24 March 2025

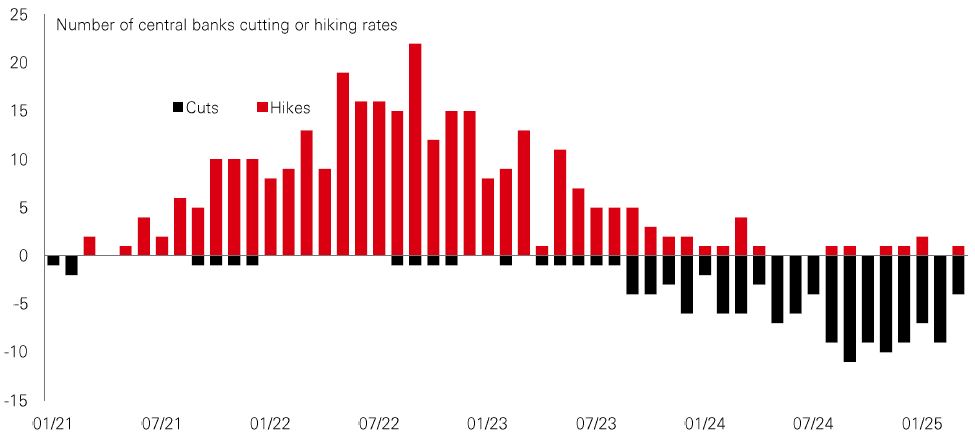

Uncertainty was very much the broad theme of last week’s central bank policy meetings, with an increasingly complex macro reality clouding the outlook.

