21 October 2024

After recently announcing new stimulus measures, China’s policymakers have yet to fill in the details on the scale of support planned for tackling issues in housing markets, local governments, and consumer confidence. But with recent press conferences unveiling new commitments, there is clear evidence of a fundamental shift in policy thinking.

Speculating on the precise timing of China’s stimulus isn’t sensible. However, the “three arrows” policy strategy – liquidity, fiscal/credit, structural measures – offers a way forward to boost the economy out of the deflation trap. With further policy meetings in the calendar – the NPC standing committee in a few weeks – we may hear more soon.

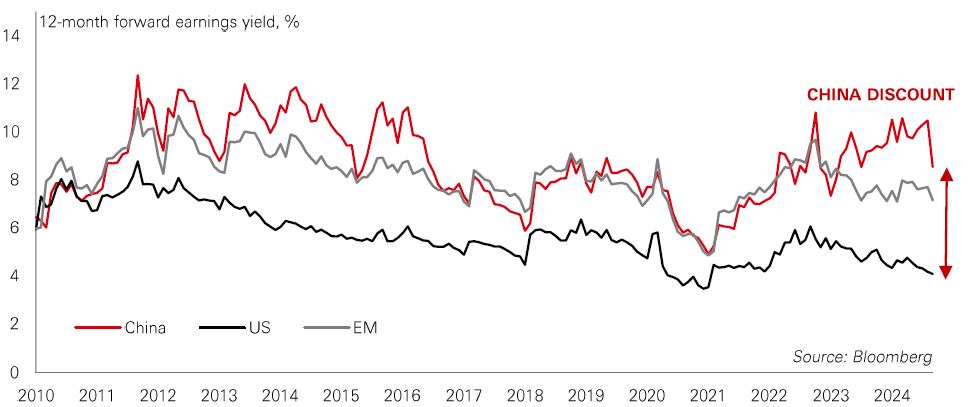

As for markets, many Asian investors remain cautious on Chinese stocks, arguing that it will take a long time for capital flows to return. But at 11.5x earnings, China still trades at a heavy discount to EM (14x) and global stocks (21x). With bad news still in the price, good news could be ‘doubly good’ for stocks.

Another way to think about market effects is that China’s stimulus sets up a rotation trade in global stocks. China’s rally has already caused volatility in regional fund flows, affecting markets like India, South Korea, and Japan.

Geopolitical risks have been on the rise in 2024 – but the first question might be, “so what?”. Many investors already feel well-equipped to deal with geopolitical risks. Most of the time, after all, the “geopolitical risk premium” has only a fleeting or transitory influence on investment markets. The effects unwind fairly quickly.

But this time could be different. There are several reasons why investors need to take geopolitics seriously in their asset allocation considerations. First, economic power is diffusing to Asia and the Global South, with profound implications for the macro-economy and the financial system. Second, the global environment has become less friendly to international cooperation. And third, the policies and principles that have stabilised the global order over the last 30 to 40 years seem increasingly obsolete.

It means that the “nice” economic regime now risks being “vile” – or, to spell it out, one of “Volatile Inflation and Limited Expansion”. If left unchecked, it implies rising prices and lower economic growth potential. For investors, portfolio strategy will need to be prepared for such an eventuality and resilient to the implications of shorter business cycles, greater market dispersion, and changed correlations.

The value of investments and any income from them can go down as well as up and investors may not get back the amount originally invested. Past performance does not predict future returns. Investments in emerging markets are by their nature higher risk and potentially more volatile than those inherent in some established markets. The level of yield is not guaranteed and may rise or fall in the future. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector or security. Any views expressed were held at the time of preparation and are subject to change without notice.

