1 July 2024

What’s next for investment markets in the second half of the year? A good starting point is to reflect on where we have come from. And 2024 has had already seen some economic and market twists and turns.

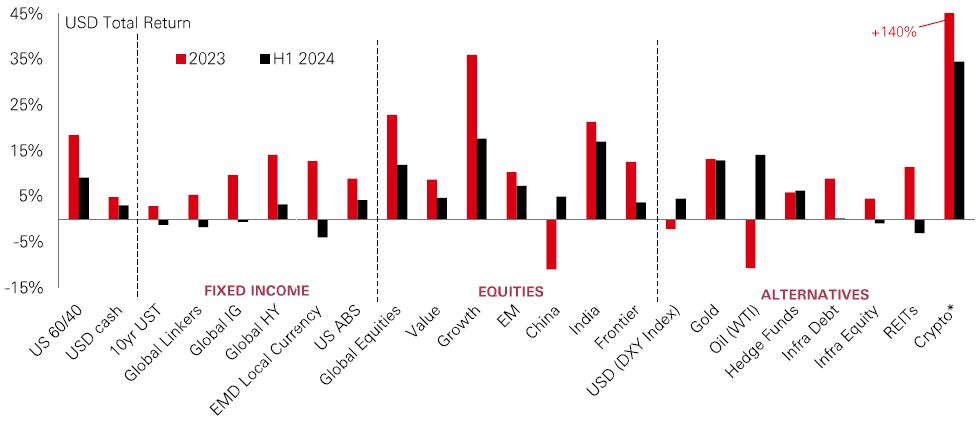

The resetting of 2024 policy rate expectations (from 7 Fed cuts to only 1-2) was the big economic event during H1. This damaged core fixed income returns. But shorter duration credits – like High Yield or ABS – fared better. Meanwhile macro resilience and the AI megatrend helped global stocks to keep on going. Value stocks couldn’t keep pace with Growth, but still managed to deliver returns (on an annualised basis) at a similar clip to 2023.

Yet the headlines mask important nuances. Strength in developed market stocks was broad-based in Q1, but performance has been more varied during Q2, with tech performing well. Likewise, Treasury bond yields rose through to late April, thanks to hot growth and inflation prints. But, since then, signs that growth is slowing and inflation unsticking itself have driven a bond rally. In investing, both the destination and the journey are important.

So, what do these trends tell us about the near-term future? Well, after a tricky start to 2024, we see a return for fixed income. For credits and stocks, a more selective approach looks warranted. Areas like infrastructure and real estate are unloved and typically defensive. Japan still looks interesting. And don’t overlook opportunities to “play the yield” especially in Asia. South Asia, after all, remains the fastest growing region in 2024.

Asia has been the best performing EM region in the first half of the year. The recovery in Chinese stocks accelerated in Q2 with investor confidence boosted by stabilising profits and policy initiatives. Elsewhere, India has seen strong returns again in 2024 – with MSCI India delivering comparable performance to the S&P500.

Latin America – the winning region in 2023 – has struggled in 2024. Stocks have both performed negatively, despite both Brazil and Mexico cutting interest rates. An interesting theme for US and European investors to mull over.

A third lesson from emerging market investing in H1 has been connected to how election uncertainty transmits to market price action. Polling results in India in June created short-lived stock and FX volatility, but the market quickly recovered as investors refocussed on a consistent policy agenda and the exciting Indian megatrends. But in Mexico, the peso has sustained a double-digit percent drawdown following the election result. For investors, it’s not just news and events that matter for market direction, but how traders’ expectations are set ahead of that news.

The value of investments and any income from them can go down as well as up and investors may not get back the amount originally invested. Past performance does not predict future returns. The level of yield is not guaranteed and may rise or fall in the future.

This information shouldn't be considered as a recommendation to buy or sell specific sector/stocks mentioned. Any views expressed were held at the time of preparation and are subject to change without notice.

Source: HSBC Asset Management. Macrobond, Bloomberg. Data as at 11am UK time 28 June 2024.

