16 December 2024

The stars aligned for a broad range of EM asset classes to perform well in 2024, propelled by the prospect of Fed rate cuts, Chinese policy stimulus, and a backdrop of big valuation discounts. While this could continue in 2025, the outlook for EMs has recently become less certain, meaning investors need to be selective.

In terms of risks, active fiscal policy, global trade uncertainty, and geopolitical tensions can stoke market volatility, and mean concerns over inflation are likely to persist for a bit longer in 2025. This unsettled backdrop is already creating policy divergence across major EM economies.

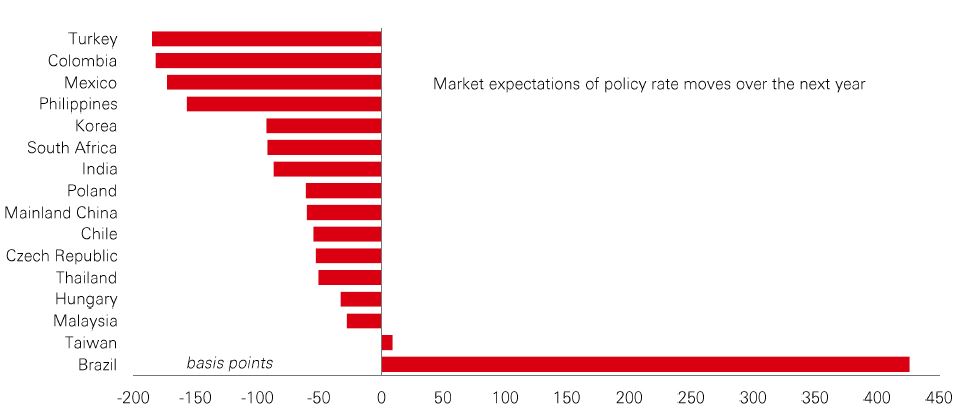

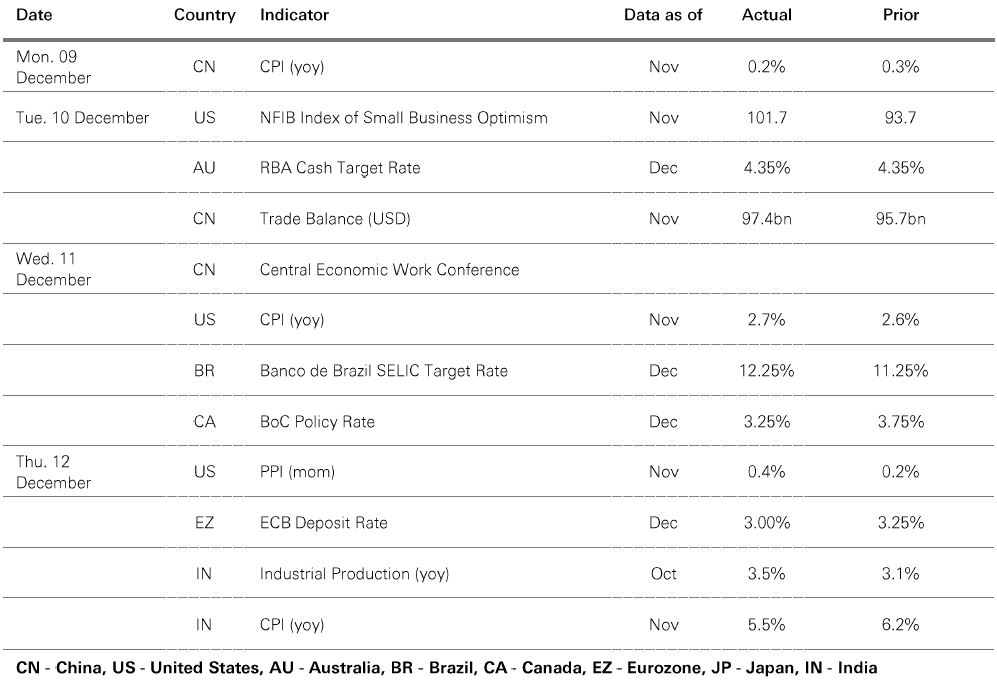

China, for instance, has maintained a gradual approach to policy easing this year, with authorities last week formally shifting the monetary policy stance from “prudent” to “moderately loose”, helping to buoy stocks. This move came as policymakers debated the economic agenda for 2025 at the annual Central Economic Work Conference, paving the way for further easing. By contrast, India faces a more complicated trade-off between growth and inflation amid a cyclical slowdown and volatile inflation driven by food prices. While growth is expected to recover, and inflation normalise, policymakers currently remain cautious, with a “neutral” policy stance. And at the other end of the spectrum, Brazil’s central bank was forced to make a higher-than-expected 1% rate hike last week in its efforts to stabilise inflation.

Put together, we think this divergent policy backdrop – with regions performing differently and facing different sets of challenges – means investors need to do their homework when deciding EM allocations.