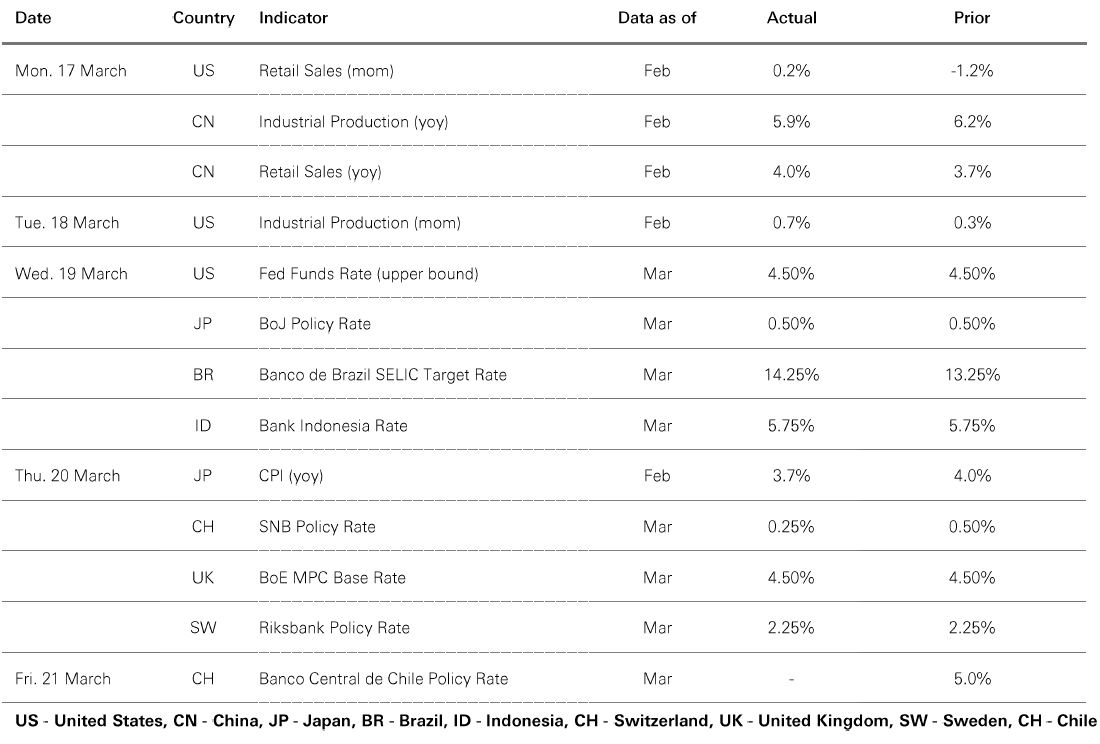

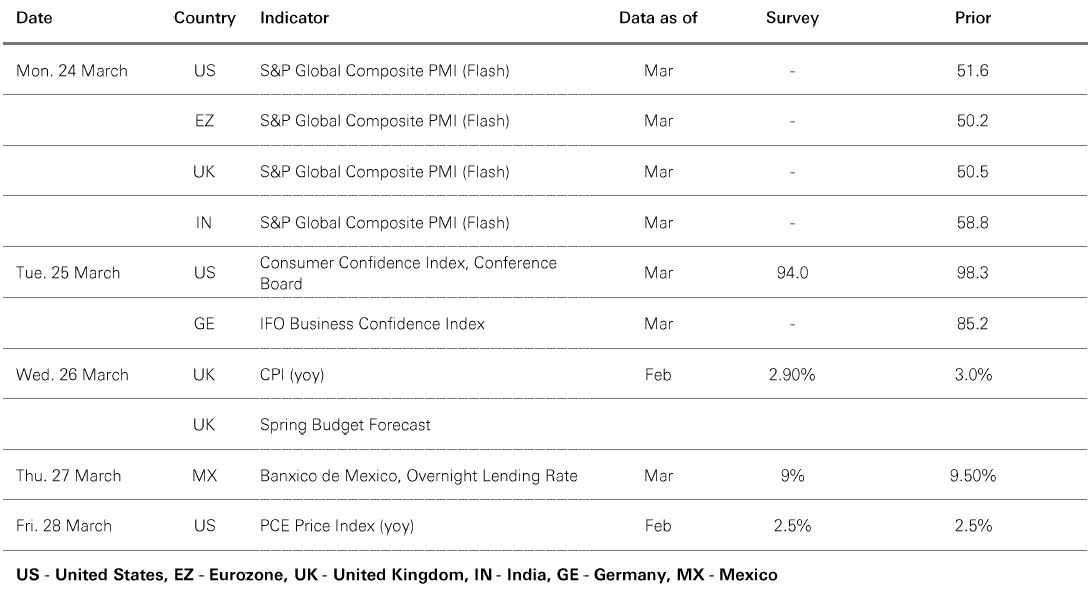

As expected, the Fed kept rates on hold, maintaining ‘wait-and-see’ mode in the face of heightened policy uncertainty. Fed Chair Jerome Powell signalled no hurry to cut rates as the central bank seeks to balance competing considerations of upward inflation pressure, downside growth risks, and fragile sentiment. The Fed revised down its 2025 GDP growth forecasts to 1.7% from 2.1% and nudged up its inflation expectations – an uneasy mix that raises the spectre of stagflation. The inescapable message was that uncertainty is “remarkably high”, with the so-called ‘dot plot’, which tracks the year-end rate projections of Fed officials, more scattered now than it was three months ago.

For other central banks, there was modest divergence but few surprises. Banco do Brasil’s ongoing efforts to tackle resurgent inflation saw it hike rates by 1%. By contrast, Swiss policymakers responded to persistently low inflation with a 0.25% cut. Others, including China, the UK, and Sweden, all followed the Fed’s cautious stance.

On balance, we think global central banks remain on course to cut rates this year as cooling labour markets allow inflation considerations to give way to shoring up growth that is being damaged by uncertainty. Barring a major shock, this would be a decent backdrop for global risk assets to perform and laggard markets to continue to catch up.

