27 January 2025

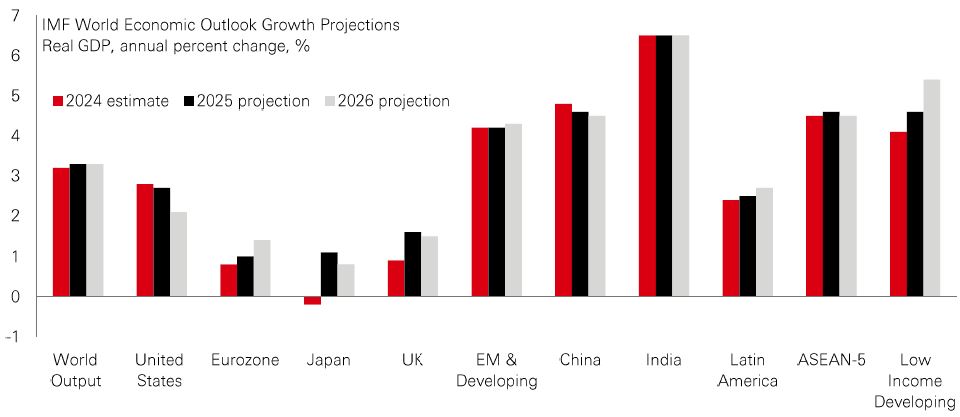

Economists are gazing into their crystal balls for 2025. Where will growth be fastest? In the last few weeks, we’ve had major economic outlook reports from the IMF, the World Bank, the UN, and the World Economic Forum. In 2025, the global economy looks like it is holding steady, with disinflation continuing. But uncertainty is significantly higher.

Among western economies, the US is expected to be the fastest grower, with the IMF raising its forecast to 2.7%. EU (+1%) and Canadian (+2%) growth assumptions have been lowered, but forecasts for the UK and Japan are steady.

The world’s premium growth rates in 2025 are in Asia and Frontier markets. Forecasters expect China (+4.6%) and India (+6.5%) to have broadly stable growth momentum. Growth in South Asia countries like Vietnam and the Philippines is also forecast to be 6%+. In Africa, a number of country stories are notable. In East Africa, Rwanda is set for 7.5% growth and Ethiopia for just under 7%. In the West, Niger (+7%) and Senegal (+8%) look like GDP stars. But “top of the pops” in terms of global growth is Guyana in South America, where economists reckon GDP will grow more than 15% in 2025, driven by an oil bonanza.

In an environment of elevated policy uncertainty, GDP point forecasting is a hazardous hobby. Even so, the data show some interesting country and regional macro themes.

Global listed infrastructure delivered a steady performance in 2024, with valuation multiples across the sector benefitting as central banks cut rates. As an asset class, infrastructure’s appeal lies in its defensive traits, dependable cashflows and inflation-resistant qualities, as well as its exposure to major economic themes. Those themes are currently dominated by digitalisation – which is fuelling significant demand for investment in data centres and networks – and electrification – which is driving investments in onshore wind, solar, and battery storage.

In 2025, the infrastructure outlook is focused on potential policy changes under the new US administration, which could affect the asset class in three ways: (1) potential changes to the scope and value of tax benefits under the Inflation Reduction Act, (2) the impact of tariffs, and (3) the potentially inflationary effect of new policies. Aside from short-term disruption, these factors are not currently expected to hinder returns significantly, with the sector either insulated from any changes, well-placed to potentially benefit from less regulatory and permitting pressures or exposed to assets positively correlated with greater US GDP growth.

The value of investments and any income from them can go down as well as up and investors may not get back the amount originally invested. Past performance does not predict future returns. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector, or security. Any views expressed were held at the time of preparation and are subject to change without notice. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way. The level of yield is not guaranteed and may rise or fall in the future. Source: HSBC Asset Management. Macrobond, Bloomberg. Data as at 7.30am UK time 24 January 2025.

