3 February 2025

Last week saw a market wobble caused by the potential disruption of AI start-up DeepSeek to the US-dominated AI business model. It’s too early to argue for a big negative impact on AI capex or the wider US tech sector, and many software names could be poised to benefit. Access to cheaper AI could even create an explosion in demand – we call this “the Jevons Paradox in action”. While equity volatility spiked last Monday, markets have regained lost ground.

Yet, last week’s developments added significant uncertainty in a sector priced for perfection. With Q4 2024 earnings season under way – and big tech profits in focus – it makes sense for investors to be more cautious on the sector.

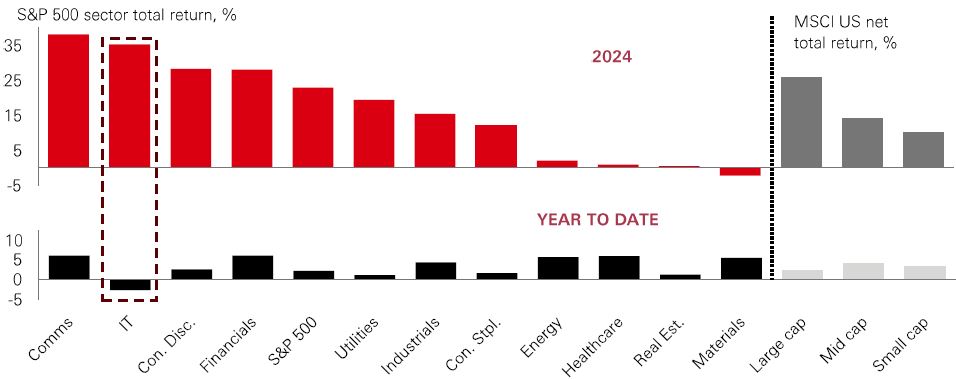

A key theme for 2025 is that investment market performance could “broaden out” into other sectors, rather than remain heavily concentrated in US mega-cap technology. Market performance this year already has a flavour of this theme. If growth can stay resilient and profits deliver as expected, a rotation into laggard sectors and regions, as well as a “deepening” across the market-cap spectrum, should continue. That could boost performance in equal-weighted and factor-balanced equity strategies.

Recent market volatility has also been driven by other challenges – including tariff uncertainty, a shifting scenario for the Fed, and stretched valuations (with bond yields rising and super-normal profits more uncertain). That means the market set up is for a “volatile Goldilocks” – a broadly constructive macro backdrop of disinflation, rate cuts, and profits resilience, but with more uncertainty creating a much bumpier ride for investors. Being active and opportunistic will be key in 2025.

Last week’s Lunar New Year marked the arrival of the Year of the Snake – the snake being a symbol of wisdom, adaptability, and renewal. Faced with heightened macro and geopolitical uncertainty, as well as recent volatility in high-growth sectors like AI, these traits will be essential for global investors in 2025.

One area where flexibility could be particularly important is in navigating trends in emerging markets, given recent signs of rotation in some of last year’s laggards. Latin American markets – which underperformed in 2024 – have been EM pace-setters in 2025. In US dollar terms, the MSCI EM LatAm index is up by nearly 8% this year, with Brazil (+9%), Mexico (+5%), and Chile (+6%) leading the recovery. In Asia, South Korean stocks have also halted last year’s sharp sell-off, with a 9% rise in January. And after a tentative start to the year, Chinese markets show signs of positive momentum versus regional peers like India, and could gain traction on further policy support this year.

While heightened volatility remains a risk for investors in 2025 – particularly given trade policy uncertainty – January’s momentum pick-up could be early evidence of a “broadening out” in markets. That could offer opportunities for adaptable investors. Kung Hei Fat Choi!

The value of investments and any income from them can go down as well as up and investors may not get back the amount originally invested. Past performance does not predict future returns. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector, or security. Any views expressed were held at the time of preparation and are subject to change without notice. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way. Source: HSBC Asset Management. Macrobond, Bloomberg. Data as at 7.30am UK time 31 January 2025.

