17 February 2025

It’s been a good start to the year for investors in China’s stock market. The MSCI China index is already up over 9%, outperforming the wider EM index and the US. This follows a very good performance in 2024 as Chinese authorities’ ramp-up of policy support helped reverse a prolonged period of weak sentiment.

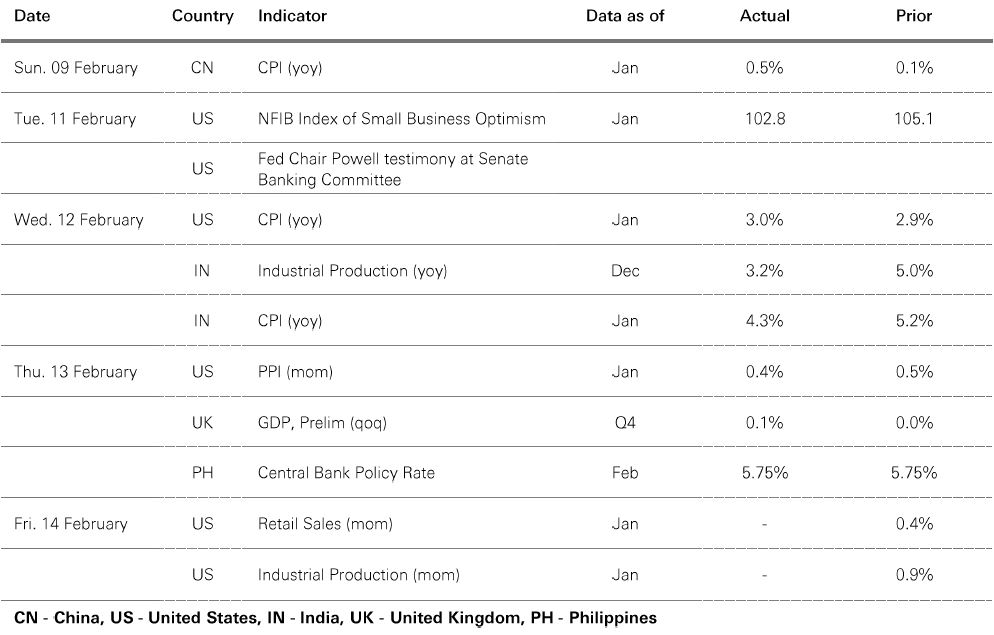

A big driver of recent gains has been a rally in China’s tech companies. The unveiling of DeepSeek late last month has triggered a reappraisal of the sector’s profits outlook and potential feedthrough to AI innovation and adoption in the country’s vast consumer market. Also, data on Lunar New Year spending has been strong, and is reflected in a higher-than-expected January CPI print.

Deep discounts versus global peers imply potential for large upside moves on better-than-expected news. After DeepSeek, there is potential for accelerated AI adoption across many industries. And last year’s late rally in the US dollar and big pick-up in global yields look to have run out of steam, boding well for the overall EM asset complex.

