20 January 2025

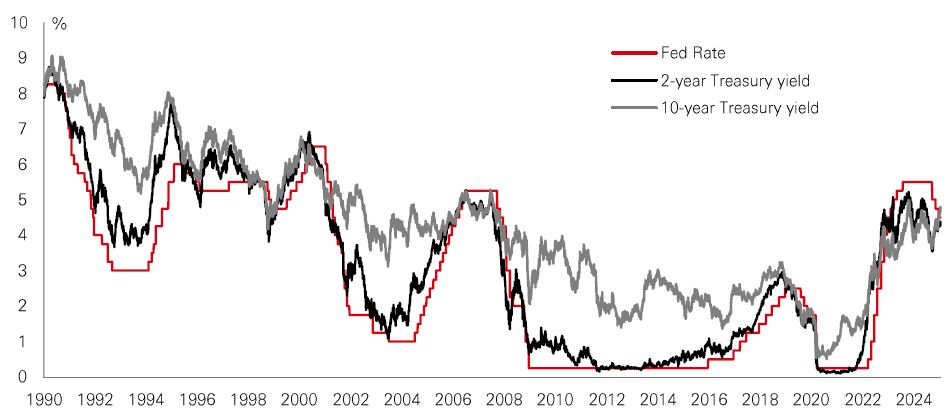

Developed market government bonds have lost significant ground in recent months. The benchmark US 10-year Treasury yield reached 4.8% mid-week; a level last seen in October 2023. UK 10-year Gilt yields rose to 4.9%; their highest level since 2008. But what does the threat of bond yields crossing 5% mean for investors?

Some macro market onlookers are calling this the “reverse conundrum”. It’s a play on the “conundrum” first termed by Alan Greenspan to describe stubbornly-low long bond yields in the face of 17 Fed rate hikes through to mid-2006. Today’s “reverse conundrum” is this process flipped around… despite Fed cuts, bond yields are on the rise.

The rise is down to a combination of fiscal concerns, bond issuance worries, and, to some extent, investor nervousness about policy mistakes. Relative to recent history, the pattern is unusual and if the “reverse conundrum” holds, it could signal that we have entered a new economic and market regime. We would no longer be in the era of low bond yields.

That could have profound implications for asset allocators. It would be a world where long bond yields would have to compensate investors for inflation and fiscal risks, with bonds no longer offering a guaranteed all-weather hedge for portfolios. Meanwhile, higher discount rates would create a pricing challenge for assets right across the risk curve (with skinny risk premiums particularly vulnerable to a re-pricing). That would leave investors seeking a new range of alternatives and private markets to build portfolio resilience. If this really is a “reverse conundrum” world, there would be a strong case for taking an active and opportunistic approach to investing in 2025.

The global listed real estate sector weakened late last year amid uncertainty over the timing of future Fed rate cuts. But some listed real estate analysis suggests parts of the European-listed market trade at an attractive discount to both other asset classes and the direct property sector. With private real estate capital markets showing signs of re-opening, investment volumes should continue to pick up, with listed property players well-placed to benefit.

In part, this is supported by the fact that REIT (Real Estate Investment Trust) balance sheets are currently in good shape, with low leverage.

Given that European economic growth is forecast to lag other regions this year, some specialists favour sectors less reliant on growth to deliver returns. They include those with secular tailwinds like senior housing, and sectors with embedded income growth like industrial warehouses. Dividend yields from global real estate equities are standing at a premium to wider equities.

The value of investments and any income from them can go down as well as up and investors may not get back the amount originally invested. Past performance does not predict future returns. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector, or security. Any views expressed were held at the time of preparation and are subject to change without notice. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way. The level of yield is not guaranteed and may rise or fall in the future. Source: HSBC Asset Management. Macrobond, Bloomberg. Data as at 7.30am UK time 17 January 2025.

