2 December 2024

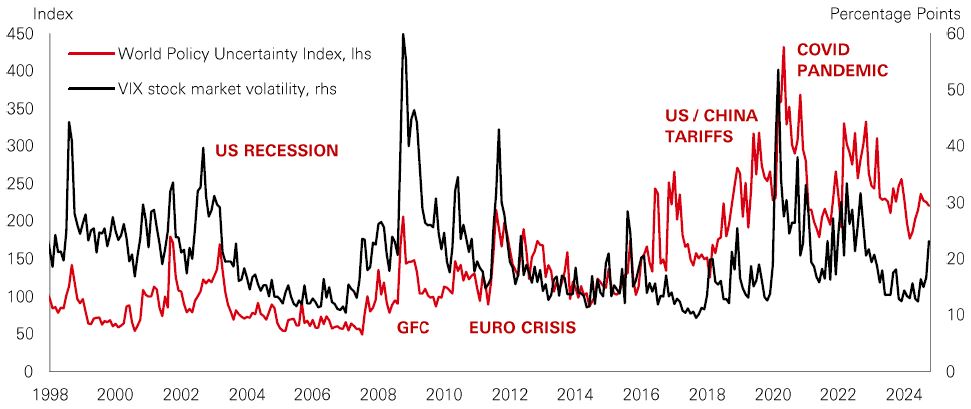

Rising uncertainty over economic and trade policy has been hanging over global markets in recent weeks. It’s the kind of anxiety that typically goes hand-in-hand with higher stock market volatility. So far, most of the volatility has been in rates markets. And that’s hardly surprising given uncertainty over the inflation outlook, particularly in a year when bond pricing has been hyper-sensitive to macro data.

Meanwhile, US stocks remain in a strong uptrend. But with market multiples pricing perfection (the S&P 500 hit another new high last week), bond yields still elevated, and growth cooling into 2025 – can calm conditions last?

In a “multi-polar world” of economic fragmentation and competing trade blocs, the most significant consequence for investors is a higher and more unpredictable inflation regime. This could constrain central bank policy easing, weighing on growth and corporate profits. Fixed income returns may still depend on yield income to support returns, and government bonds may not be a dependable hedge for portfolios. With geopolitics potentially disrupting underlying investor assumptions on the growth, profits, and inflation outlook, market volatility could easily pick up, should the global news flow deteriorate - and the most expensive parts of the market could be vulnerable.

Private credit has been a popular portfolio diversifier with investors in recent years – helped by an era of elevated rates that enhanced returns. But with central banks pivoting in the second half of 2024, a shift to lower rates has raised questions about whether that will change.

Yet, demand for private credit has remained robust. One explanation is that, while rates are on their way down, they are unlikely to fall to the very low levels experienced during the last decade. If rates begin to normalise at around 3%, it should leave room for private credit assets to deliver still-attractive all-in yields – particularly when compared to fixed-rate bonds. In fact, private credit premiums could potentially deliver a cushion as floating-rate yields decline. Another attraction is that private credit doesn’t rely on an exit market to fund the distributions given that loans are repaid after a fixed period. This has been an important differentiator to private equity markets, where a weaker exit environment recently has led to lower distributions back to investors.

Despite recent growth, private credit only accounts for around 6% of corporate lending in the US – which is one of the most mature private credit markets.

The value of investments and any income from them can go down as well as up and investors may not get back the amount originally invested. Past performance does not predict future returns. Investments in emerging markets are by their nature higher risk and potentially more volatile than those inherent in some established markets. The level of yield is not guaranteed and may rise or fall in the future. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector or security. Any views expressed were held at the time of preparation and are subject to change without notice. Any forecast, projection or target where provided is indicative only and not guaranteed in any way. Diversification does not ensure a profit or protect against loss.

Source: HSBC Asset Management. Macrobond, Bloomberg. Data as at 7.30am UK time 29 November 2024.

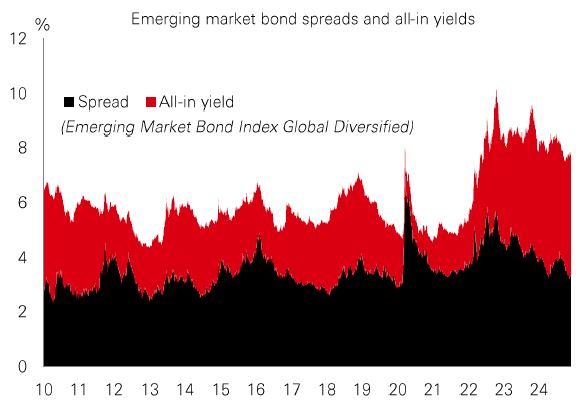

Investor sentiment towards emerging markets (EM) has been cautious in the wake of US elections and growing concerns about tariffs. EM sovereign bonds (tracked by the EMBI index), for instance, are a high-duration asset class with a structurally improving average credit-rating outlook. If bond yields gradually grind lower globally, EM sovereigns could be well-placed to perform given their historically high all-in yields. Spreads have compressed but are expected to remain well-behaved, thanks to a structural improvement in credit quality.

