22 July 2024

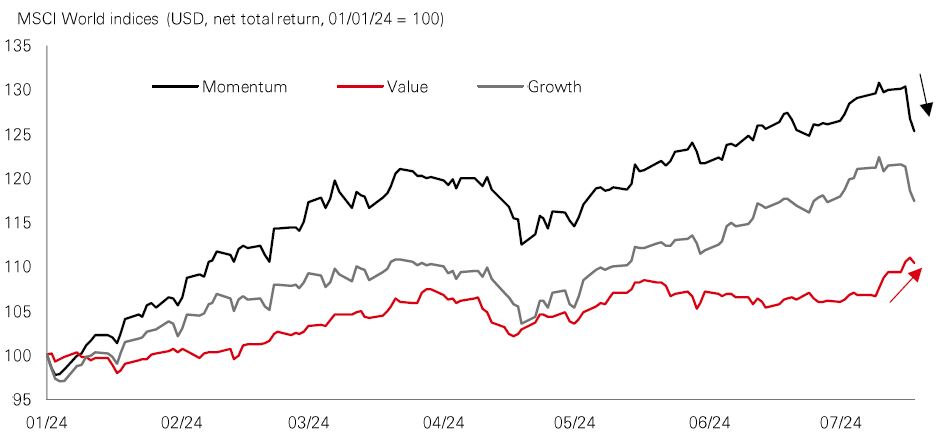

US stocks have been big winners in 2024 – driven by two key themes. First, the supportive backdrop of resilient growth, falling inflation, and recovering corporate profits, which all point to an economic soft landing. Second, the exceptional outperformance of the so-called Magnificent Seven (Mag 7) technology mega-caps. From a factor perspective, it has meant that Momentum – the tendency for trends to persist – has outpaced Growth, which in turn has trounced Value. But can that continue in H2?

Data show the US economy is cooling. Renewed expectations of near-term rate cuts have spurred a shift in performance across factor styles, sectors, and stock sizes. Mag 7 prices have taken a hit, and high-flying Momentum and Growth factors have slipped. By contrast, previous laggards like Value, real estate, and small caps have seen upward moves.

Some analysis points to a less concentrated market performance in H2 amid a broadening out of global profits growth. As Q2 earnings season progresses, there is scope for tech profits to disappoint versus elevated expectations, with other sectors and factors potentially coming to the fore. Meanwhile, political, and geopolitical factors are likely to inject more volatility.

Emerging market equities have had a good year so far, with the MSCI EM index clocking in double-digit returns. And the previous week’s cooler-than-expected US inflation and increased expectations of Fed easing is undoubtedly good news for the EM asset universe.

Take Latin America for example. An EM laggard this year, a delay to the Fed pivot has forced the likes of Brazil, Mexico, and Chile – which were early rate-cutters – to adopt a more cautious approach. But recent developments in the US revives hopes that they can proceed with more easing – which should be good for local asset prices.

Underlying inflation in Brazil and Mexico has softened, and Brazil has announced spending cuts to allay fiscal concerns, even if this may weigh on growth. Regional stock markets are also benefitting from a global broadening of profit growth.

The value of investments and any income from them can go down as well as up and investors may not get back the amount originally invested. Past performance does not predict future returns. The level of yield is not guaranteed and may rise or fall in the future.

This information shouldn't be considered as a recommendation to buy or sell specific sector/stocks mentioned. Any views expressed were held at the time of preparation and are subject to change without notice. While any forecast, projection or target where provided is indicative only and not guaranteed in any way.

Source: HSBC Asset Management. Macrobond, Bloomberg. Data as at 11.00am UK time 19 July 2024.