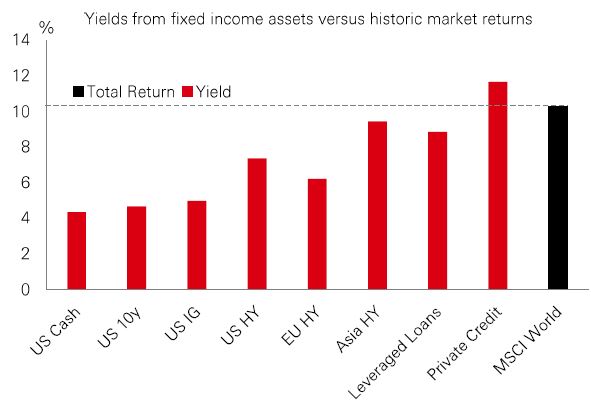

Despite a backdrop of volatile rates, policy uncertainty, and geopolitical stress, global corporate credit spreads currently trade at close to 30-year tights. This tightening has been driven by a combination of strong fundamentals and stable technical demand. Spreads have been underpinned by robust profits growth and continuing evidence of US economic resilience, particularly in the labour market. With US rates still elevated – and further policy easing now being priced-out by the market – high credit yields have been a major attraction for fixed income investors. This ensured that a record supply of bond issuance last year was soaked up by keen demand. |

In a higher-for-longer rate scenario, riskier credits may be vulnerable as more leveraged firms struggle to cover interest expenses or as economic growth cools. Floating rate spread products, like securitised credit or private credit, should maintain their yield advantage.

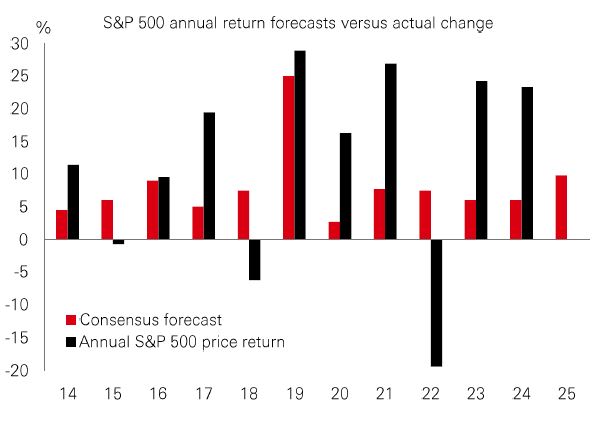

The S&P 500 has delivered back-to-back annual gains of nearly 25% over the past two years. Last year, analysts pencilled-in an expected 2024 index price gain of only mid-single-figures. That was too bearish, and it proved once again that full-year price forecasting is notoriously difficult. This year, analysts think the index will gain around 10%. In 2024, resilient profits, the strong performance of ‘Magnificent 7’ stocks, and expectations of revitalised US growth under the incoming administration were key drivers of returns. With Q4-24 earnings season now under way, we should get a sense of whether that can continue. Financial stocks are among the first to report, with Factset data showing that they are expected to see the highest quarterly year-on-year profits growth rate of all 11 sectors, at 39.5%. Overall, index profits are expected to grow by 11.7% yoy in Q4 (and by around 14.5% yoy in CY2025). |

One catch is that strong recent sentiment in the S&P 500 has driven valuations higher. The index currently trades on a forward 12-month P/E ratio of 22x (above its 10-year average of 18x).

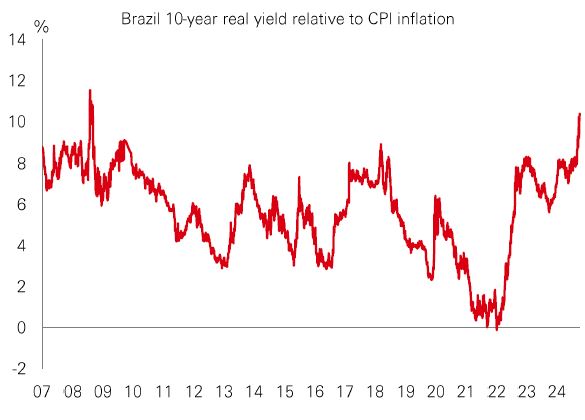

Brazilian bonds and the real (BRL) have been under pressure in recent months. There have been clear drivers behind recent moves, with the structural fiscal picture remaining a concern. Just to stabilise public debt relative to GDP, Brazil needs a primary surplus of 2% of GDP. At the end of Q3 2024, it had a budget deficit of 9.2%. The road to sustainability is both long and difficult. Yet, at least in the short term, it is tempting to consider whether Brazilian local-currency assets may have become oversold. From a policy perspective, Congress has approved most of the expenditure containment measures proposed last year, which can mitigate risks of further fiscal slippage. The finance ministry is working on further measures to reduce expenditure. |

