment, which is now happening with data such as January retail sales and the February US services PMI and consumer confidence numbers surprising to the downside. |

The base case has been for the US economy to slow somewhat during 2025, given still-restrictive monetary policy, moderating wage growth and a likely fading of consumers’ willingness to continue running a low savings rate. While analysts do not expect a sharp weakening and would caution against putting too much weight on January data, given large seasonal swings in the underlying numbers, heightened policy uncertainty does create downside risks to growth that may have been overlooked in recent months and requires close monitoring.

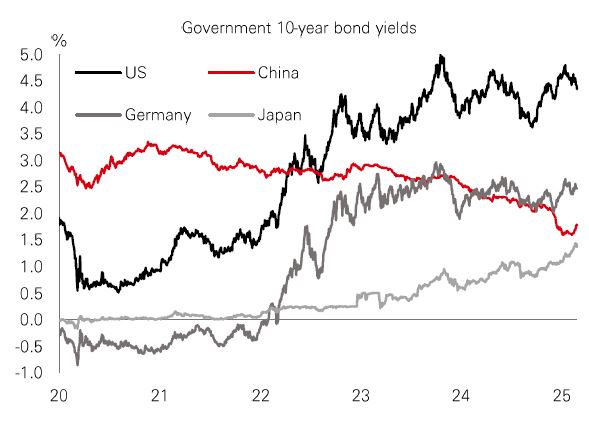

Trends in Chinese government bond yields have diverged markedly from other major bond markets in recent years. The low correlation has been driven by China’s domestic economic and policy cycles, as well as relatively low foreign investor participation in the CGB market. CGB yields have also experienced relatively low volatility versus other bond markets, thanks to careful liquidity management by the PBoC. The central bank has managed both upside and downside yield moves in line with macro fundamentals and to safeguard financial stability. |

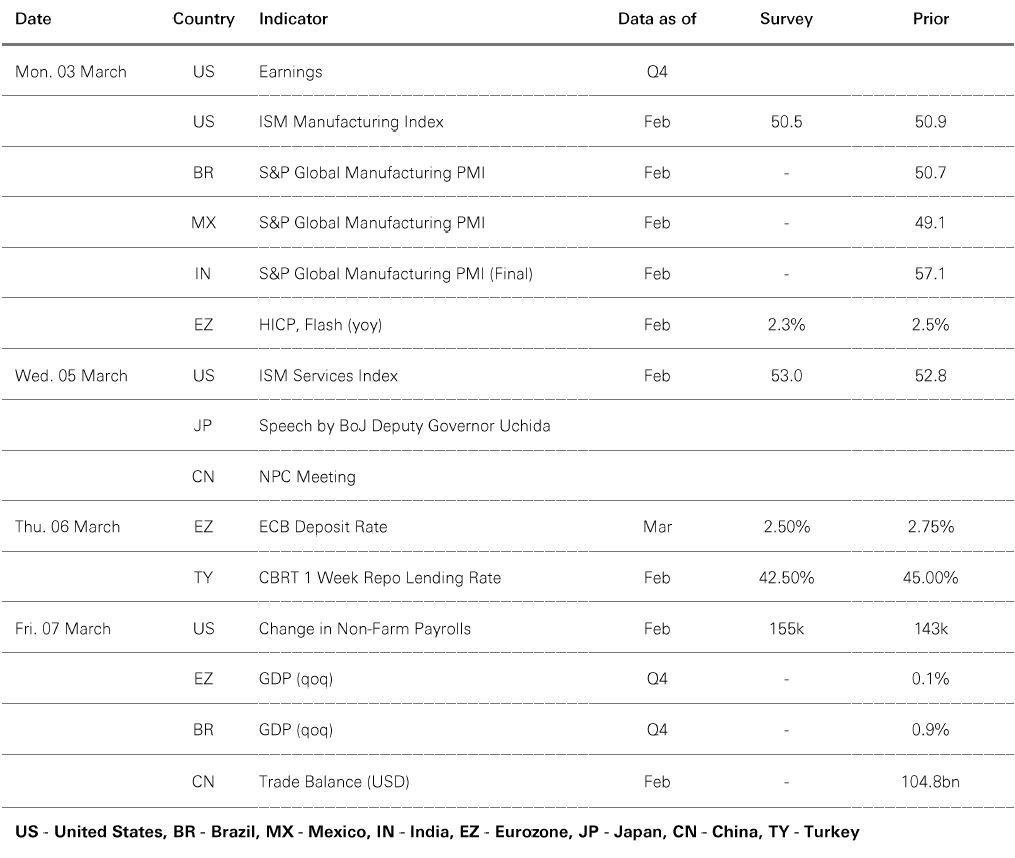

In recent weeks, 10-year CGB yields have edged up after hitting record lows in early February and after notable declines in 2024. But yields are likely to trade in a range in the near term, given domestic growth, inflation, and policy outlooks and amid elevated external geopolitical and macro uncertainties. This week’s National People’s Congress (NPC) meeting could be key for further news on fiscal support to revive confidence and consumer demand, and support modest inflation. Any further material rise in China’s rates near-term could present opportunities for investors.

Past performance does not predict future returns. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector, or security. Any views expressed were held at the time of preparation and are subject to change without notice. Source: HSBC Asset Management. Macrobond, Bloomberg, Datastream. Data as at 7.30am UK time 28 February 2025.

Source: HSBC Asset Management. Data as at 7.30am UK time 28 February 2025. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector or security. Any views expressed were held at the time of preparation and are subject to change without notice.

Rising jitters about a weaker US economy, fuelled by downside surprises in the PMI services and Conference Board’s consumer confidence surveys, weighed on risk appetite. The US dollar index remained largely stable amid ongoing geopolitical uncertainty. US Treasuries rallied, outperforming eurozone government bonds and UK Gilts, driven by lower US rate expectations. US corporate spreads widened modestly, with IG faring better than HY. US equities experienced broad-based weakness, with tech stocks leading losses as investors absorbed the latest Q4-24 earnings. The Euro Stoxx 50 index was little changed, while the German DAX reached a new high. In Asia, the Hang Seng index reversed from earlier gains following rallies in previous weeks, with the Shanghai Composite falling ahead of the National People’s Congress annual meeting. Both Japan’s Nikkei 225 and South Korea’s Kospi tracked US tech stocks markedly lower, as India’s Sensex also weakened. In commodities, oil fell, while gold and copper posted larger losses.

We’re not trying to sell you any products or services, we’re just sharing information. This information isn’t tailored for you. It’s important you consider a range of factors when making investment decisions, and if you need help, speak to a financial adviser.

As with all investments, historical data shouldn’t be taken as an indication of future performance. We can’t be held responsible for any financial decisions you make because of this information. Investing comes with risks, and there’s a chance you might not get back as much as you put in.

This document provides you with information about markets or economic events. We use publicly available information, which we believe is reliable but we haven’t verified the information so we can’t guarantee its accuracy.

This document belongs to HSBC. You shouldn’t copy, store or share any information in it unless you have written permission from us.

We’ll never share this document in a country where it’s illegal.

This document is prepared by, or on behalf of, HSBC UK Bank Plc, which is owned by HSBC Holdings plc. HSBC’s corporate address is 1 Centenary Square, Birmingham BI IHQ United Kingdom. HSBC UK is governed by the laws of England and Wales. We’re authorised by the Prudential Regulation Authority (PRA) and regulated by the Financial Conduct Authority (FCA) and the PRA. Our firm reference number is 765112 and our company registration number is 9928412.