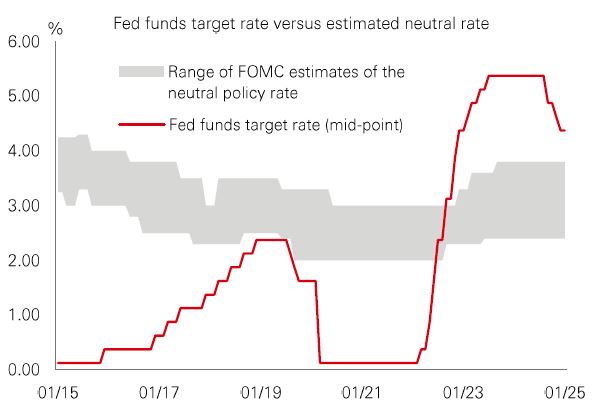

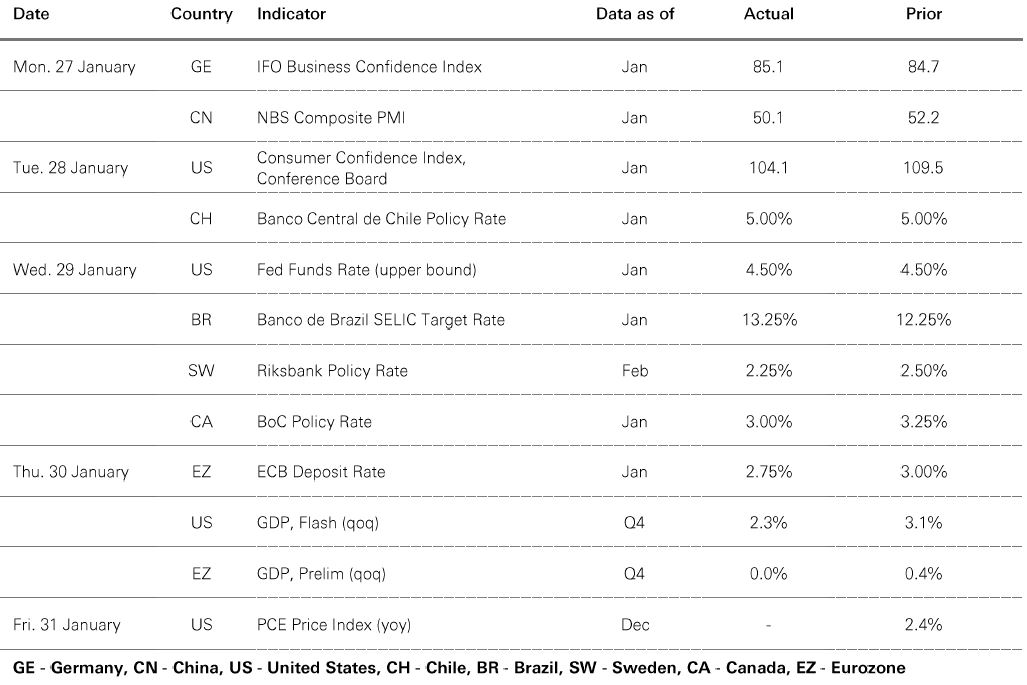

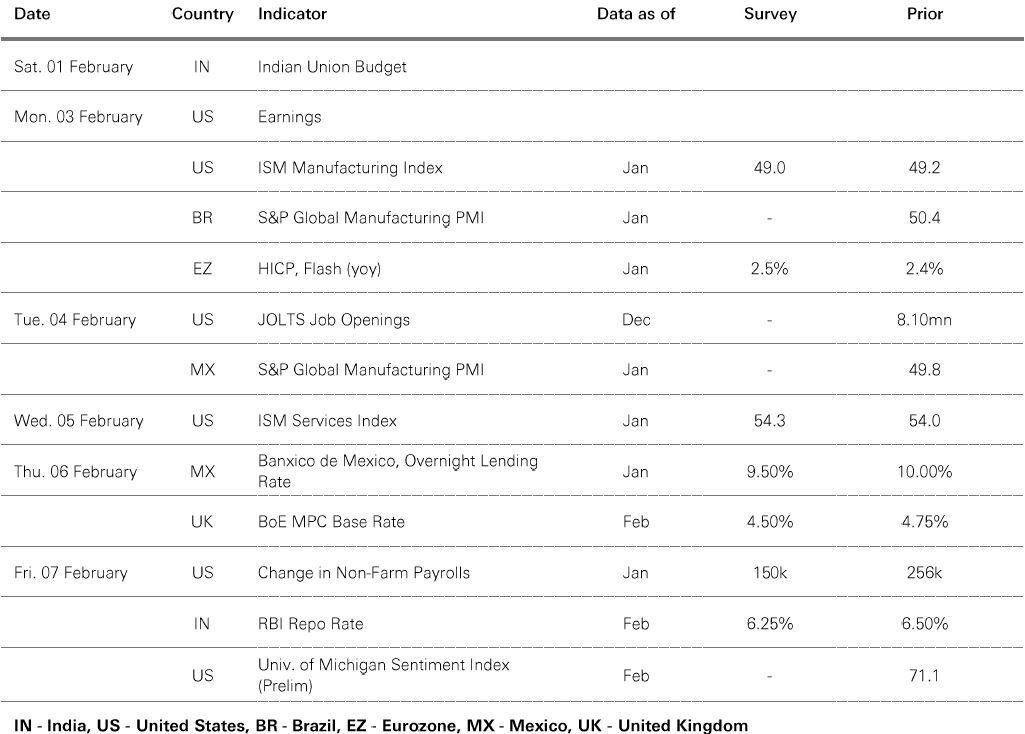

Divergent macro trends and trade policy uncertainty resulted in the Fed diverging from other Northern Hemisphere central banks last week. The ECB, Bank of Canada, and Riksbank all cut rates, and the Bank of England is expected to follow suit this week. While conditions across these economies are not identical, broadly speaking, growth has been subdued and there is some concern that uncertainty over, or the implementation of, US trade tariffs is more of a problem for activity than inflation. |

In the US, still-robust growth and a solid labour market allowed the Fed to leave the funds rate unchanged and await details on the new US administration’s policies. While the Fed is not in a hurry, rate cuts later in 2025 remain likely, given “meaningfully restrictive” policy. The base case is that targeted implementation of tariffs against a backdrop of cooling wages results in some cooling of growth and some bumpiness in inflation, but does not unsettle inflation expectations or unnerve the Fed. Overall, an outlook of no recession, further rate cuts, and profits resilience is a largely constructive mix for risk assets and fixed income in 2025.