An interesting divergence in fiscal policy has emerged between a number of frontier and mainstream emerging markets – with previous fiscal “saints” and “sinners” switching roles. Some formerly fragile frontier economies have been embracing reforms, and boosting their sustainability metrics, just as several EMs have seen a deterioration.

Frontier markets like Argentina, Ecuador, Ethiopia, Kenya, Nigeria, Pakistan, Sri Lanka, and Turkey have adopted reforms (often supported by IMF programs) aimed at mitigating vulnerabilities. Policies have included ending FX market distortions, reining in public debt by targeting primary surpluses, and accumulating foreign exchange reserves.

Meanwhile, some mainstream EMs usually associated with stronger macroeconomic fundamentals and better institutional credibility have been pursuing looser fiscal policies – leading to a widening of budget deficits. Prominent examples include Brazil, Hungary, Indonesia, Mexico, Poland, and Thailand.

In many cases, these looser policies have been deployed to stimulate domestic growth, and active fiscal policy will be a key feature of the global macro environment in 2025. For investors, it’s a further reminder that selectivity will be important in finding opportunities in EM and FM markets.

The value of investments and any income from them can go down as well as up and investors may not get back the amount originally invested. Past performance does not predict future returns. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector or security. Any views expressed were held at the time of preparation and are subject to change without notice. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way. Diversification does not ensure a profit or protect against loss. Source: HSBC Asset Management. Macrobond, Bloomberg. Data as at 7.30am UK time 13 December 2024.

