14 October 2024

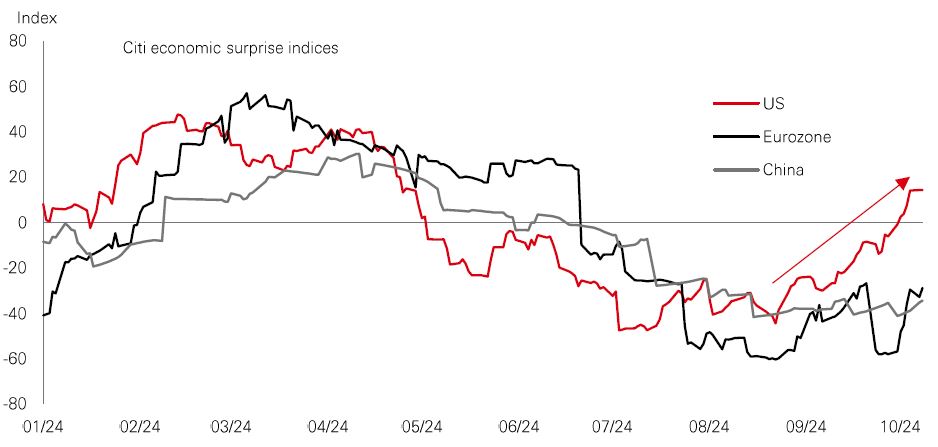

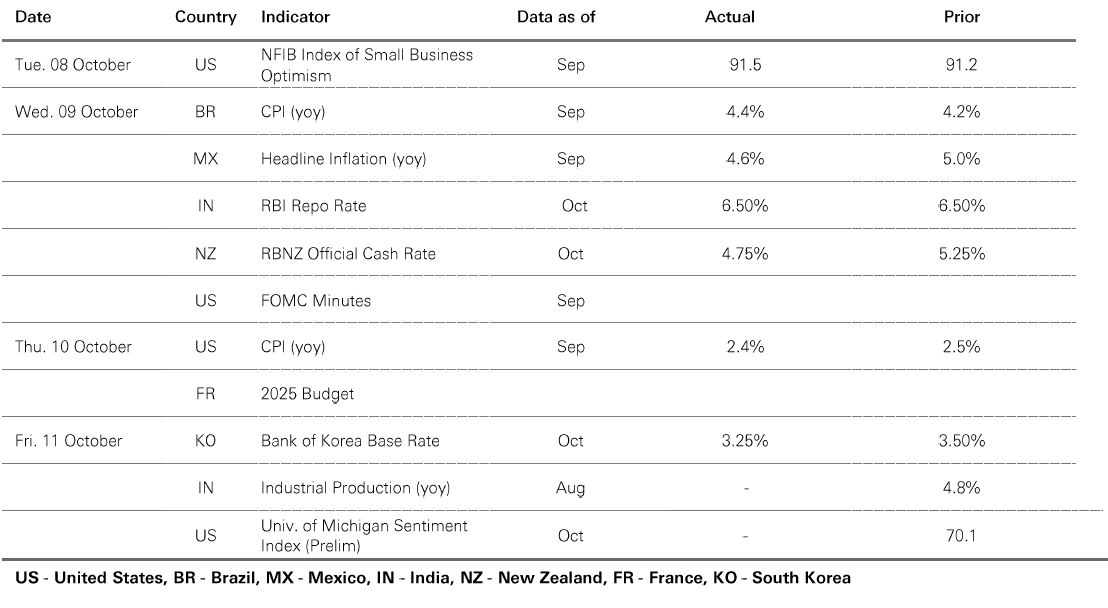

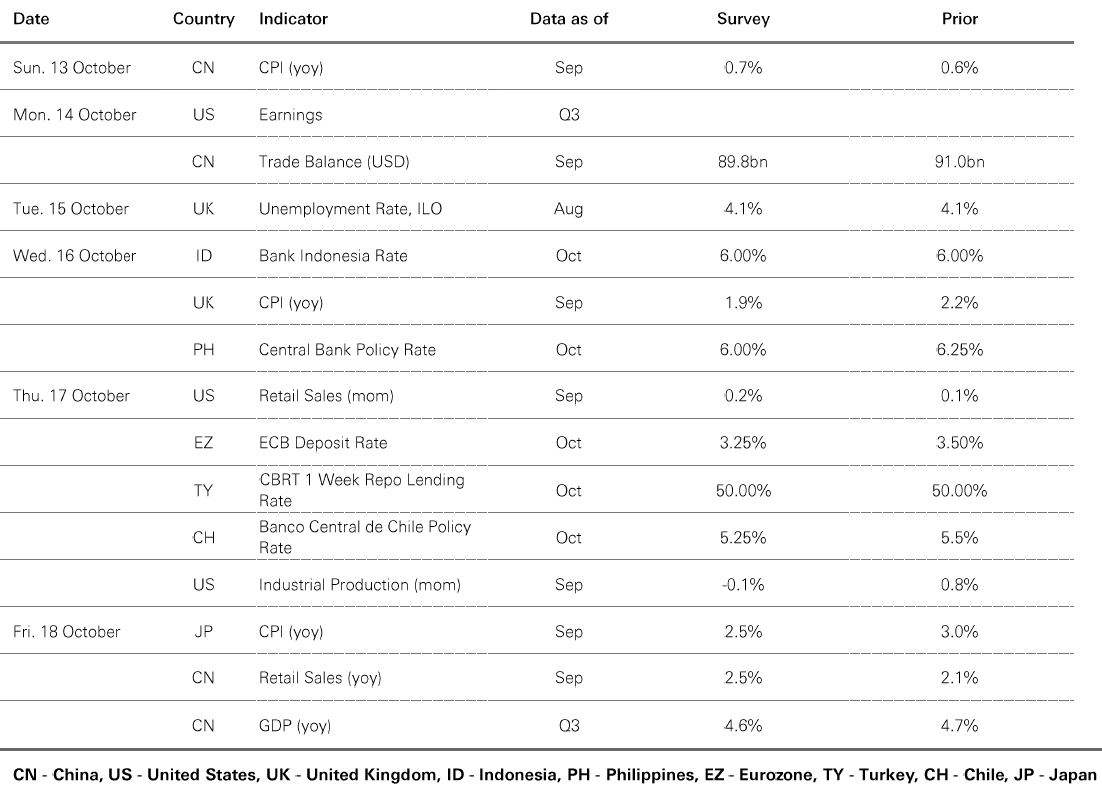

September’s strong US employment report, with non-farm payrolls up 254k (versus 150k expected) and the unemployment rate unexpectedly edging lower to 4.1%, was good news for those hoping for a soft landing for the world’s largest economy. The recent run of better-than-expected economic data (see chart) also coincides with an underlying trend of disinflation – despite September’s stronger-than-expected CPI print. Leading indicators point to a further moderation in price pressures, including the shelter component which is contributing to high services inflation.

August’s market wobble – partly triggered by a weak July payrolls number – now seems like a distant memory. US stock markets are notching up fresh all-time highs and the US 10-year Treasury yield is back above 4%.

A soft landing is good news for global risk assets. But markets are likely to remain volatile as investors grapple with uncertainty over the economic outlook. Rates remain restrictive and the US election has the potential to usher in policy shifts. And despite better US macro news, some labour market data suggests cooling ahead. The October payrolls report could be weak again. Earnings could also disappoint – doubly bad news given stretched valuations.

It was a bumpy week for Chinese stocks as investors digested the recent surge in prices and the National Development and Reform Commission’s (NDRC) announcement that it would accelerate bond issuance to support the economy.

A pause for breath last week isn’t surprising given the extremity of recent market moves – the MSCI China had gained around 26% in the 10 trading days leading up to the Golden Week holiday. Investor expectations around the speed and scale of incoming fiscal support may have become too optimistic.

Despite the lack of details on potential fiscal stimulus offered by the NDRC, it is likely that Chinese authorities will still unveil a meaningful fiscal package in the coming weeks. The Ministry of Finance held a press briefing on 12 October, while another opportunity for action comes at the National People’s Congress standing committee meeting later this month.

