15 July 2024

Coming into 2024, investors were convinced that central banks were poised to slash rates. Yet, resilient growth and sticky inflation have, so far, put paid to that. And for core bond markets, the spectre of ‘higher for longer’ policy has delivered a poor performance. But it could change in H2.

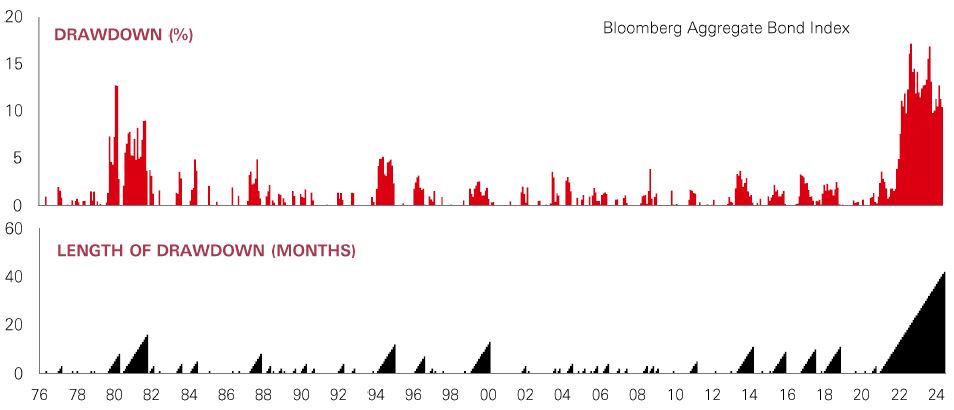

Four years of rising yields on 10-year US Treasuries reflect what has arguably been the worst bond bear market ever. The Bloomberg Aggregate Index – a barometer of the broader bond universe – is in its deepest, longest drawdown since its inception in 1976. But now, a starting point of high yields provides scope for significant capital growth.

That’s because signs of cooling in the US economy could finally prompt the Fed to pivot policy in the near-term. Last week's June CPI inflation print came in below expectations, with key components such as shelter and auto inflation softening. Meanwhile, the unemployment rate rose for the third month in a row in June, hinting that wage growth – an important driver of services inflation – is likely to decline further. Other data suggest weakness in rate-sensitive sectors like housing. And retail sales softened in Q2, amid rising delinquency rates for lower income households.

There are risks, of course, including a potentially bumpy path for disinflation and geopolitical and election headwinds. Even so, there may be an opportunity to ‘play the yield’. And with inflation heading back to target, there is the possibility that bonds return to their traditional role as defensive portfolio diversifiers.

Surging price momentum in the technology sector has driven growth stocks to new highs this year. And over the past five years, the US Growth factor has outperformed Value by around 95 percentage points.

But it’s worth remembering that markets can quickly blow the froth off prices when earnings disappoint. In late 2021, the price-earnings (PE) ratio of the S&P 500’s seven largest tech stocks hit a high of 36x. By January 2022, that valuation had collapsed by 15% as the market levelled out and cheaper stocks rebounded. By June, their combined PE had fallen to 24x. And with that in mind, the current PE valuations of the Magnificent Seven stocks are the most stretched they’ve been since December 2021 – at 34x versus the rest of the S&P on 18x. Excessive valuations create a vulnerability to anything short of exceptionally good news.

As for Value, unloved sectors like utilities and staples, as well as small-caps generally, have lagged the market of late. But if earnings begin to disappoint elsewhere, they could offer a more defensive option for portfolios, and should be well-placed to attract market interest once the Fed begins to cut rates.

The value of investments and any income from them can go down as well as up and investors may not get back the amount originally invested. Past performance does not predict future returns. The level of yield is not guaranteed and may rise or fall in the future. Investments in emerging markets are by their nature higher risk and potentially more volatile than those inherent in some established markets. This information shouldn't be considered as a recommendation to buy or sell specific sector/stocks mentioned. Any views expressed were held at the time of preparation and are subject to change without notice. Source: HSBC Asset Management. Macrobond, Bloomberg.Data as at 11.00am UK time 13 July 2024.

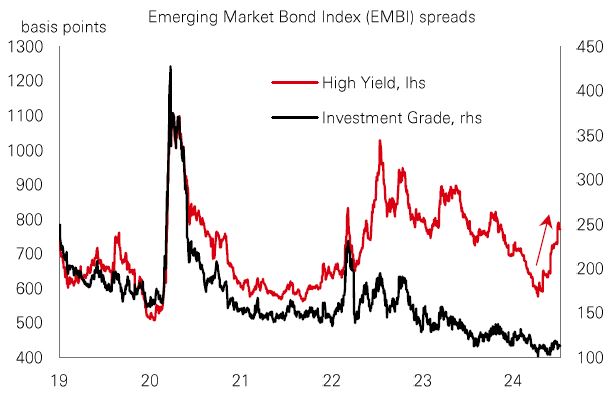

Like many fixed income asset classes, the year-to-date performance of emerging market (EM) bonds has been hamstrung by delays to the Fed easing cycle. For the benchmark EMBI (index of US dollar-denominated bond issued by EM sovereigns and state-owned firms), there has been a particularly sharp increase in the spreads in the high-yield (HY) component.