The real yield (based on CPI inflation) on long-end Brazilian bonds is now over 10%, the highest since the 2008 global financial crisis.

Past performance does not predict future returns. The level of yield is not guaranteed and may rise or fall in the future. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector, or security. Any views expressed were held at the time of preparation and are subject to change without notice. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way. Index returns assume reinvestment of all distributions and do not reflect fees or expenses. Source: HSBC Asset Management. Macrobond, Bloomberg, Datastream. Data as at 7.30am UK time 17 January 2025.

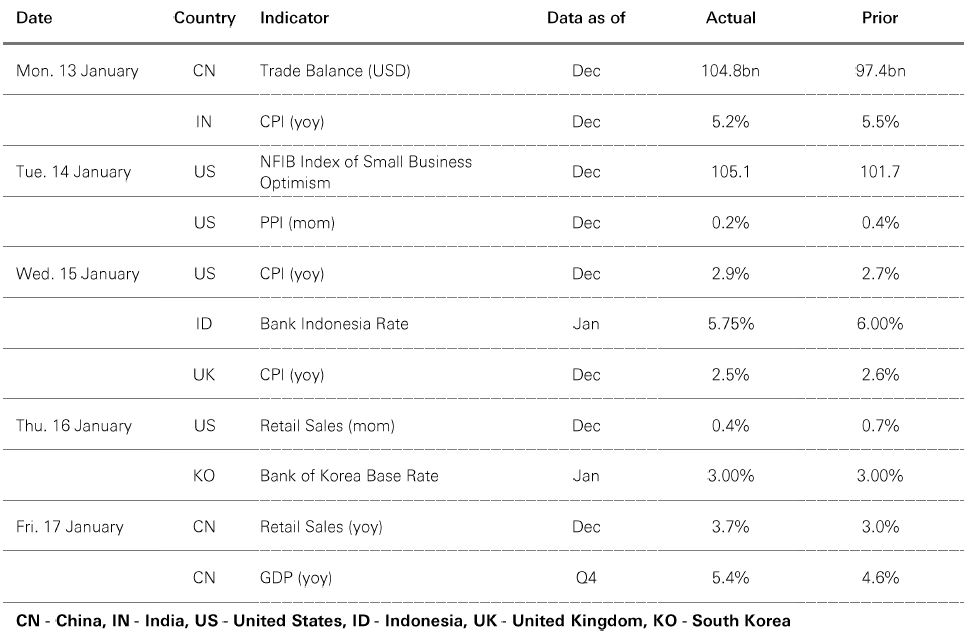

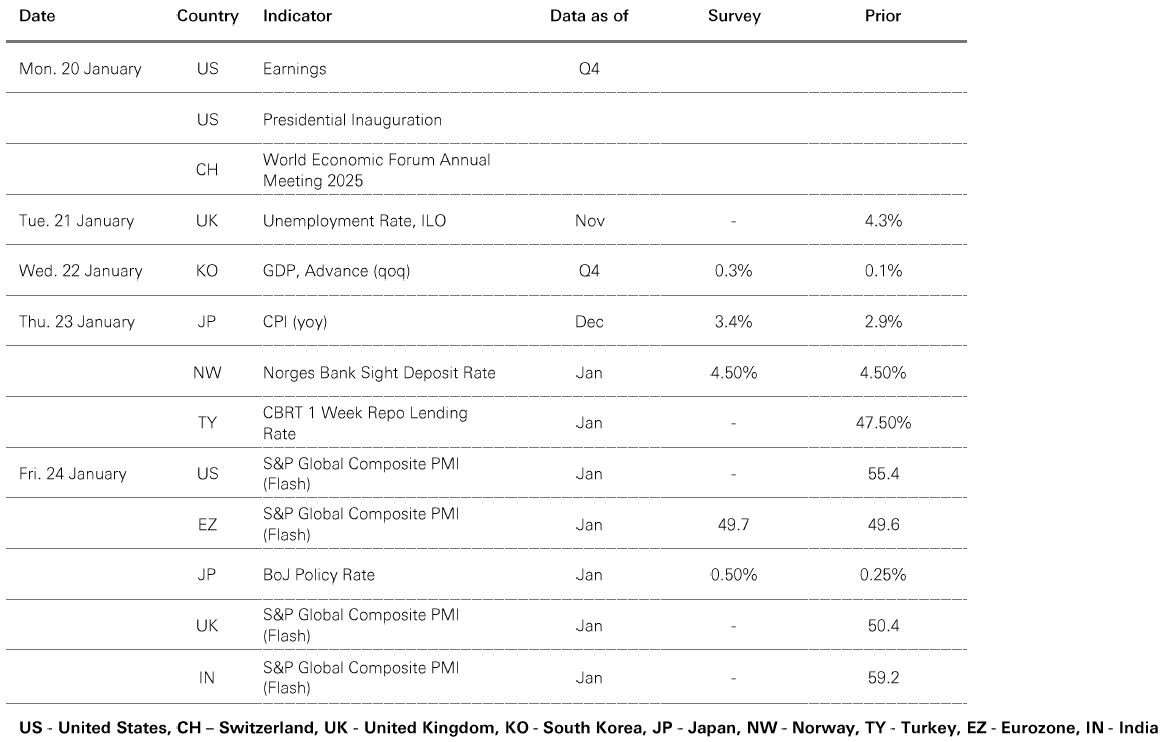

Source: HSBC Asset Management. Data as at 7.30am UK time 17 January 2025. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector or security. Any views expressed were held at the time of preparation and are subject to change without notice.

A benign US core CPI inflation print lifted risk appetite, with the US dollar consolidating ahead of US president-elect Trump’s inauguration. Core government bonds rose, with Gilts outperforming US Treasuries and Bunds, aided by a downside surprise in UK inflation. US equities exhibited broad-based strength, led by the small-cap Russell 2000 index. The Euro Stoxx 50 index posted solid gains, whereas Japan’s Nikkei 225 fell on a firmer yen, as investors raised expectations for a January BoJ rate hike. Other Asian stock markets were mixed. Strength was most evident in the Shanghai Composite and Hang Seng indices. South Korea’s Kospi reversed early losses last week as the BoK