31 March 2025

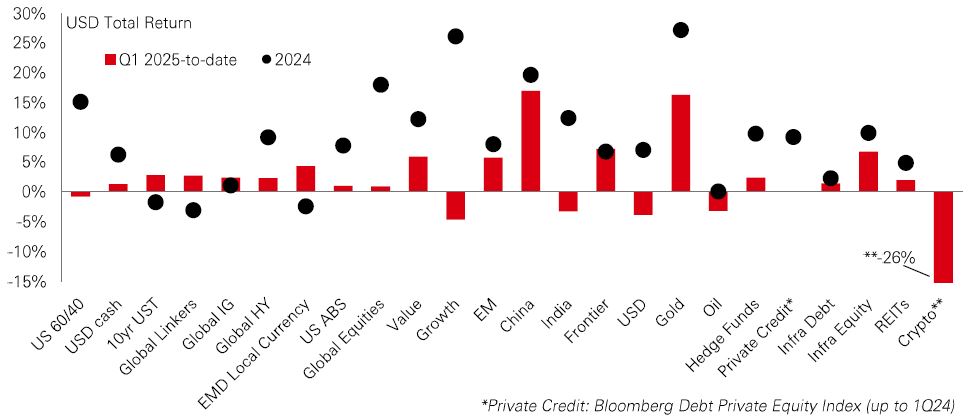

First quarter action in investment markets has been dominated by policy uncertainty, volatility, and a broadening-out of performance beyond the US.

It was a quarter marked by sharp moves and rotations across asset classes. Among the starkest was a sell-off, and then partial recovery, in US stocks. Worst hit were mega-cap tech names, which despite still-strong profits growth, saw momentum slip. A mix of frothy valuations and signs of China’s growing competitiveness in AI (evidenced by advances at tech firm DeepSeek), unsettled confidence. By contrast, European and Chinese stock markets recorded double-digit rallies, with broad emerging markets also seeing gains. That was captured in a swift change of fortune for major style premia, with Value paying off, and Growth losing ground.

Coming into the year, post-US election consensus trades had formed, betting on further upside to US stocks and the dollar and higher US bond yields. All three quickly unwound in Q1 on trade uncertainty and signs of weaker US GDP and profits growth. In response, fixed income assets, including government bonds and credits, provided an effective hedge. Other diversifiers – including gold, hedge funds, real estate, and infrastructure – also proved resilient.

So, what’s next? After some wild narrative shifts in Q1, the base case is that ‘spinning around’ will persist in markets in 2025, but the growth outlook remains a key question for investors. Policy uncertainty looks set to continue being a risk to the cycle, but it’s not clear when, or even whether, that will translate to the real economy. For Q2, we could see more of a stop-start performance, as investors and policymakers remain in wait-and-see mode.

Chinese stocks set the pace in Asian stock markets in Q1, rising 17% in a rally driven by the technology sector. Hong Kong stocks (as measured by MSCI HK) also outperformed, with financials leading the gains. A key theme was a rotation favouring cheaper markets, with China beating India, and South Korea beating Taiwan.

This came amidst a cautious backdrop, with global policy uncertainty sparking broad fund outflows (excluding Chinese stocks). Regional currencies were mostly positive in response to lower US Treasury yields and a weaker US dollar index, but were still volatile. Inflation continued to ease in most of the region, giving space for central banks to focus on growth risks. In response, government bond yields fell in most Asian economies. One exception was Indonesia, where fiscal and macro concerns drove the rupiah to its lowest level since the late 90s Asian financial crisis, and bond yields rose. In fixed income, Asia credits were resilient despite weaker global risk sentiment, with high yield outperforming investment grade. Overall, global trade policy and regional politics continue to be key issues to watch in Asia in 2025.

The value of investments and any income from them can go down as well as up and investors may not get back the amount originally invested. Past performance does not predict future returns. The level of yield is not guaranteed and may rise or fall in the future. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector, or security Any views expressed were held at the time of preparation and are subject to change without notice. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way. Source: HSBC Asset Management. Macrobond, Bloomberg. See page 8 for details of asset class indices. Data as at 7.30am UK time 31 March 2025.

The unusually uncertain outlook means it pays to consider risk scenarios. The base case – ‘spinning around’ – assumes above target inflation and a period of below trend growth, but there is a risk of a more damaging scenario – ‘toppling over’ as we call it – playing out. At the limit, changes to US trade policy could result in the effective US tariff rate jumping to levels last seen in the 1930s. For consumers, elevated policy uncertainty is driving fears of unemployment, which is often (but not always) a precursor of a marked labour market deterioration. Even if unemployment does not rise abruptly, consumers could curb spending as a precaution. This would further deter firms from investing and weigh on profits, ultimately putting pressure on stock prices. This could then further undermine spending – a vicious cycle. |

In the past, the Fed may have leant against elevated uncertainty by pre-emptively easing policy. But the risk is that renewed price pressures from any large-scale tariffs may mean it can only ease policy once confident that a weak economy would rein in inflation. Overall, this would be an environment where volatility spikes and risk asset valuations are damaged, especially where risk premiums are skinny.