There is a good chance that HY spreads will tighten again once the Fed starts cutting rates. EM investment specialists also see room for credit rating upgrades amid solid and improving fundamentals. The Dominican Republic for example (BB- rating) has solid external buffers and fiscal policy anchors which could support lower levels of debt to GDP.

Meanwhile, the investment-grade component, while less attractive on a stand-alone spread basis, still benefits from elevated “all-in yields” and high credit quality.

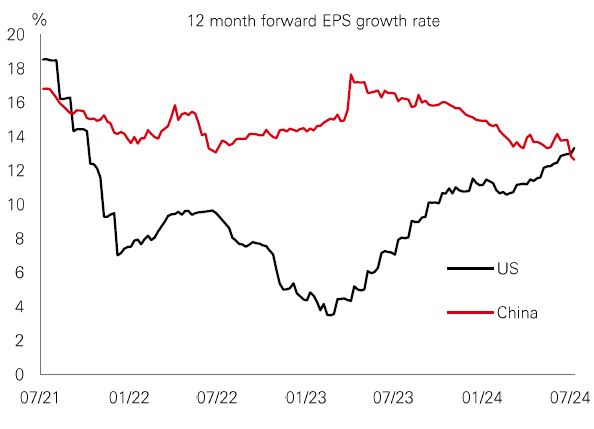

Profit growth estimates for Chinese and US stocks had an intriguing coming together the previous week – with analysts forecasting growth of 13% in both markets over the next 12 months.

The last time we saw this kind of convergence was in September 2021 – just as analysts were slashing forecasts for US stocks on rising inflation. Since then, sentiment across the two markets has diverged. For US stocks, growth forecasts continued to drop until profit recovery took hold in early 2023. But in China, average profit growth expectations have stayed in the mid-teens throughout.

While Chinese profit growth has been resilient, the local equity market has underperformed. In part, this has been down to macro concerns like weak consumer demand and a faltering property sector. But recent policy support for priority sectors and positive corporate reforms have helped – and there are hopes that this week’s third plenum meetings will go further. As it stands the valuation of Chinese equities remains below its longer-term average, and materially below DM and EM peers. But with improving news on the macro and earnings outlook, a re-rating is possible.

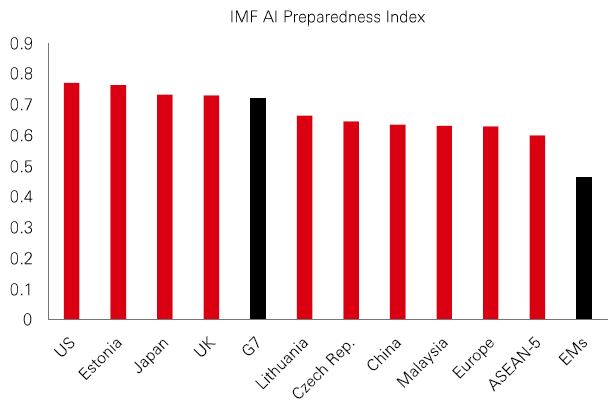

When OpenAI launched its ChatGPT chatbot in 2022, it sparked huge interest in how artificial intelligence might transform productivity. Tech firms are estimated to be spending more than USD 1 trillion on AI services in the coming years. But there are questions over what it means for economies, and the trade-off between higher growth and the potential for millions of lost jobs.

To find an answer, IMF researchers have studied AI preparedness across 174 economies based on factors like digital infrastructure, employment markets and policies, innovation, and regulation. Predictably, they found wealthier economies tend to be best equipped for AI adoption.

Interestingly, emerging and frontier markets in eastern Europe including Estonia, Lithuania and the Czech Republic, place relatively high up the list. And across the broader EM universe, China, Malaysia, and ASEAN nations also rate well. Good news then for these countries’ longer-term productivity and growth prospects.

Past performance does not predict future returns. Investments in emerging markets are by their nature higher risk and potentially more volatile than those inherent in some established markets.

Source: HSBC Asset Management. Macrobond, Bloomberg, IMF. Data as at 11.00am UK time 13 July 2024.