That said, global risks remain high, which could impact the asset class. Worries about inflation and more active fiscal policy mean markets are pricing a shallower path for US monetary easing. And tariffs are unlikely to leave many EMs unscathed, with risks of a strong US dollar tightening global financial conditions. For EM investors, country sensitivity to these headwinds will depend on factors like existing free trade agreements, relationships with the new US administration, and the degree of trade exposure that they have to the US.

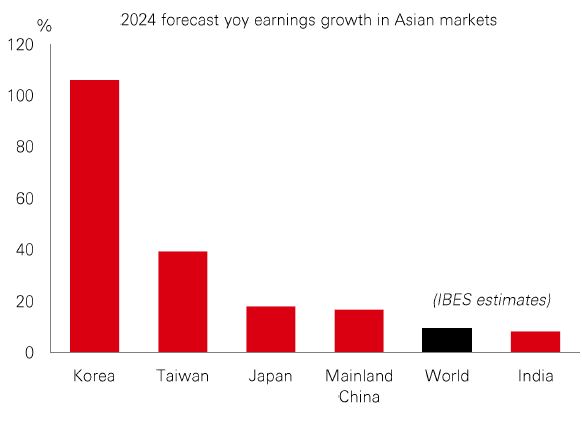

Asian stock markets have delivered decent performances this year, with mainland China and India setting the pace. But as Asia’s Q3 earnings season rolls on, we’ve seen regional variations in terms of sector winners and losers.

Technology-led markets in South Korea and Taiwan are still the region’s profit engine. Strong demand in industries like semiconductors and hardware has been potent, particularly in South Korea, which has seen a strong rebound in profits growth. In Japan, Q3 has also been solid, with financial stocks the big driver on improving margins. But its discretionary stocks have lagged, with profits falling among automakers. In mainland China, financial stocks (particularly insurance firms) have underpinned robust Q3 profits growth, and firms in hardware and e-commerce have been strong too.

By contrast, profits in India have surprised to the downside. But weak macro momentum in the quarter is expected to recover, and sectors like financials, healthcare, and real estate have performed well. Overall, some specialists continue to see fair valuations across the region, as well as solid growth and appealing economic diversification.

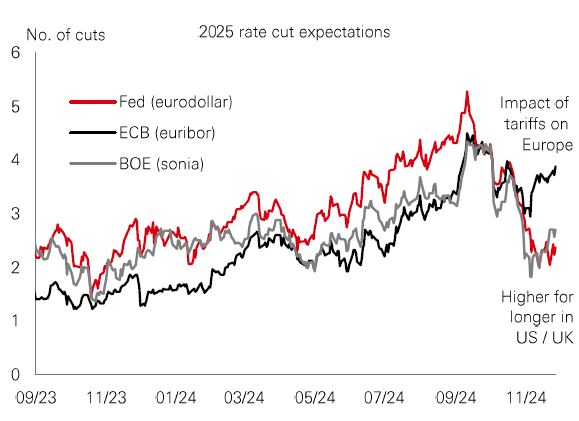

In addition to concerns about potential changes to US trade policy next year, the Eurozone is already dealing with its own fair share of problems – much of which are weighing on the euro.

Growth has weakened again, with manufacturing PMIs in France and Germany in the low 40s and services failing to do enough to produce positive growth. Then there is political uncertainty, with general elections in Germany in February and ongoing instability in France.

These risks have led to a sharp repricing in the relative outlooks for growth and monetary policy. Markets have priced in more aggressive monetary easing by the ECB, just as Fed rate cuts have been priced out.

The result is the euro has weakened in the face of a strengthening US dollar – and the next few months could be challenging.

The good news is a weaker euro supports domestic exporters, despite near-term caution on the profits outlook. Likewise, ECB rate cuts should boost both the macro outlook and government bonds.

Past performance does not predict future returns. The level of yield is not guaranteed and may rise or fall in the future. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector or security. Any views expressed were held at the time of preparation and are subject to change without notice. Index returns assume reinvestment of all distributions and do not reflect fees or expenses. You cannot invest directly in an index. Any forecast, projection or target where provided is indicative only and not guaranteed in any way. Source: HSBC Asset Management. Macrobond, Bloomberg, Datastream. Data as at 7.30am UK time 29 November 2024.