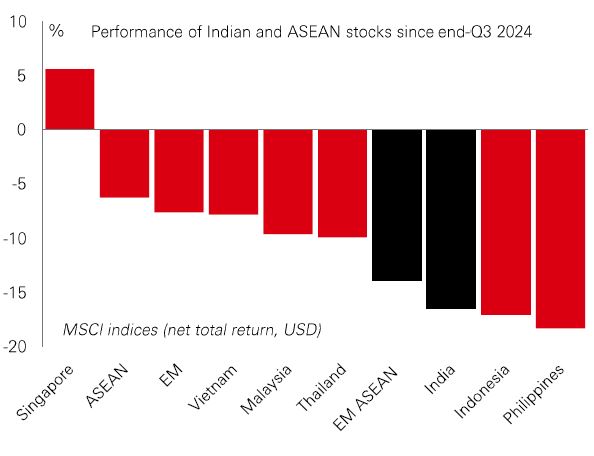

Returns from emerging Asian stocks have come under pressure since the end of Q3 last year, with India and EM ASEAN among the hardest hit. The weakness has been driven by a rally in the US dollar and the prospect of higher-for-longer US rates – as well as geopolitical worries and global trade uncertainty. These factors have weighed on Asian currencies, complicating the ability of regional central banks to cut rates amid a more tepid outlook. In India, weak market confidence has also played a part, with disappointing macro data and earnings news dragging on stocks, which still exhibit rich valuations. Investors are now looking to February’s Union Budget and RBI policy decision as catalysts for a market pick-up. |

While these challenges demand caution, the tailwinds of superior growth rates driven by strong structural stories continue to support Indian and ASEAN equities. Beyond short-term frictions, their idiosyncratic trends and more domestically-oriented markets should offer opportunities for portfolio diversification, with stable inflation and expected modest policy easing supporting the macro and profits outlook.

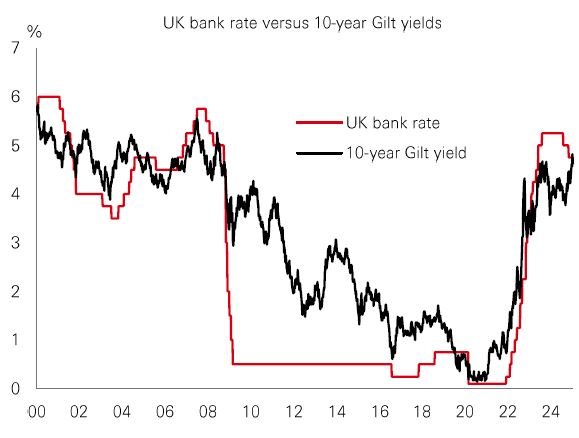

The first two weeks of the year saw fears of a ‘doom-loop’ emerge in the UK. Rising US yields weighed on the Gilts market, raising questions about UK fiscal sustainability, which if unchecked could have led to a further sell-off in Gilts. So far, such an outcome has been avoided, largely due to a pullback in Treasury yields. And the base case is for a gradual further, albeit potentially bumpy, decline in both Treasury and Gilt yields. Provided the new US administration introduces targeted rather than wide-ranging tariffs, US inflation should behave in a way that allows the Fed to deliver some modest further rate cuts. In the UK, the economy is already stagnating, and employment indicators are weakening notably, so current uncomfortably strong wage and price pressures should fade. This would allow the Bank of England to ease policy by more than priced later in the year. |

However, recent volatility is a timely reminder that in a world of higher-for-longer rates and the potential for the Fed to remain on hold, the UK’s mix of poor growth and stretched public finances creates risks that warrant close monitoring.