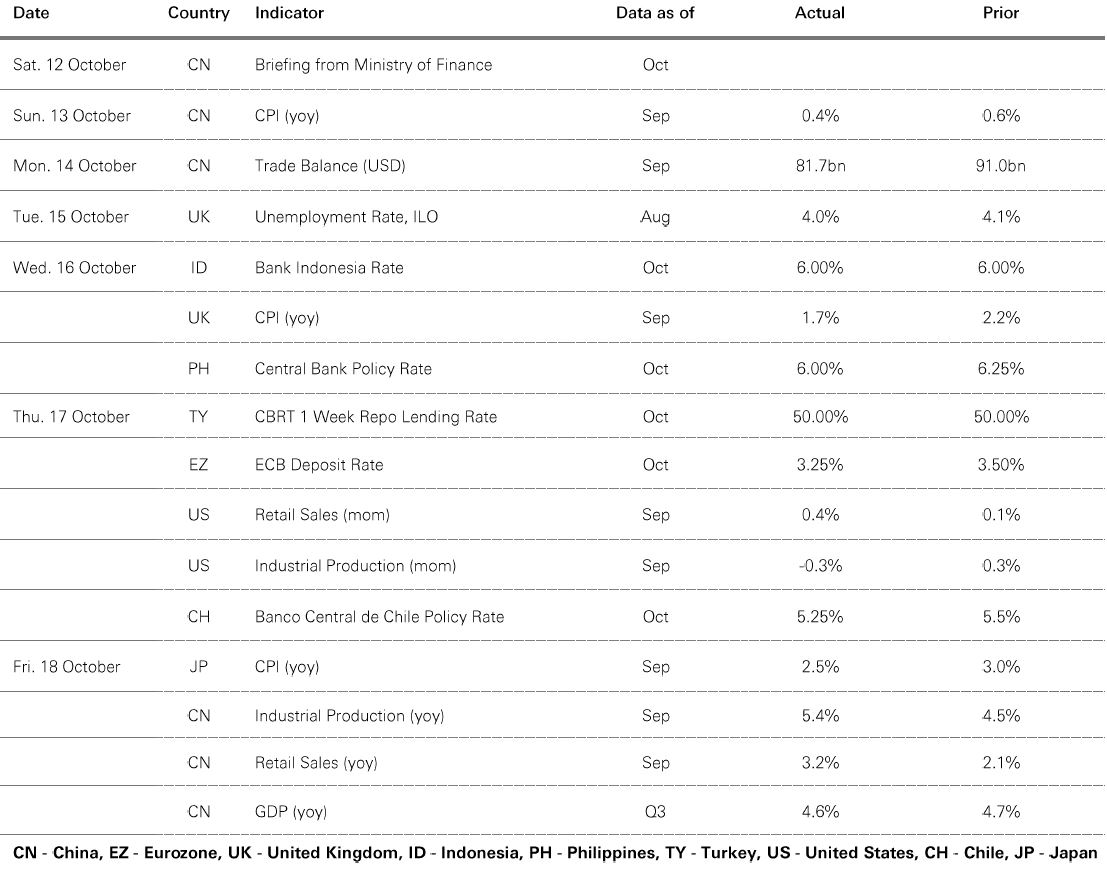

Source: HSBC Asset Management. Macrobond, Bloomberg. Data as at 11.00am UK time 18 October 2024.

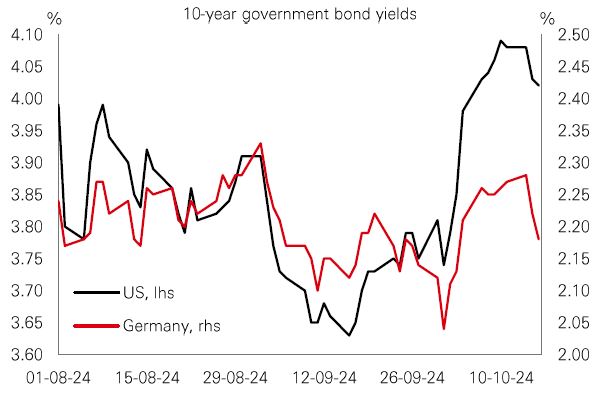

At its October meeting, the European Central Bank (ECB) delivered its second rate cut in as many months and its third of this easing cycle. During the summer, the expectation was that it would cut at a pace of 0.25% every other meeting. What has changed? One factor is that the Federal Reserve has become more willing to ease policy. However, there have also been important eurozone developments. First, the latest inflation numbers show tentative signs that service sector inflation is now weakening, having been relatively sticky earlier this year. Wage growth is also softening, supporting the view that inflation pressures are fading. Second, activity data have surprised to the downside – the PMIs point to a deceleration in growth during H2 2024, led by Germany.