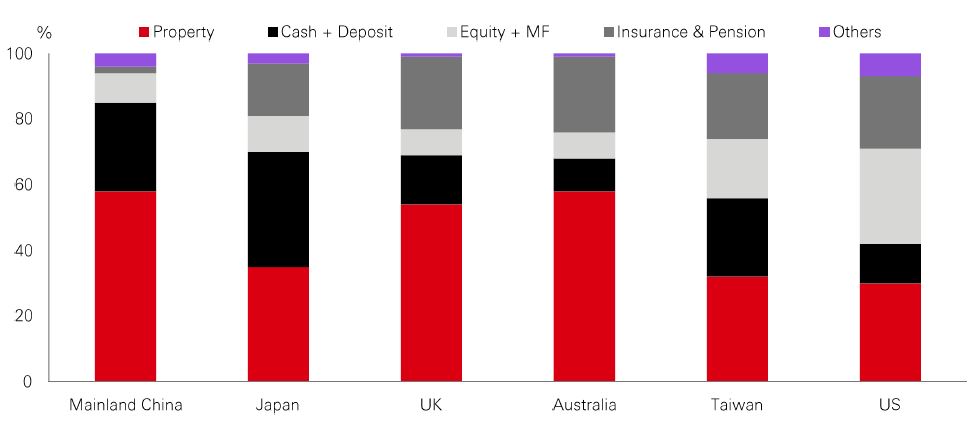

Nevertheless, with a big chunk of China’s household wealth tied up in property, the real estate slump remains a major challenge, and with it the threat of sustained deflation. Recent policy measures have helped stabilise the situation, but more demand-boosting stimulus will be required to keep growth on the right track and maintain positive momentum in markets. All eyes will be on next month’s National People’s Congress (NPC) meeting.

Elevated all-in yields and tighter spreads helped deliver a strong performance in Asian credit last year. And despite a recent pick-up in global policy uncertainty, macro tailwinds could make 2025 another strong year for the asset class.

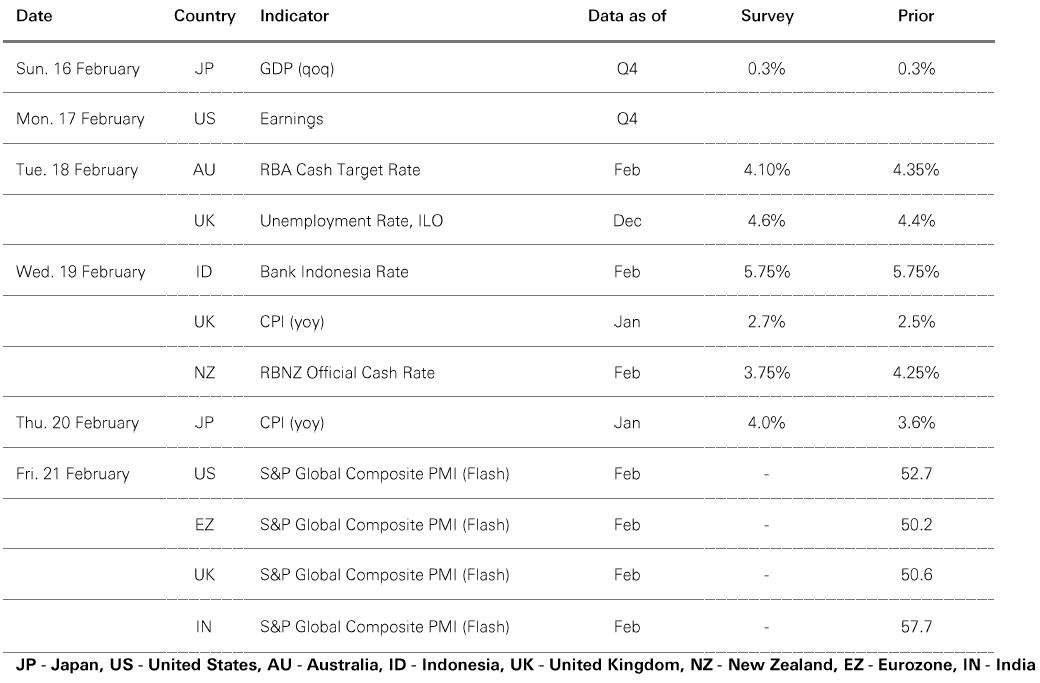

Asian markets benefit from the twin-drivers of relatively high GDP growth and benign inflation. But there are other key themes, too. One is China’s continuing path to recovery. Its outlook hinges on navigating external headwinds and domestic imbalances with policies to boost domestic demand and cut industrial over-capacity. A clear pro-growth, pro-market policy stance could help – and we’re expecting more details on policy support in March. That ongoing stimulus could have spillover effects for the rest of Asia and provide a cushion from global headwinds.

Meanwhile, the region’s credit market also benefits from the strong growth, rising trade flows, and insulated nature of domestically oriented economies like India and parts of ASEAN, including Indonesia and the Philippines. These economies are less sensitive to global trade, making them potentially more resilient to external shocks.