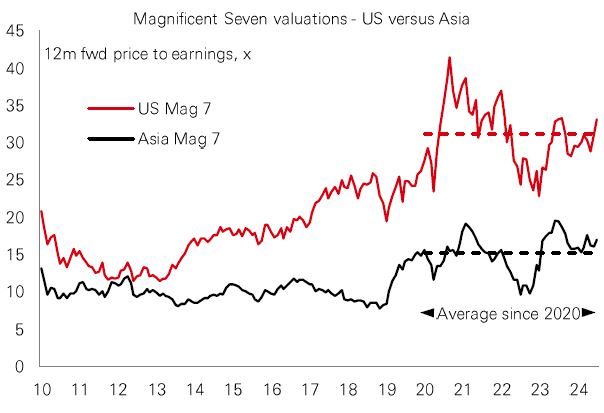

Technology and AI have been the biggest themes in global stocks for two years. Nowhere has that been more evident than in the strong returns of the US’s Mag 7 tech stocks. But while those firms dominate headlines, an alternative Mag 7 in Asia could offer similar tech-driven growth at a more reasonable price.

A basket of seven of Asia’s largest and fastest-growing chip makers and IT electronics firms has delivered a near 20% annualised return since 2020. While that falls short of the 30% return from the US Mag 7, it handily beats the 14% return from the MSCI USA index over the same period.

Back in 2012, the two Mag 7 groups traded on similar valuations, with forecast price-earnings (PE) ratios of around 12x. But since 2020, the average forecast PE of the US group has jumped to 30x, while the Asia Mag 7 is just half that. With superior sales and earnings forecasts for 2024 and 2025, the Asia Mag 7 growth outlook looks encouraging, and could offer a more attractively priced route to investing in the global technology theme.

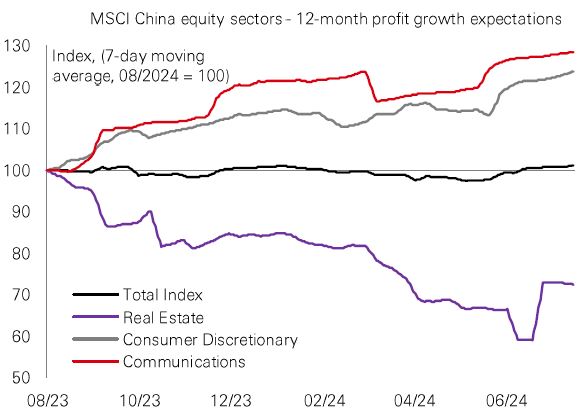

In China, mixed macro data have translated into some investor concerns over the earnings outlook. This coincides with a period of weakness in the country’s equity markets that began in late May, despite still solid year-to-date gains. And last week’s softer-than-expected Q2 GDP print is unlikely to help.

While government policy support has buoyed confidence, all eyes are on further pro-growth measures that might come after last week’s Third Plenum meetings.

Targeted policy measures so far reflect a shift in China’s economy away from reliance on property towards high-tech manufacturing and service sectors. This is showing up in a pick-up in profit growth expectations for sectors like consumer discretionary and communications services. These moves have offset a negative trend in the profit outlook for real estate and kept expectations for the broader market steady.

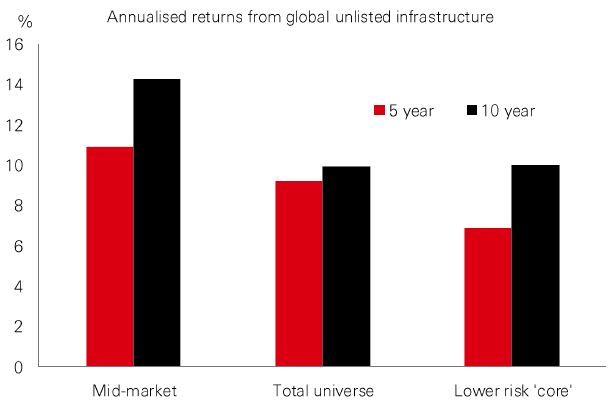

Global unlisted infrastructure has become a popular portfolio diversifier over the past 20 years. Some of the strongest returns across the asset class have come from the mid-market, where infrastructure projects tend to be smaller but less prone to cost over-runs and delays. It’s a part of the market that is sensitive to inflation and elevated rates, so recent progress on disinflation and the prospect of Fed rate cuts could provide a welcome boost. Asia, in particular, is a region where vast investment demand offers attractive opportunities.