The value of investments and any income from them can go down as well as up and investors may not get back the amount originally invested. Past performance does not predict future returns. Investments in emerging markets are by their nature higher risk and potentially more volatile than those inherent in some established markets. The level of yield is not guaranteed and may rise or fall in the future. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector or security. Any views expressed were held at the time of preparation and are subject to change without notice.

Source: HSBC Asset Management. Macrobond, Bloomberg. Data as at 11.00am UK time 11 October 2024.

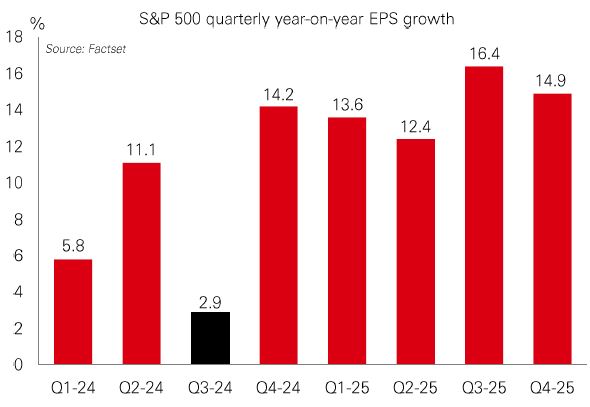

Q3 results season kicks off this week with 8% of the S&P 500 (by market cap) reporting, and 60% expected by Halloween. Annual consensus profits growth is 10% for this year, and 15% for 2025. But on a quarterly year-on-year basis, analysts have slashed forecasts for Q3 to just 2.9% – down from 10.2% a year ago. So, what has spooked them?

Economically-sensitive sectors like materials, consumer discretionary (autos/retail), and industrials have seen some of the biggest cuts. Soft economic data over the summer are likely to blame, and lower oil prices hit energy names. But from Q4, that changes. Five quarters of growth averaging 14% (double the long-run average) suggests a rosier outlook.

Technology is set to be the fastest growing sector in Q3, while analysts expect energy to be the weakest. Financial stocks, which are among the first to report, are anticipated to slow. Overall, a low growth bar could offer scope for above-average beats for Q3. But with the market already trading on a relatively high PE of 21x, a soft landing and giddy profit growth from Q4 onwards appear to be priced-in, just as momentum in tech earnings is starting to slip.

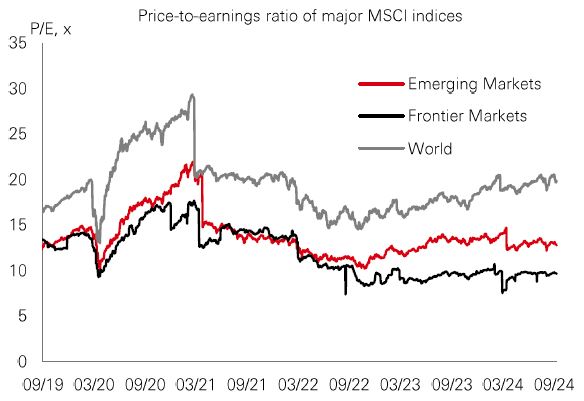

Many Frontier and smaller emerging market countries were relatively quick to respond to the post-Covid inflation surge, hiking rates faster than the US. With real rates now significantly positive, they have room to cut – and stimulate growth – without pressuring their currencies. We’ve seen recent cuts in countries like Iceland, Kenya, Pakistan, and Serbia. It’s a trend that should act as a tailwind for Frontier valuations.

It comes as valuation discounts between Frontier and both DM and EM regions remain well above their 5-year averages. Frontier markets are currently trading at a price-earnings ratio of 9.7x – a 51% discount to DMs (at 19.9x) and a 24% discount to EMs (at 12.8x).

Yet, Frontier offers superior earnings growth and higher dividend yields, plus the diversification benefit of low correlation with other asset classes. This is largely being driven by structural trends like the relocation of manufacturing hubs, re-routing of supply chains, social and economic reforms (especially across Gulf Cooperation Council countries), and digitisation.