The value of investments and any income from them can go down as well as up and investors may not get back the amount originally invested. Past performance does not predict future returns. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector, or security. Any views expressed were held at the time of preparation and are subject to change without notice. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way. Source: HSBC Asset Management. Macrobond, Bloomberg. Data as at 7.30am UK time 14 February 2025.

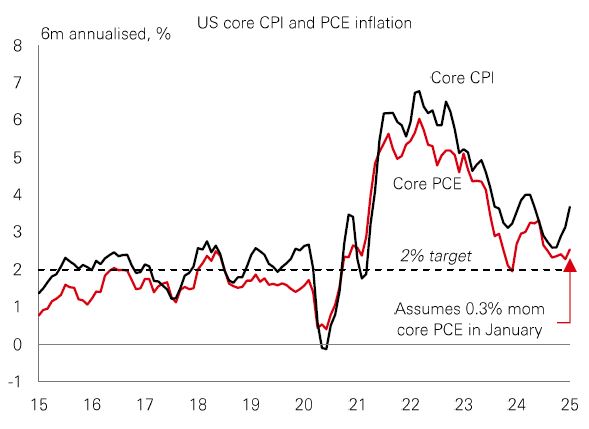

US core CPI surprised to the upside, rising by 0.4% month-on-month in January. Some of the strength reflected outsized gains in some components – used car prices jumped 2.2% m-o-m, vehicle insurance rose by 2.0% m-o-m and airfares were up 1.2%. Strong demand for new and used cars in recent months – potentially in anticipation of tariffs – may be supporting prices and insurance premiums. Airfares look more like a case of a bit of noise in the data, what some economists have called ‘residual seasonality’. Absent these factors, core CPI would have risen by a more palatable, albeit still robust, 0.3% m-o-m. |

Luckily for the Fed, it targets PCE. The CPI data, when combined with the produce price release, has led economists to conclude that core PCE is likely to have risen by 0.2-0.3% m-o-m in January, following prints of only 0.1-0.2% in the previous two months. In that sense, while the Fed won’t be overly happy with the January inflation data, it will also want to see whether it follows the same pattern as recent years – a strong start that fades away. The bond market, having initially sold off in reaction to the CPI, has calmed down and largely reversed its losses.

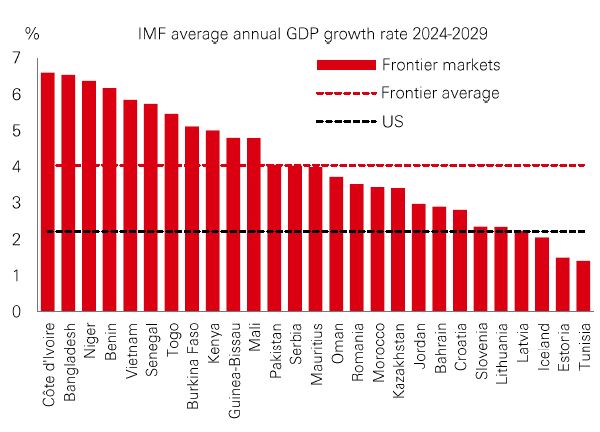

A key attraction of frontier markets is portfolio exposure to smaller, rapidly growing economies. According to the IMF, the average GDP growth rate for frontier economies is 4% over the next five years, well above 2.2% for the US, and 1.2% for the big-four eurozone economies. Vietnam – a big weight in the frontier index – has a well-documented structural growth story centred on attracting FDI amid the recent trend of global “friendshoring”. Bangladesh has become a key textiles exporter. But perhaps less talked about is the impressive growth now being seen in many West African nations, with Côte d’Ivoire, Niger, and Benin expected to grow in excess of 6% per annum over the next five years. |

A big part of this growth will be driven by recent hydrocarbon development, which brings with it a dependence on global energy prices. And regional politics remain difficult. Nonetheless these growth numbers signal a region with growing economic clout – supported by a young and growing population – and with it an emerging consumer base. As these economies mature, investor allocations and market liquidity are likely to increase.