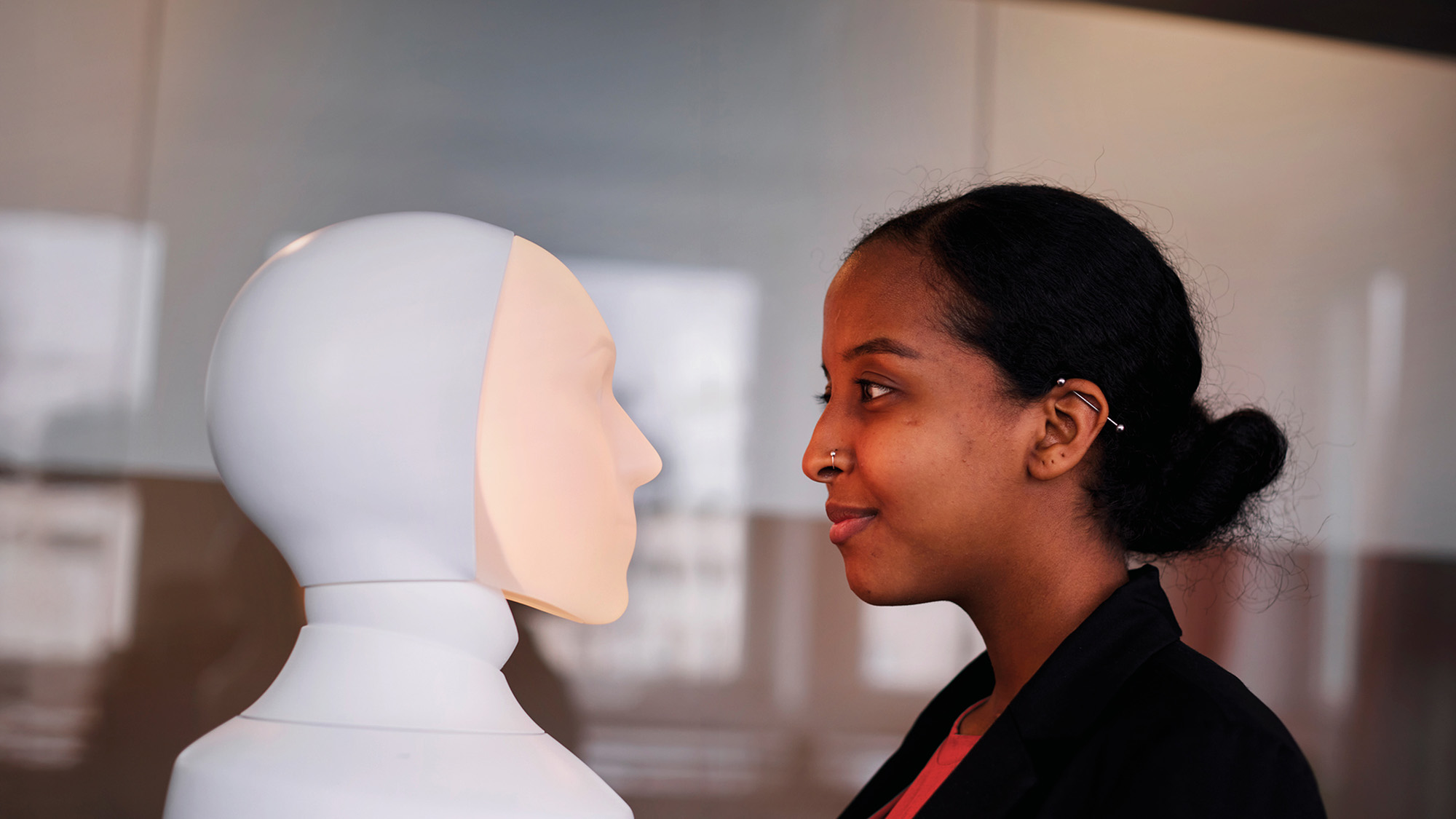

Ten years ago, the United Nations agreed a set of Sustainable Development Goals (SDGs) aimed at promoting a fairer, healthier, and more sustainable future. Since then, asset allocators have used them to measure sustainability outcomes in portfolios. But there have been challenges, particularly because there is no one-size-fits-all way of measuring companies against broad and often overlapping goals.

Part of the challenge with SDGs is that they were designed with sovereigns, rather than corporates, in mind and many of them are qualitative. That can make them difficult to measure and apply to investment portfolios, especially at scale. The ambiguity raises the risk of greenwashing and missing out on investment opportunities.

The quant solution is to move away from viewing SDGs primarily as reporting metrics aiming to measure every company against every SDG and instead break them into granular investment themes that are easier to link to specific company activities. That way, it’s possible to be more precise about how firms’ impact on those individual themes within SDGs, and do it – with the help of AI – at scale. The result is a more robust, quantitative process for thematic portfolios, that offers a competitive edge in rapidly changing markets.