Globally, the bulk of funds raised for infrastructure investment target the US and Europe. But with countries across Asia requiring huge investments in areas like renewables and digitisation, it’s arguably being under-served. In its favour, Asia offers plentiful projects and lower competition for deals, with many countries enjoying relatively benign inflation – putting them in a solid position to pursue new infrastructure developments. But there are risks in mid-market projects, so careful deal selection, intensive asset management, and on-the-ground knowledge are essential.

Past performance does not predict future returns. This information shouldn't be considered as a recommendation to buy or sell specific sector/stocks mentioned. Any views expressed were held at the time of preparation and are subject to change without notice.

Source: HSBC Asset Management. Macrobond, Bloomberg, EDHEC indices: Infra100 Midmarket, Infra300, Infra100 Core. Data as at 11.00am UK time 19 July 2024.

Source: HSBC Asset Management. Data as at 11.00am UK time 19 July 2024.

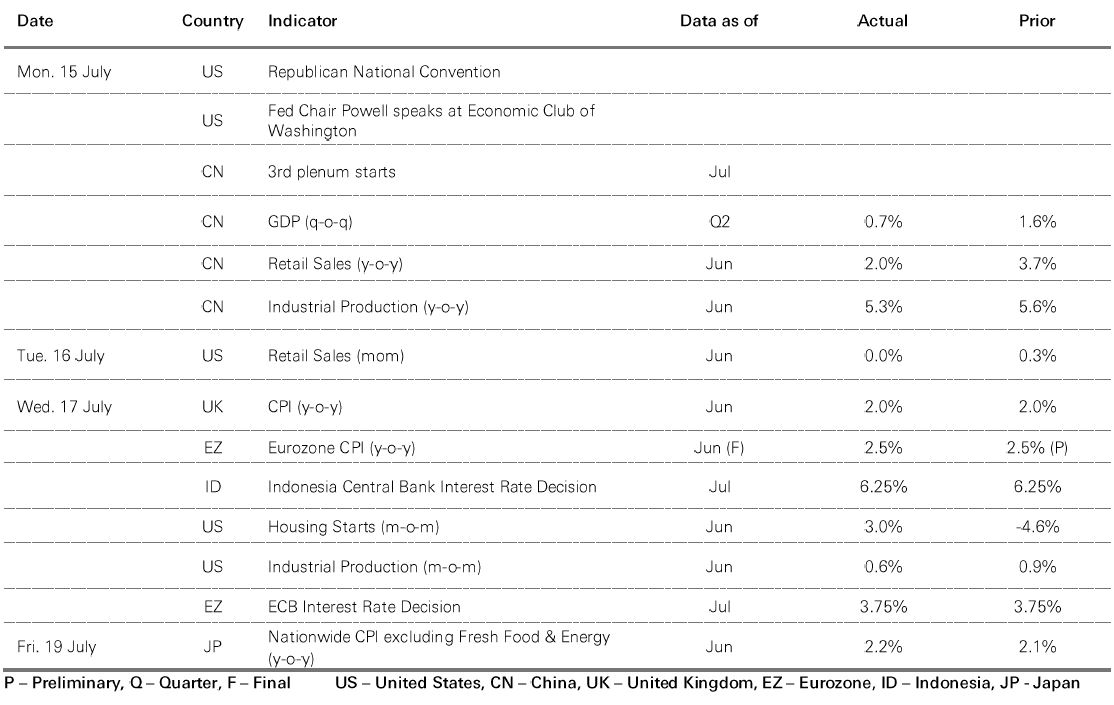

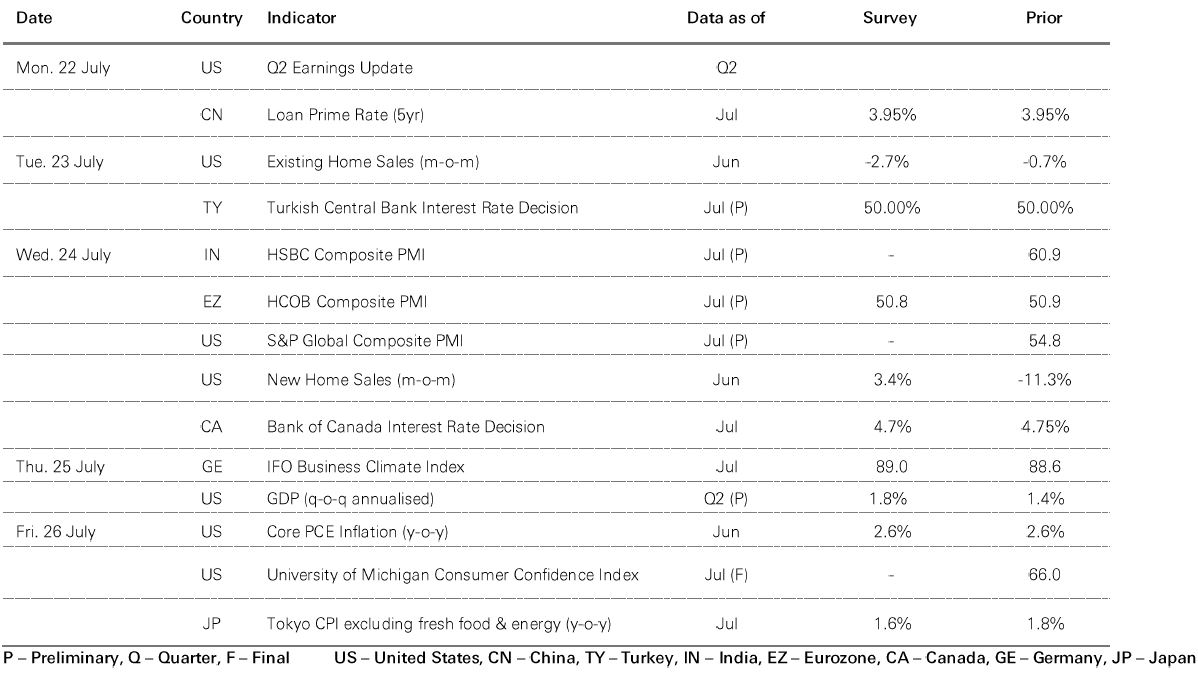

Rising US political uncertainty weighed on risk markets, with the US DXY index remaining on the defensive. Core government bonds were range-bound despite stronger-than-expected US data. Dovish comments from Fed Chair Powell cemented market expectations of two 0.25% rate cuts in H2 2024. ECB president Lagarde stated September’s meeting was “wide open”, and reiterated rate cuts are “data dependent”. US equities saw a rotation away from the tech-dominant S&P500 and Nasdaq to the rate-sensitive Russell 2000. The Euro Stoxx 50 fell, with the defensive Swiss SMI outperforming