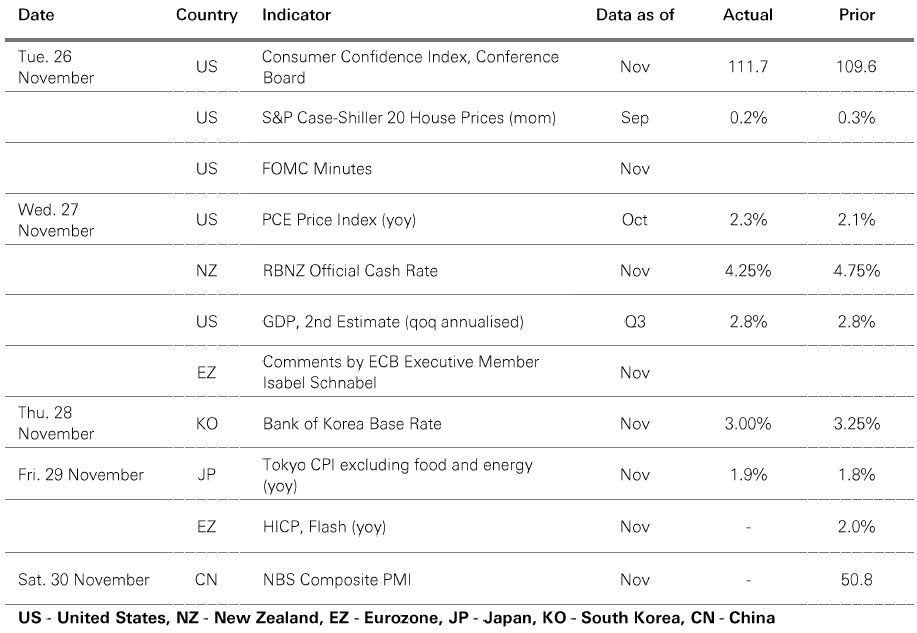

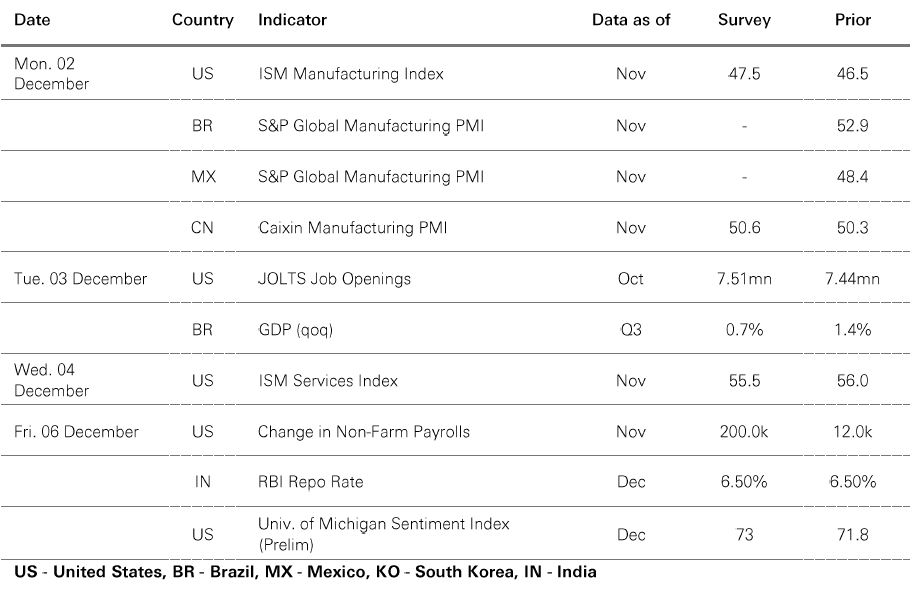

Source: HSBC Asset Management. Data as at 7.30am UK time 02 December 2024. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector or security. Any views expressed were held at the time of preparation and are subject to change without notice.

Risk markets were stable, with the US dollar index correcting lower amid rising trade tensions. Core government bonds rallied as investors digested the latest appointments to the forthcoming US administration. Rising budget concerns prompted a wider 10yr yield spread between French and German government bonds. US equities posted modest gains in a holiday-shortened week, whereas the Euro Stoxx 50 index softened, led by a weakness in French stocks. Japan’s Nikkei 225 reversed earlier gains last week as the yen rebounded versus the US dollar. Emerging market equity performance was mixed. China’s Shanghai Composite and India’s Sensex advanced, while Korea’s Kospi index dropped on lingering worries over domestic macro outlook and geopolitical risks as the BoK delivered a surprise rate cut. In commodities, oil and gold consolidated. Copper edged higher.

We’re not trying to sell you any products or services, we’re just sharing information. This information isn’t tailored for you. It’s important you consider a range of factors when making investment decisions, and if you need help, speak to a financial adviser.

As with all investments, historical data shouldn’t be taken as an indication of future performance. We can’t be held responsible for any financial decisions you make because of this information. Investing comes with risks, and there’s a chance you might not get back as much as you put in.

This document provides you with information about markets or economic events. We use publicly available information, which we believe is reliable but we haven’t verified the information so we can’t guarantee its accuracy.

This document belongs to HSBC. You shouldn’t copy, store or share any information in it unless you have written permission from us.

We’ll never share this document in a country where it’s illegal.

This document is prepared by, or on behalf of, HSBC UK Bank Plc, which is owned by HSBC Holdings plc. HSBC’s corporate address is 1 Centenary Square, Birmingham BI IHQ United Kingdom. HSBC UK is governed by the laws of England and Wales. We’re authorised by the Prudential Regulation Authority (PRA) and regulated by the Financial Conduct Authority (FCA) and the PRA. Our firm reference number is 765112 and our company registration number is 9928412.