With the inflation situation improving, growth looking patchy – particularly in Germany – and the ECB easing policy at a brisker pace, Bunds have been outperforming US Treasuries since mid-September, reversing the trend seen since mid-April.

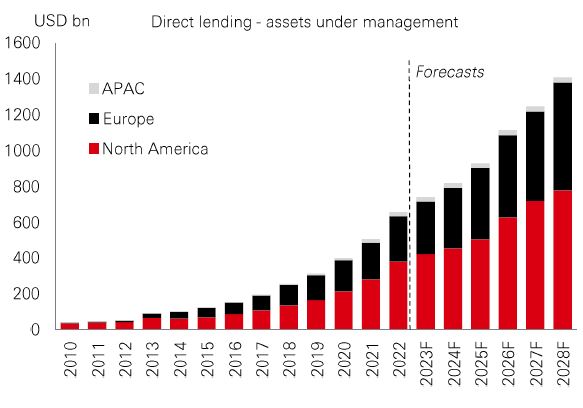

The private credit market has grown rapidly in recent years, driven in part by strong demand for direct lending. There have been two key reasons for this: one is that traditional banks have retrenched from parts of the lending market, leaving private credit managers to fill the void. Another is that direct lending proved popular with private equity managers during the post-Covid deal-making boom.

For private credit investors, the returns have been strong. With an average yield of nearly 12%, the asset class has outperformed other Credits. With the global easing cycle underway, returns are expected to moderate over time, but it’s expected to remain a high yield asset class.

While North America and Europe currently dominate the direct lending markets, Asia is comparatively small – but growing strongly in some areas. With around 80% of total credit in Asia still provided by banks, there is growing demand for alternative sources of finance for fast-growing firms, mergers and acquisitions, and private equity deals.

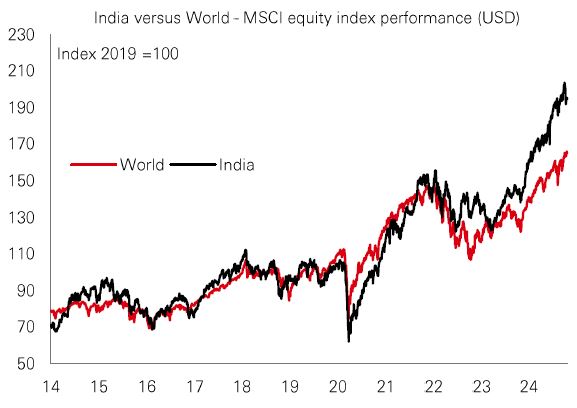

Reforms implemented over the past decade along with more credible monetary and fiscal policy have allowed India to begin tapping its catch-up potential and enviable demographics. The IMF expects India to be the fastest growing G20 economy over the remainder of the decade, with real GDP rising by almost 50% by 2029.

Consistent with the recent strong and expected growth, MSCI India has outperformed MSCI ACWI by a significant margin over the last five years. Importantly, however, the Indian equity market now offers greater diversification and less volatility than in the past – MSCI India now comprises over 150 stocks versus under 80 in late 2019. Moreover, it is not just in the equity space that India stands out – its 10y government yield is among the highest for investment grade issuers and has a low correlation with global bonds. Add in an undervalued INR, which also exhibits less volatility than the average EM currency, and there is a strong case for India to be viewed as an asset class in its own right, rather than simply part of a benchmark.

Past performance does not predict future returns. The level of yield is not guaranteed and may rise or fall in the future. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector or security. Any views expressed were held at the time of preparation and are subject to change without notice.