signalled further easing in the near term, despite keeping its policy rate on hold. India’s Sensex struggled to gain traction, with corporate earnings in focus. In commodities, rising supply concerns propelled oil prices to a five-month high, while gold and copper advanced.

We’re not trying to sell you any products or services, we’re just sharing information. This information isn’t tailored for you. It’s important you consider a range of factors when making investment decisions, and if you need help, speak to a financial adviser.

As with all investments, historical data shouldn’t be taken as an indication of future performance. We can’t be held responsible for any financial decisions you make because of this information. Investing comes with risks, and there’s a chance you might not get back as much as you put in.

This document provides you with information about markets or economic events. We use publicly available information, which we believe is reliable but we haven’t verified the information so we can’t guarantee its accuracy.

This document belongs to HSBC. You shouldn’t copy, store or share any information in it unless you have written permission from us.

We’ll never share this document in a country where it’s illegal.

This document is prepared by, or on behalf of, HSBC UK Bank Plc, which is owned by HSBC Holdings plc. HSBC’s corporate address is 1 Centenary Square, Birmingham BI IHQ United Kingdom. HSBC UK is governed by the laws of England and Wales. We’re authorised by the Prudential Regulation Authority (PRA) and regulated by the Financial Conduct Authority (FCA) and the PRA. Our firm reference number is 765112 and our company registration number is 9928412.