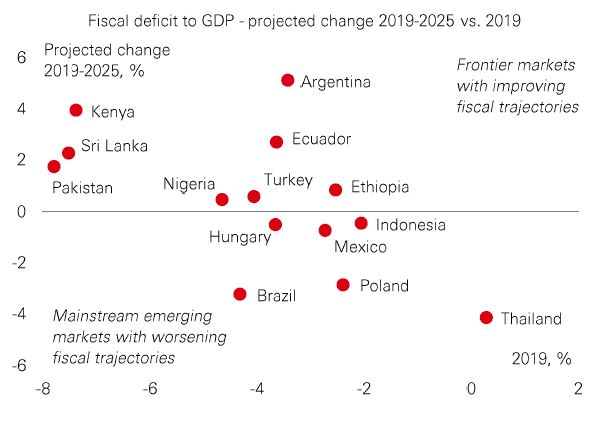

Argentina has seen an extraordinary turnaround. Last year, it delivered its first fiscal surplus since the 2000s after recording a near 7% deficit in 2017. Monthly inflation collapsed from 25% in December 2023 to under 3% a year later. These shifts helped its hard-currency bonds return a staggering 100% in 2024. Despite the shock therapy and its social costs, the government is popular and may win a greater share of representation in Congress in October’s mid-term elections. So far so good. But there are lingering questions about external adjustment. The country has limited ability to meet rising external debt-servicing needs in the coming years. Fear of stoking inflation means its currency can only be devalued gradually via a ‘crawling peg’, limiting the scope for an improvement in the balance of payments. A new deal with the IMF for external financing is in the works but may be delayed until after the mid-term elections. |

Overall, Argentina has an improving structural story. While further reform and IMF funding is needed, it is becoming a fiscal ‘saint’ just as many of its EM peers are turning into fiscal ‘sinners’.