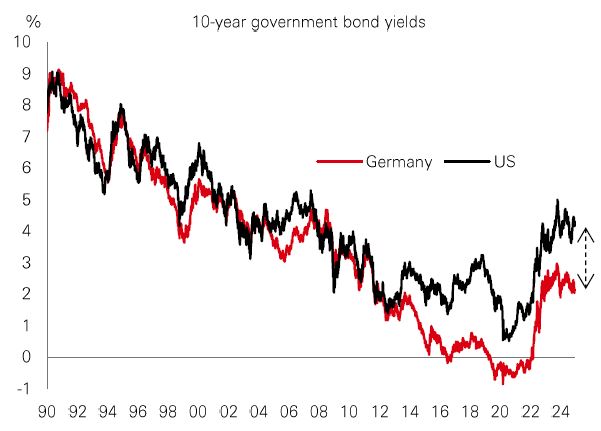

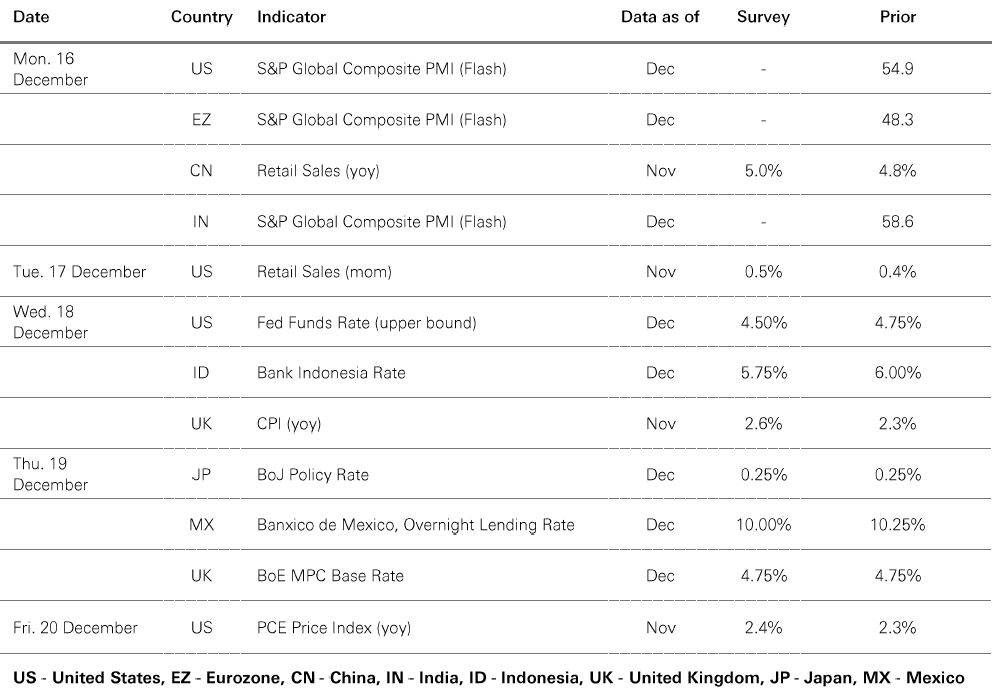

Following the recent political drama in Europe, the ECB did its best not to add to the volatility and delivered the expected 0.25% rate cut, shunning any pressure to follow the Bank of Canada and Swiss National Bank which delivered 0.50% moves.

With Chair Powell having said recently that the Fed could afford to be “a little more cautious” in delivering rate cuts, it was unlikely that the ECB would throw caution to the wind. While recent eurozone survey data have shown renewed signs of weakness, they have not been the best guide to growth in the past few years. And although the latest CPI data suggest previously sticky service sector inflation may now be softening, more progress on this front would have been needed to prompt an aggressive move by the ECB.

However, further easing is coming. With an uncertain political landscape and the potential for the US to impose trade tariffs, downside risks to growth mean the cutting cycle could either extend into H2 or happen faster. This supports the outlook for Bunds, even if a narrowing of the yield gap versus Treasuries would likely be required for a big rally to take hold.

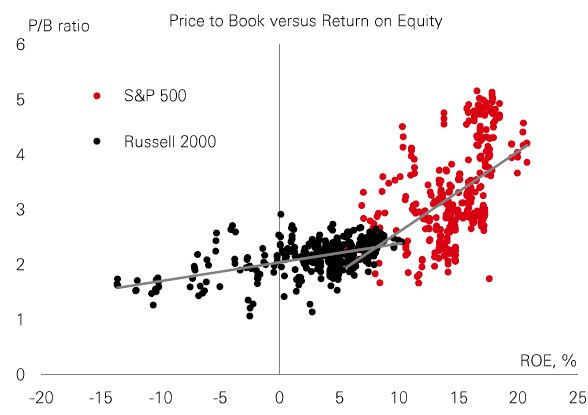

Small-cap stocks are traditionally popular with investors looking for rapid earnings growth and superior returns. But at the index level, US small-caps have underperformed large-caps since 2008. Today, valuation divergence between them has reached historic extremes, with average price-to-book valuations of 5.0 and 2.0 respectively.

One factor driving this is company profitability. Research shows that, at more than 15%, the spread of Return on Equity (a measure of profitability) has opened up between them in recent years. Large caps have become more profitable, which is reflected in higher valuations, whereas small-caps have deteriorated.

For investors, it’s a reminder that small-cap investing demands nuance. Looking globally to regions like Europe and China, smaller-cap stocks are more closely tied to macro-economic cycles and activity. That can make them volatile, but it also offers potentially attractive exposure to economic recoveries.