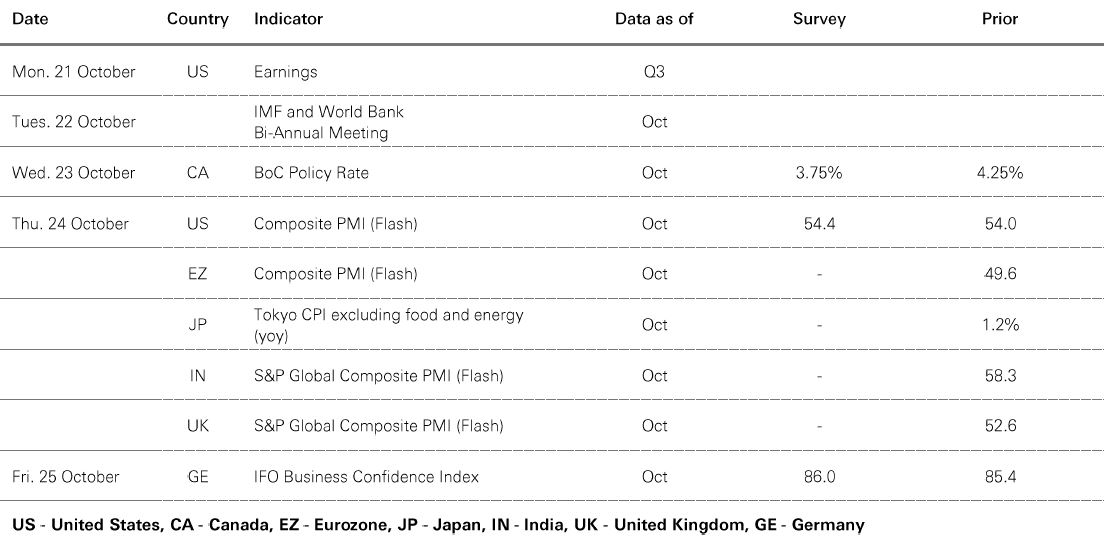

Source: HSBC Asset Management. Macrobond, Bloomberg, Datastream, Preqin. Data as at 11.00am UK time 18 October 2024.

Source: HSBC Asset Management. Data as at 7.30am UK time 18 October 2024. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector or security. Any views expressed were held at the time of preparation and are subject to change without notice.

A solid increase in US retail sales during September buoyed US Treasury yields towards the end of last week. In stocks, the small-cap Russell 2000 saw the strongest gains, with the large-cap S&P 500 touching new highs, helped by upbeat Q3 earnings news. In Europe, the ECB cut rates by 0.25%, noting that inflation was increasingly under control but warning the outlook for the bloc’s economy was worsening. In Asia, Chinese equities pulled back for a second week following recent rallies, with a slew of macro data releases and policy expectations remaining in focus. India’s Sensex also fell, but some ASEAN markets fared better, with Thai and Indonesian equities ending positively. Brazil’s Ibovespa and Mexico’s IPC were also both on course to finish higher. Elsewhere, the oil price fell on easing fears over tensions in the Middle East. Gold once again reached new highs.

We’re not trying to sell you any products or services, we’re just sharing information. This information isn’t tailored for you. It’s important you consider a range of factors when making investment decisions, and if you need help, speak to a financial adviser.

As with all investments, historical data shouldn’t be taken as an indication of future performance. We can’t be held responsible for any financial decisions you make because of this information. Investing comes with risks, and there’s a chance you might not get back as much as you put in.

This document provides you with information about markets or economic events. We use publicly available information, which we believe is reliable but we haven’t verified the information so we can’t guarantee its accuracy.

This document belongs to HSBC. You shouldn’t copy, store or share any information in it unless you have written permission from us.

We’ll never share this document in a country where it’s illegal.

This document is prepared by, or on behalf of, HSBC UK Bank Plc, which is owned by HSBC Holdings plc. HSBC’s corporate address is 1 Centenary Square, Birmingham BI IHQ United Kingdom. HSBC UK is governed by the laws of England and Wales. We’re authorised by the Prudential Regulation Authority (PRA) and regulated by the Financial Conduct Authority (FCA) and the PRA. Our firm reference number is 765112 and our company registration number is 9928412.