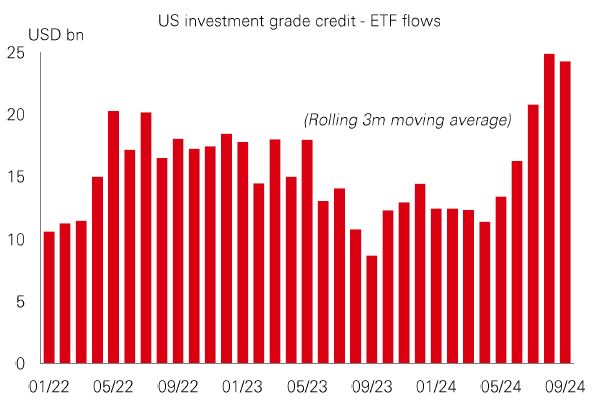

Growing expectations of a soft economic landing bode well for US investment grade (IG) debt. With Fed policy easing expected to continue at a cautious pace, and recent jobs data mitigating recession worries, 10yr Treasury yields have risen, which has improved the attractive all-in yields that IG debt offers.

IG debt has a high correlation with government bonds. So, if risk appetite falters, IG should be a defensive play as the widening in credit spreads is likely to be, at least partially, offset by the fall in government bond yields.

The fundamental backdrop for IG has also been positive. Corporate profits have been resilient, and the net issuance outlook is expected to remain favourable. Above all, investor demand remains upbeat. There have been strong flows for much of this year into US IG exchange traded funds and the unwinding of popular carry trades during the summer did little to dent investor enthusiasm. The experience suggests that the marginal spread-widening required to attract buyers is smaller than it was in the past.

Past performance does not predict future returns. The level of yield is not guaranteed and may rise or fall in the future. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector or security. Any views expressed were held at the time of preparation and are subject to change without notice. Source: HSBC Asset Management. Macrobond, Bloomberg, Datastream. Data as at 11.00am UK time 11 October 2024.

Source: HSBC Asset Management. Data as at 11.00am UK time 11 October 2024. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector or security. Any views expressed were held at the time of preparation and are subject to change without notice.

Risk markets were firm ahead of Q3 earnings season in the US. Core government bonds fell on an upward surprise in September’s employment report. US CPI data also came in stronger than expected. Bunds continued to fare better than US Treasuries as investors priced in a 0.25%, rate cut at October’s ECB Council meeting. In stocks, the US S&P 500 touched a new all-time high, the Euro Stoxx 50 index traded sideways, and Japan’s Nikkei 225 inched higher. Emerging market equities weakened as investors awaited further details on potential fiscal stimulus for the Chinese economy. The Hang Seng fell sharply, with China’s Shanghai Composite also weakening after the Golden Week holiday. The Korean Kospi rebounded, with India’s Sensex little changed. In commodities, geopolitical tensions are supporting energy prices. Copper weakened, while gold was on course to finish the week flat.

We’re not trying to sell you any products or services, we’re just sharing information. This information isn’t tailored for you. It’s important you consider a range of factors when making investment decisions, and if you need help, speak to a financial adviser.

As with all investments, historical data shouldn’t be taken as an indication of future performance. We can’t be held responsible for any financial decisions you make because of this information. Investing comes with risks, and there’s a chance you might not get back as much as you put in.

This document provides you with information about markets or economic events. We use publicly available information, which we believe is reliable but we haven’t verified the information so we can’t guarantee its accuracy.

This document belongs to HSBC. You shouldn’t copy, store or share any information in it unless you have written permission from us.

We’ll never share this document in a country where it’s illegal.

This document is prepared by, or on behalf of, HSBC UK Bank Plc, which is owned by HSBC Holdings plc. HSBC’s corporate address is 1 Centenary Square, Birmingham BI IHQ United Kingdom. HSBC UK is governed by the laws of England and Wales. We’re authorised by the Prudential Regulation Authority (PRA) and regulated by the Financial Conduct Authority (FCA) and the PRA. Our firm reference number is 765112 and our company registration number is 9928412.