The value of investments and any income from them can go down as well as up and investors may not get back the amount originally invested. Past performance does not predict future returns. The level of yield is not guaranteed and may rise or fall in the future. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector, or security Any views expressed were held at the time of preparation and are subject to change without notice. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way. Source: HSBC Asset Management. Macrobond, Bloomberg. Data as at 7.30am UK time 21 March 2025.

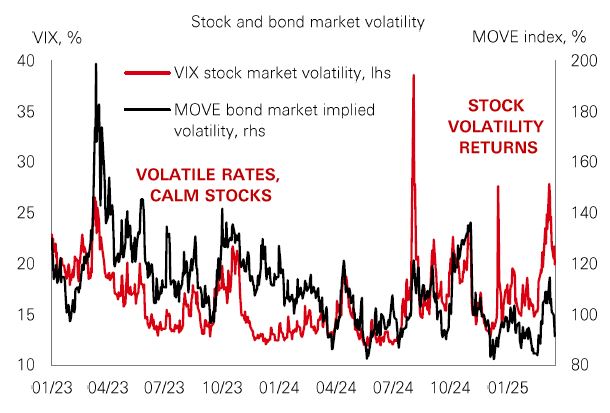

The noise level in markets remains very high. A dramatic rise in policy uncertainty is creating a more volatile environment, which could persist. What’s new is that volatility is back in the stock market. After the 2021-22 inflation burst, volatility in 2023 and 2024 was mostly contained to short-term interest rates and bond markets, with technical factors also keeping the VIX index supressed. This year, elevated policy uncertainty, the AI wobble, and investors’ reduced faith in US exceptionalism are all creating a rockier journey in US stocks. The US market has gone from hero to zero. China, broad emerging markets, the eurozone, and even the FTSEs are all outperforming. |

Uncertainty is not great for macro trends either. Both consumers and businesses move into wait-and-see mode, which can stall economic activity. For now, we don’t think the system is in imminent recession danger. Instead, the situation is one of growth cooling down. But even without a more adverse scenario materialising, uncertainty has a price. Investors should prepare for more surprises as we head toward Q2. Only one thing is for sure: the uncertainty trade is back.

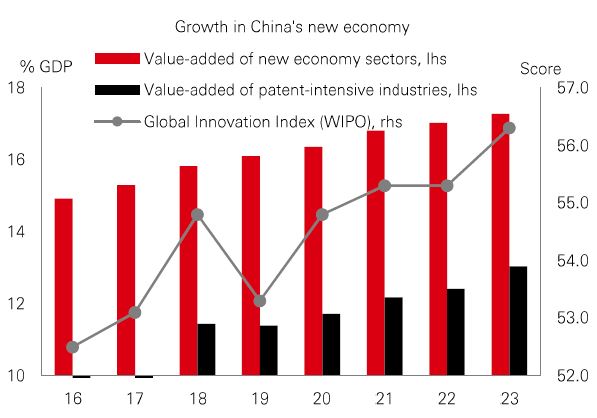

Chinese policymakers have unveiled a new 30-point plan to boost domestic consumption as part of efforts to fire-up the country’s economy. It follows recent National People’s Congress meetings, where domestic demand stimulus was billed as the government’s top priority. The plan reiterates previous announcements designed to raise wages, cut financial burdens, and encourage spending. It includes measures to stabilise the stock market – a driving force of consumer confidence – and develop more bond products suitable for individual investors. As well as promoting traditional consumer sectors like cars and property, the plan also encourages high-growth areas of consumer spend, such as ‘silver tourism’, and AI-powered technologies like autonomous driving, smart wearables, ultra-high-definition video, robotics, and 3D printing. |

For now, China looks to be in ‘wait and see’ mode amid elevated global economic and trade policy uncertainty. But the policy shift toward consumption is positive. And while there is no magic bullet to drive a quick or strong turnaround in consumer spending, the perceived policy put may continue to support investor sentiment, propagating a virtuous cycle between consumption and the stock market.