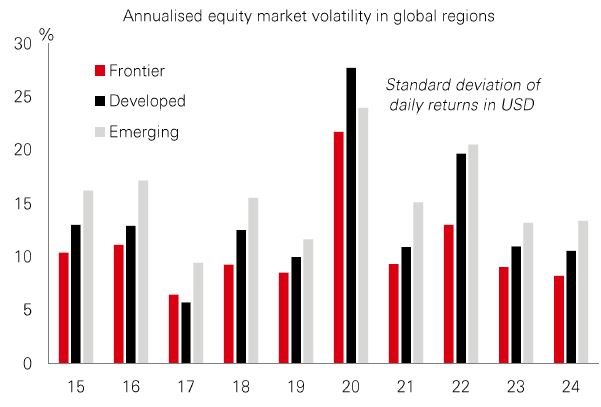

Against a backdrop of economic policy uncertainty, global markets could be prone to volatility this year. For asset allocators looking to manage that risk, Frontier markets could offer some relatively low-vol respite. Frontiers have been consistently less volatile than emerging markets over the past decade – as measured by the standard deviation of daily returns. And for nine of the past 10 years, they have also been less volatile than developed markets. Much of this is down to their domestically-driven economies, with local idiosyncrasies a key reason for low intra-country correlation between them. That’s sheltered them from macro headwinds. |

But there are also broad investment themes at play. One has been the shift of manufacturing hubs out of China into regional Frontier countries like Vietnam, and a similar ‘nearshoring’ of manufacturing to European periphery countries. Liberalisation and sector diversification, notably in Gulf Cooperation Council countries, has also been important. So too has been the growth of digitisation.

Past performance does not predict future returns. The level of yield is not guaranteed and may rise or fall in the future. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector, or security. Any views expressed were held at the time of preparation and are subject to change without notice. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way. Index returns assume reinvestment of all distributions and do not reflect fees or expenses. Source: HSBC Asset Management. Macrobond, Bloomberg, Datastream. Data as at 7.30am UK time 24 January 2025.