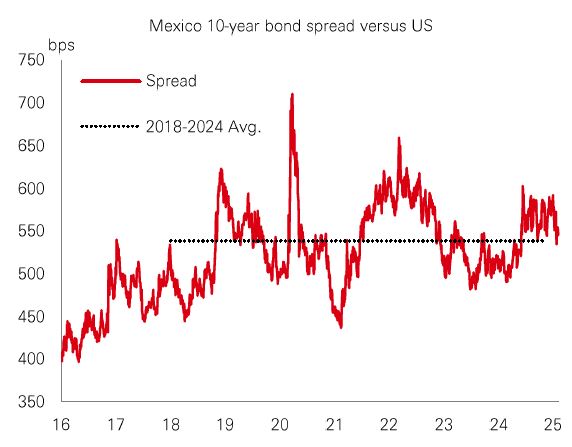

Mexico has found itself at the centre of a rise in global policy uncertainty recently. After regional political discussions in early February, volatility in the peso subsided, and the currency rebounded. That upbeat reaction spilled into the stock market, where equities saw a pick-up, and in sovereign bonds, where there was a modest fall in both two- and 10-year yields. |

However, volatility and investment uncertainty are expected to continue. In FX, the peso has room to depreciate to buffer any shock in terms of trade, and if so, financial authorities may intervene to secure orderly trading conditions without targeting any specific FX level. But peso weakness could pose upside risks to inflation and downside risks to economic activity. These factors are likely to shape policy direction from Mexico’s central bank. The base case view is that while Banxico is ready to decouple slightly from the Fed and cut rates by ~1.50% this year, the uncertain outlook could frustrate efforts.

Past performance does not predict future returns. The level of yield is not guaranteed and may rise or fall in the future. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector, or security. Any views expressed were held at the time of preparation and are subject to change without notice. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way. Index returns assume reinvestment of all distributions and do not reflect fees or expenses. Source: HSBC Asset Management. Macrobond, Bloomberg, Datastream. Data as at 7.30am UK time 14 February 2025.

Source: HSBC Asset Management. Data as at 7.30am UK time 14 February 2025. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector or security. Any views expressed were held at the time of preparation and are subject to change without notice.

Global policy uncertainty continued to overhang risk markets, with the US DXY dollar index weakening. US Treasuries ended a volatile week modestly lower, underperforming Eurozone bonds and UK gilts following higher-than-expected US CPI data, as Fed Chair Powell reiterated that there is no urgency to cut rates. US equities rose, with the Russell 2000 lagging both the Nasdaq and S&P 500. The Euro Stoxx 50 index posted strong gains, bolstered by better-than-expected Q4 earnings, while the German DAX reached an all-time high. Japan’s Nikkei 225 performed well amid a weaker yen. Other Asian markets were mixed, with the Hang Seng leading the region amid optimism about the AI/tech sectors, followed by South Korea’s Kospi, and the Shanghai Composite also extended its rallies. However, India’s Sensex index fell. In commodities, gold and copper were on track to close higher, while oil finished a choppy week with moderate gains.

We’re not trying to sell you any products or services, we’re just sharing information. This information isn’t tailored for you. It’s important you consider a range of factors when making investment decisions, and if you need help, speak to a financial adviser.

As with all investments, historical data shouldn’t be taken as an indication of future performance. We can’t be held responsible for any financial decisions you make because of this information. Investing comes with risks, and there’s a chance you might not get back as much as you put in.

This document provides you with information about markets or economic events. We use publicly available information, which we believe is reliable but we haven’t verified the information so we can’t guarantee its accuracy.

This document belongs to HSBC. You shouldn’t copy, store or share any information in it unless you have written permission from us.

We’ll never share this document in a country where it’s illegal.

This document is prepared by, or on behalf of, HSBC UK Bank Plc, which is owned by HSBC Holdings plc. HSBC’s corporate address is 1 Centenary Square, Birmingham BI IHQ United Kingdom. HSBC UK is governed by the laws of England and Wales. We’re authorised by the Prudential Regulation Authority (PRA) and regulated by the Financial Conduct Authority (FCA) and the PRA. Our firm reference number is 765112 and our company registration number is 9928412.