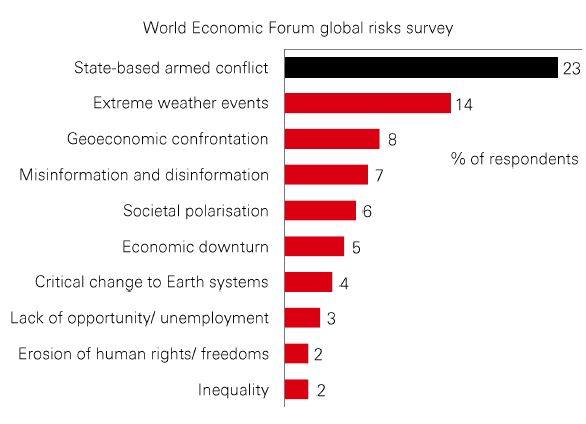

As world leaders and CEOs return from the ski slopes of Davos Klosters, and the recent annual meeting of the World Economic Forum, a key takeaway is that global risk perceptions have shifted dramatically. Topping the list of concerns in this year’s Global Risks Report is ‘state-based armed conflict’ – which barely featured as a risk in the same survey two years ago. Extreme weather, geoeconomic confrontation, mis/disinformation, and societal polarisation together make up the top five fears. AI was also a major talking-point in this year’s discussions, with leaders focusing on its potential to revolutionise industries as well as concerns over economic disruption, job displacement, and regulatory uncertainty – many of which feed into the top risks. |

Broadly, this year’s survey reflects a sense that some of the biggest perceived risks to global stability concern geopolitical tensions and climate change. Some analysts see a shift towards an increasingly multi-polar world where fiscal activism, climate change and technology will dominate. It implies a regime of more volatile inflation and rates amid greater macro uncertainty; more complex asset allocation solutions will likely be required.

Past performance does not predict future returns. The level of yield is not guaranteed and may rise or fall in the future. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector, or security. Any views expressed were held at the time of preparation and are subject to change without notice. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way. Index returns assume reinvestment of all distributions and do not reflect fees or expenses. Source: HSBC Asset Management. Macrobond, Bloomberg, Datastream. Data as at 7.30am UK time 31 January 2025.

Source: HSBC Asset Management. Data as at 7.30am UK time 31 January 2025. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector or security. Any views expressed were held at the time of preparation and are subject to change without notice.

Risk appetite soured on an AI-driven sell-off in US big tech and IT stocks early last week, with the US DXY dollar index range-bound. US Treasuries rallied, outperforming Gilts and Bunds. The FOMC left policy unchanged, with Fed chair Powell emphasising “no rush” to alter its policy stance. The ECB lowered rates by 0.25%, with ECB president Lagarde signalling further gradual easing. US equities were mixed as investors digested the latest Q4 earnings updates. The Euro Stoxx rallied further, with Germany’s Dax index reaching a new high. Japan’s Nikkei lost ground as the yen firmed versus the US dollar. In EM, most Asian stock markets were closed for the Lunar New Year holiday, with India’s Sensex eking out a small rise. Brazil’s Bovespa index increased further, with Banco do Brasil hiking rates another 1%. In commodities, oil weakened. Gold and copper were also on course to close higher.

We’re not trying to sell you any products or services, we’re just sharing information. This information isn’t tailored for you. It’s important you consider a range of factors when making investment decisions, and if you need help, speak to a financial adviser.

As with all investments, historical data shouldn’t be taken as an indication of future performance. We can’t be held responsible for any financial decisions you make because of this information. Investing comes with risks, and there’s a chance you might not get back as much as you put in.

This document provides you with information about markets or economic events. We use publicly available information, which we believe is reliable but we haven’t verified the information so we can’t guarantee its accuracy.

This document belongs to HSBC. You shouldn’t copy, store or share any information in it unless you have written permission from us.

We’ll never share this document in a country where it’s illegal.

This document is prepared by, or on behalf of, HSBC UK Bank Plc, which is owned by HSBC Holdings plc. HSBC’s corporate address is 1 Centenary Square, Birmingham BI IHQ United Kingdom. HSBC UK is governed by the laws of England and Wales. We’re authorised by the Prudential Regulation Authority (PRA) and regulated by the Financial Conduct Authority (FCA) and the PRA. Our firm reference number is 765112 and our company registration number is 9928412.