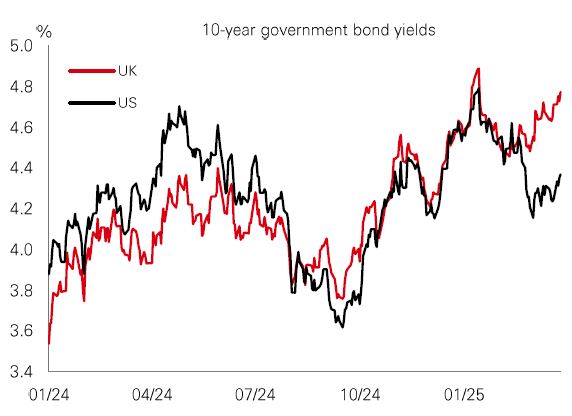

After spooking markets in last October’s UK Budget by raising taxes but unexpectedly increasing public spending, Rachel Reeves’ Spring Statement was more restrained. With the Office for Budget Responsibility (OBR) downgrading its 2025 growth forecast, and the Gilt-Treasury 10-year spread widening by around 0.5% since mid-February, the Chancellor unveiled back-loaded spending cuts to meet her fiscal rules. Even with these changes, there is little room for slippage and UK net debt-to-GDP ratio (excluding debt held by the Bank of England) is expected to trend higher. The UK is walking a tightrope – debt concerns are putting upward pressure on Gilt yields, which worsens the public finances. But cutting spending or raising taxes to narrow the deficit would undermine already lacklustre growth. |

This is a potentially cautionary tale for other advanced economies. In Europe, much has been made of recent commitments to boost public investment in Germany – a country with ample fiscal space. But the likes of France and Italy are more likely to face the same constraints as the UK if they try the German approach. With most governments facing pressure to open the fiscal taps to deliver social, economic, and geopolitical objectives, the bond market vigilantes are watching closely.

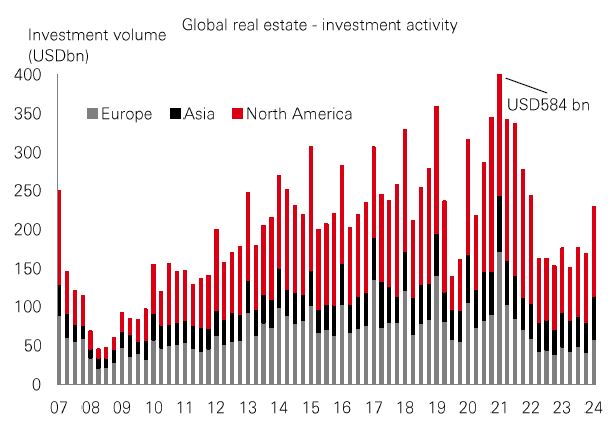

Global real estate investment volumes picked up late last year, rising 31% in Q4 2024 versus the same quarter in 2023. It came as investors took advantage of stabilising interest rates and lower valuations. MSCI data shows that real estate capital values edged up 0.2% in Q4 last year, having fallen 16% over the prior nine quarters. Occupancy levels are being supported by falling development activity, with rising costs making new projects uneconomic. Retail has been a key beneficiary, with stable leasing and falling vacancy rates boosting rental income. Office vacancy rates were stable in Q4 but remain elevated, especially in the US. Meanwhile, logistics leasing was subdued but is expected to pick up in 2025. Finally, non-traditional sectors are still delivering the strongest rental growth – including senior housing and data centre leasing. |

Despite uncertainty, some real estate specialists expect capital values to grow in 2025, driven by growing incomes rather than yield compression. And although the outlook for leasing is mixed, low development activity should support property fundamentals across sectors.

Past performance does not predict future returns. The level of yield is not guaranteed and may rise or fall in the future. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector, or security Any views expressed were held at the time of preparation and are subject to change without notice. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way. Source: HSBC Asset Management. Macrobond, Bloomberg, Datastream, Real Capital Analytics. Data as at 7.30am UK time 31 March 2025.

Source: HSBC Asset Management. Data as at 7.30am UK time 31 March 2025. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector or security. Any views expressed were held at the time of preparation and are subject to change without notice.

Global trade uncertainty continued to overhang risk markets last week, with the US dollar index trading sideways. US Treasuries fell, and the yield curve steepened while eurozone sovereign bonds remained relatively unchanged. US IG and HY stayed close to recent lows. US equities extended modest gains, whereas the Euro Stoxx 50 index edged lower, primarily driven by lower auto stocks, with Germany’s DAX index being the main casualty. Japan’s Nikkei 225 fell due to weaker export-oriented stocks. Other Asian markets were largely on the defensive, with the most significant weakness observed in South Korea’s Kospi index, followed by the Hang Seng and Shanghai Composite. In contrast, India’s Sensex bucked the trend, rising on the strength of financials. In Latin America, Mexican stocks led the gains in the region as Banxico, the central bank lowered policy rate by 0.5% with dovish guidance. In commodities, oil and gold increased, while copper ended a volatile week with little change.

We’re not trying to sell you any products or services, we’re just sharing information. This information isn’t tailored for you. It’s important you consider a range of factors when making investment decisions, and if you need help, speak to a financial adviser.

As with all investments, historical data shouldn’t be taken as an indication of future performance. We can’t be held responsible for any financial decisions you make because of this information. Investing comes with risks, and there’s a chance you might not get back as much as you put in.

This document provides you with information about markets or economic events. We use publicly available information, which we believe is reliable but we haven’t verified the information so we can’t guarantee its accuracy.

This document belongs to HSBC. You shouldn’t copy, store or share any information in it unless you have written permission from us.

We’ll never share this document in a country where it’s illegal.

This document is prepared by, or on behalf of, HSBC UK Bank Plc, which is owned by HSBC Holdings plc. HSBC’s corporate address is 1 Centenary Square, Birmingham BI IHQ United Kingdom. HSBC UK is governed by the laws of England and Wales. We’re authorised by the Prudential Regulation Authority (PRA) and regulated by the Financial Conduct Authority (FCA) and the PRA. Our firm reference number is 765112 and our company registration number is 9928412.