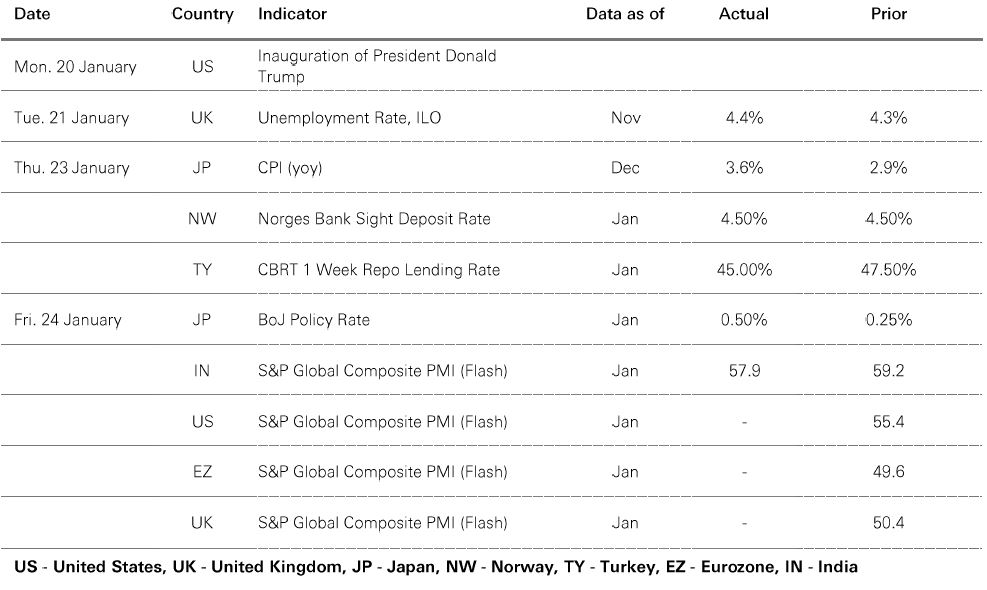

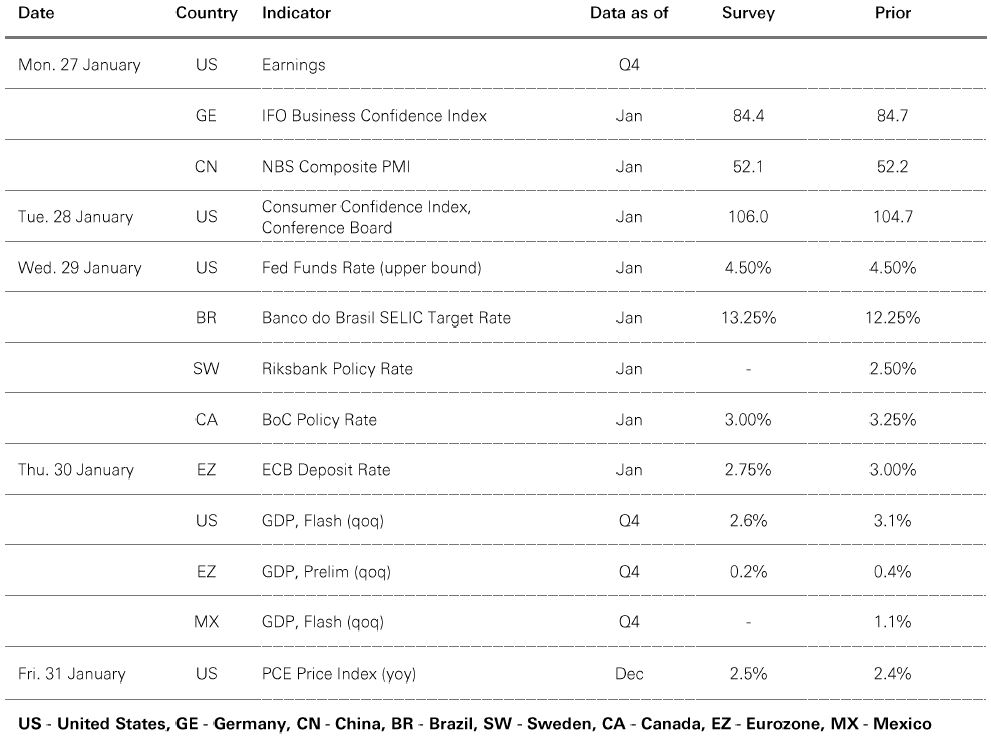

Source: HSBC Asset Management. Data as at 7.30am UK time 24 January 2025. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector or security. Any views expressed were held at the time of preparation and are subject to change without notice.

Risk markets rallied as investors digested US president Trump’s comments during his inauguration, with the US DXY dollar index drifting lower. Core government bonds consolidated ahead of the FOMC and ECB meetings, with US high yield corporate credit outperforming US investment grade. US equities rallied across the board, buoyed by Q4 earnings news and the new AI infrastructure investment plan. The recent outperformance of the equal weighted S&P 500 compared to the ‘Magnificent 7’ stalled. The Euro Stoxx 50 built on recent gains, with Germany’s DAX index reaching an all-time high, and France’s CAC index also performing well. Japan’s Nikkei 225 surged, led by higher IT and communication services stocks, as the BoJ delivered an anticipated 0.25% rate hike. Other Asian markets broadly rose; the Hang Seng extended its gains, while South Korea’s Kospi edged higher. China’s Shanghai Composite and India’s Sensex also posted modest gains. In commodities, oil prices fell, while copper remained firmed, and gold rose further.

We’re not trying to sell you any products or services, we’re just sharing information. This information isn’t tailored for you. It’s important you consider a range of factors when making investment decisions, and if you need help, speak to a financial adviser.

As with all investments, historical data shouldn’t be taken as an indication of future performance. We can’t be held responsible for any financial decisions you make because of this information. Investing comes with risks, and there’s a chance you might not get back as much as you put in.

This document provides you with information about markets or economic events. We use publicly available information, which we believe is reliable but we haven’t verified the information so we can’t guarantee its accuracy.

This document belongs to HSBC. You shouldn’t copy, store or share any information in it unless you have written permission from us.

We’ll never share this document in a country where it’s illegal.

This document is prepared by, or on behalf of, HSBC UK Bank Plc, which is owned by HSBC Holdings plc. HSBC’s corporate address is 1 Centenary Square, Birmingham BI IHQ United Kingdom. HSBC UK is governed by the laws of England and Wales. We’re authorised by the Prudential Regulation Authority (PRA) and regulated by the Financial Conduct Authority (FCA) and the PRA. Our firm reference number is 765112 and our company registration number is 9928412.