Source: HSBC Asset Management. Data as at 11.00am UK time 13 July 2024.

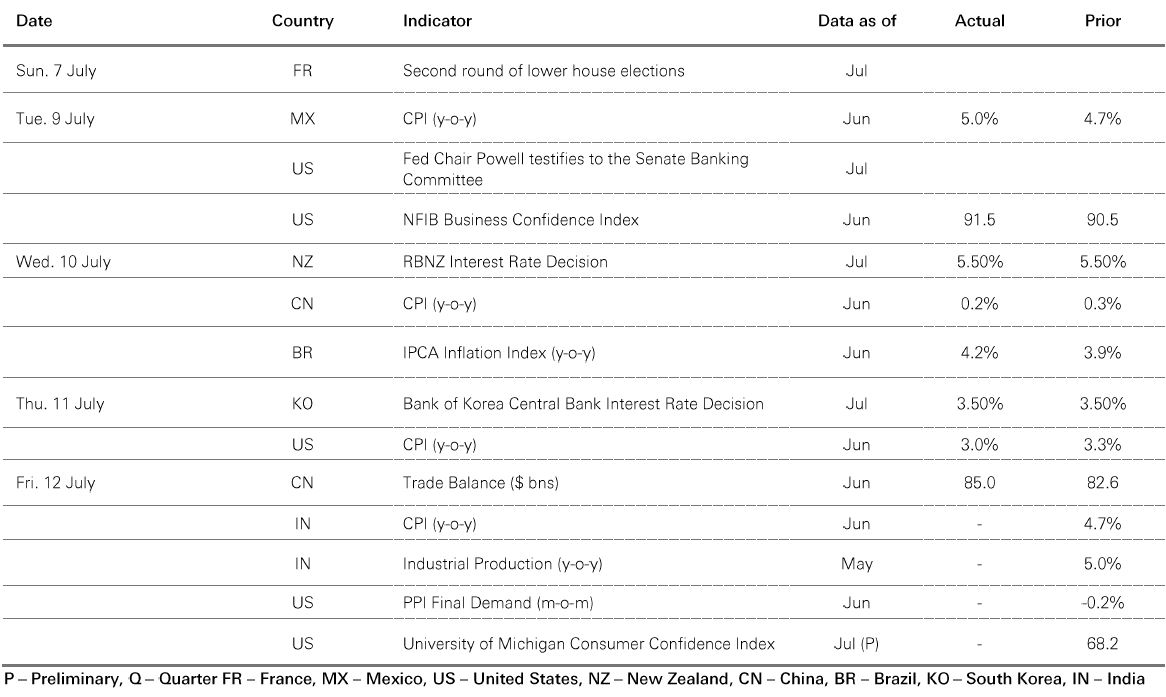

A downside surprise in US inflation supported risk assets last week. Core government bonds rallied as dovish comments from Fed Chair Powell at his semi-annual testimony reinforced market expectations of a 0.25% rate cut in September. The US DXY index weakened. US equities were mixed, with the interest rate sensitive Russell 2000 outperforming the S&P500 and Nasdaq. The Euro Stoxx 50 index drifted sideways in volatile trading amid political uncertainty in France. The Nikkei 225 rose to a new historic high as Japanese officials attempted to stabilise the weak yen. In EM, China’s Shanghai Composite index rebounded ahead of the third plenum. India’s Sensex moved modestly higher, led by rising tech stocks. In Latin America, Brazil’s Bovespa also rose. In commodities, oil prices lost ground as the IEA left its 2024 global oil demand projection unchanged. Gold and copper consolidated. |

We’re not trying to sell you any products or services, we’re just sharing information. This information isn’t tailored for you. It’s important you consider a range of factors when making investment decisions, and if you need help, speak to a financial adviser.

As with all investments, historical data shouldn’t be taken as an indication of future performance. We can’t be held responsible for any financial decisions you make because of this information. Investing comes with risks, and there’s a chance you might not get back as much as you put in.

This document provides you with information about markets or economic events. We use publicly available information, which we believe is reliable but we haven’t verified the information so we can’t guarantee its accuracy.

This document belongs to HSBC. You shouldn’t copy, store or share any information in it unless you have written permission from us.

We’ll never share this document in a country where it’s illegal.

This document is prepared by, or on behalf of, HSBC UK Bank Plc, which is owned by HSBC Holdings plc. HSBC’s corporate address is 1 Centenary Square, Birmingham BI IHQ United Kingdom. HSBC UK is governed by the laws of England and Wales. We’re authorised by the Prudential Regulation Authority (PRA) and regulated by the Financial Conduct Authority (FCA) and the PRA. Our firm reference number is 765112 and our company registration number is 9928412.