the Dutch AEX index. Japan’s Nikkei suffered as a firmer yen weighed on export-orientated stocks. In EM, the Shanghai Composite weakened amid disappointing Q2 GDP data. India’s Sensex reached new highs. In commodities, oil prices traded sideways, and copper fell. Gold remains just below all-time highs.

We’re not trying to sell you any products or services, we’re just sharing information. This information isn’t tailored for you. It’s important you consider a range of factors when making investment decisions, and if you need help, speak to a financial adviser.

As with all investments, historical data shouldn’t be taken as an indication of future performance. We can’t be held responsible for any financial decisions you make because of this information. Investing comes with risks, and there’s a chance you might not get back as much as you put in.

This document provides you with information about markets or economic events. We use publicly available information, which we believe is reliable but we haven’t verified the information so we can’t guarantee its accuracy.

This document belongs to HSBC. You shouldn’t copy, store or share any information in it unless you have written permission from us.

We’ll never share this document in a country where it’s illegal.

This document is prepared by, or on behalf of, HSBC UK Bank Plc, which is owned by HSBC Holdings plc. HSBC’s corporate address is 1 Centenary Square, Birmingham BI IHQ United Kingdom. HSBC UK is governed by the laws of England and Wales. We’re authorised by the Prudential Regulation Authority (PRA) and regulated by the Financial Conduct Authority (FCA) and the PRA. Our firm reference number is 765112 and our company registration number is 9928412.