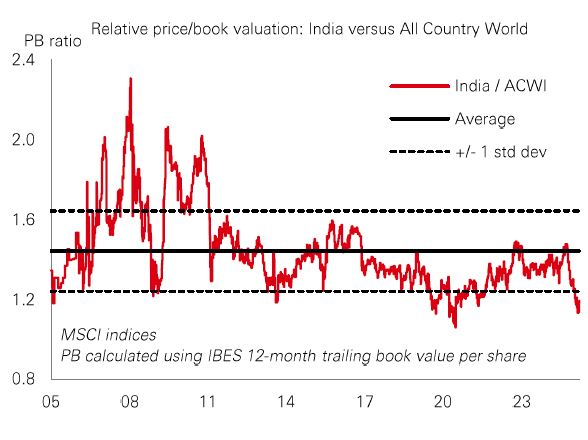

After an impressive two-year rally driven by strong inflows and high growth expectations, Indian stocks have lagged their global peers in 2025 – with MSCI India down 7%. After recent falls, India’s price/book valuation relative to the rest of the world (excluding the Covid sell-off) has slipped to a 20-year low. But why? Recent weakness has been driven by a mix of foreign investment outflows, lacklustre Q3-FY25 profits news, and trade policy uncertainty. That’s despite the stimulative effects of an RBI rate cut, measures to boost system liquidity, and positive signals from February’s Union Budget. In addition, India’s relatively closed economy could make it less sensitive to trade tariffs than some of its Asian neighbours. |

Against that backdrop, its stocks are still expected to deliver mid-teens earnings growth in each of the next two years. Near-term performance could be driven by favourable base effects, a pick-up in government capex, and strong rural growth. Longer-term, India’s structural growth story remains intact, underpinned by favourable demographics, rising incomes, supply chain diversification, and government reforms – making recent market weakness a potential buying opportunity.

Past performance does not predict future returns. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector, or security Any views expressed were held at the time of preparation and are subject to change without notice. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way.

Source: HSBC Asset Management. Macrobond, Bloomberg, Datastream, MOVE: BofA ICE. Data as at 7.30am UK time 21 March 2025.

Source: HSBC Asset Management. Data as at 7.30am UK time 21 March 2025. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector or security. Any views expressed were held at the time of preparation and are subject to change without notice.

Risk markets rebounded as investors digested the latest Federal Reserve FOMC meeting and Chair Powell’s post-meeting remarks, while the US dollar index remained range-bound. Core government bonds saw a broad-based rally. The FOMC downgraded its growth projection, upgraded its near-term inflation forecast and maintained its projection for further gradual easing. US equities mostly rose, led by the Russell 2000. The Euro Stoxx 50 posted decent gains. Japan’s Nikkei 225 moved higher, driven by Financials, as the latest data and the BoJ officials’ comments reinforced market expectations of further gradual BoJ policy normalisation. In emerging markets, India’s Sensex rose strongly, and South Korea’s Kospi performed well, while Chinese equities drifted lower. In commodities, oil prices advanced, with geopolitical developments remaining in focus, and both copper and gold rose.

We’re not trying to sell you any products or services, we’re just sharing information. This information isn’t tailored for you. It’s important you consider a range of factors when making investment decisions, and if you need help, speak to a financial adviser.

As with all investments, historical data shouldn’t be taken as an indication of future performance. We can’t be held responsible for any financial decisions you make because of this information. Investing comes with risks, and there’s a chance you might not get back as much as you put in.

This document provides you with information about markets or economic events. We use publicly available information, which we believe is reliable but we haven’t verified the information so we can’t guarantee its accuracy.

This document belongs to HSBC. You shouldn’t copy, store or share any information in it unless you have written permission from us.

We’ll never share this document in a country where it’s illegal.

This document is prepared by, or on behalf of, HSBC UK Bank Plc, which is owned by HSBC Holdings plc. HSBC’s corporate address is 1 Centenary Square, Birmingham BI IHQ United Kingdom. HSBC UK is governed by the laws of England and Wales. We’re authorised by the Prudential Regulation Authority (PRA) and regulated by the Financial Conduct Authority (FCA) and the PRA. Our firm reference number is 765112 and our company registration number is 9928412.

We use cookies to help keep our website and services working properly. These cookies are necessary and are set automatically.

We'd also like to use some optional cookies that:

You can either 'Accept' or 'Decline' these cookies or choose what cookies to accept in 'Manage cookies'.

To learn more about how we use cookies, visit our Cookie Notice.