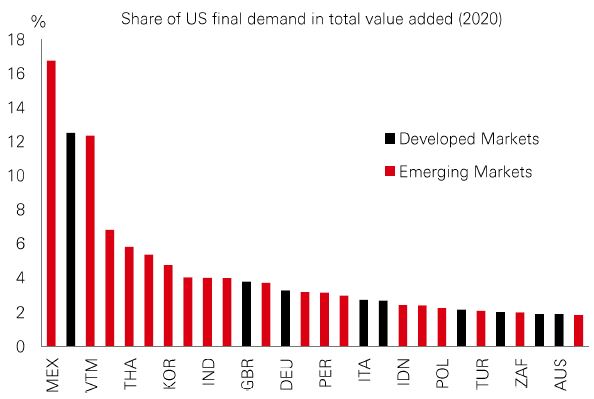

Trade tariffs are back on the table post-US election – but depending on the details, not all economies will feel the impact equally. In emerging markets, major exporters to the US like Mexico and Vietnam could face some of the greatest risks. But across Asia, the picture is mixed. Technology and electronics centres like South Korea, Taiwan, Malaysia, and Thailand don’t have the same US exposure as Vietnam, but they are more reliant on US trade than India and Indonesia.

Perhaps surprisingly, the share of China’s value-added accounted for by US domestic demand is lower than India’s although the threatened tariffs on China are larger. Perversely, the potential for China-related US tariffs could help other Asian economies. First, they could benefit from trade diversion. Second, Chinese policy easing in the face of increased tariffs could have modest positive spillovers regionally.

Combined with reasonable valuations in much of Asia, the fact that tariffs are not a given and, even if they are delivered, could take some time.

Past performance does not predict future returns. The level of yield is not guaranteed and may rise or fall in the future. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector or security. Any views expressed were held at the time of preparation and are subject to change without notice. Index returns assume reinvestment of all distributions and do not reflect fees or expenses. You cannot invest directly in an index. Any forecast, projection or target where provided is indicative only and not guaranteed in any way. Source: JP Morgan, HSBC Asset Management. Macrobond, Bloomberg, Datastream. Data as at 7.30am UK time 13 December 2024.

Source: HSBC Asset Management. Data as at 7.30am UK time 13 December 2024. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector or security. Any views expressed were held at the time of preparation and are subject to change without notice.

Risk markets lacked clear direction, with the US DXY dollar index strengthening on continued “US exceptionalism”. US Treasuries lagged eurozone government bonds on rising inflation jitters. The ECB lowered rates by 0.25%, dropping their reference to “sufficiently restrictive” monetary policy. US equities retreated from their highs, with the tech-driven Nasdaq outperforming. The Euro Stoxx 50 edged down, as the Nikkei climbed on a weaker Japanese yen, with technology stocks leading. China’s Shanghai Composite reversed early gains last week as investors digested the policy signals from the key meetings, while Hong Kong’s Hang Seng closed higher. South Korea’s Kospi index rebounded, whereas India’s Sensex declined. In Latin America, the Bovespa ended almost flat as Brazil’s central bank hiked rates by 1%. In commodities, oil prices and gold rallied, but copper edged lower.

We’re not trying to sell you any products or services, we’re just sharing information. This information isn’t tailored for you. It’s important you consider a range of factors when making investment decisions, and if you need help, speak to a financial adviser.

As with all investments, historical data shouldn’t be taken as an indication of future performance. We can’t be held responsible for any financial decisions you make because of this information. Investing comes with risks, and there’s a chance you might not get back as much as you put in.

This document provides you with information about markets or economic events. We use publicly available information, which we believe is reliable but we haven’t verified the information so we can’t guarantee its accuracy.

This document belongs to HSBC. You shouldn’t copy, store or share any information in it unless you have written permission from us.

We’ll never share this document in a country where it’s illegal.

This document is prepared by, or on behalf of, HSBC UK Bank Plc, which is owned by HSBC Holdings plc. HSBC’s corporate address is 1 Centenary Square, Birmingham BI IHQ United Kingdom. HSBC UK is governed by the laws of England and Wales. We’re authorised by the Prudential Regulation Authority (PRA) and regulated by the Financial Conduct Authority (FCA) and the PRA. Our firm reference number is 765112 and our company registration number is 9928412.