*Note: Asset class performance is represented by different indices. US 60/40: Bloomberg EQ:FI 60:40 Index, Cash: JP Morgan Cash Index (3month), 10yr UST: ICE BofA 10yr US Treasury Index, Global Linkers: ICE BofAGlobal Inflation-Linked Government Index, Global IG: Bloomberg Barclays Global IG Total Return Index unhedged. Global High Yield Index: ICE BoFaUS High Yield Index, EMD Hard currency: US ABS: Bloomberg US ABS Floating Rate Total Return index; Bloomberg Barclays Global Aggregate Treasuries Total Return Index. EMD local currency JP Morgan EMBI Global Total Return local currency. Global Equities: MSCI ACWI Net Total Return USD Index. Value: MSCI Value Index, Growth: MSCI Growth Index, Global Emerging Market Equities: MSCI Emerging Market Net Total Return USD Index. China: MSCI China Index, India: MSCI India Index. Frontier: MSCI Frontier Markets Total Return Index, Alternatives: USD: DXY Index, Gold Spot $/OZ, Oil: WTI crude oil, Hedge funds: Credit Suisse Hedge Fund Index, Leverage Loans: JP Morgan liquid Loan Index, Infra Debt: iBoxx USD Infrastructure Total Return Index, Infra Equity: Dow Jones Brookfields Global Infrastructure Total Return Index, REITS Real Estate: FTSE EPRA/NAREIT Global Index TR USD. *Crypto: Bloomberg Galaxy Crypto Index.

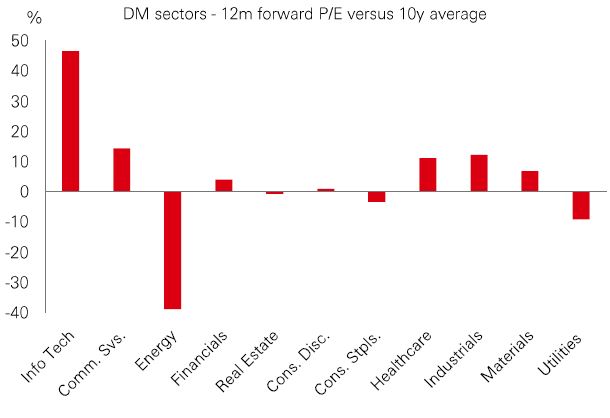

Developed market stocks delivered strong returns in H1. But looking ahead, a key question for investors is whether valuations are overstretched, and whether future returns could suffer as a result.

An obvious place to start is the Info Tech and Communications Services sectors. These have been the epicentre of the AI mega-theme in equities for more than 18 months – and a prime driver of returns. IT currently trades on a forward price-earnings (PE) ratio nearly 47% above its 10-year average. Communications is 14% ahead (and even higher in the US). While these sectors could continue to perform well, rich valuations can be vulnerable to profit disappointments, especially if conditions weaken.

By contrast, some of the more defensive and rate-sensitive sectors are cheaper and could offer respite if growth starts to soften. Utilities, Staples and Real Estate trade below their 10-year average Energy is the cheapest of the lot.

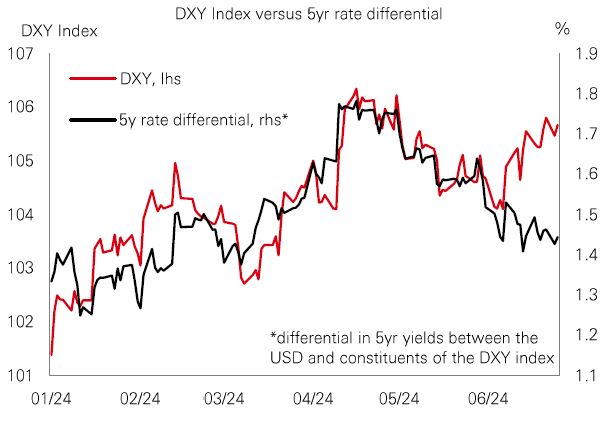

By rights, the US dollar should have weakened through June. US activity data have been surprising meaningfully to the downside, which, combined with soft May inflation readings, has meant that US yields have declined relative to yields elsewhere. Yet the dollar has gained ground.

A large part of the answer lies in what’s driving the euro, which has the largest weight in the DXY index. Idiosyncratic risks for the euro have gone up materially, reflecting political developments in France. The euro is caught up in the tussle between euro-positive moves in rate differentials and euro-negative peripheral spreads, with the latter dominating thus far.

However, if the macro undercurrents continue to evolve against the dollar, as we expect, and if the European political situation quietens down during the summer break, the recent divergence between the dollar and rates may prove temporary. Furthermore, over the medium-term, a US slowdown is likely to be more consequential for the dollar.

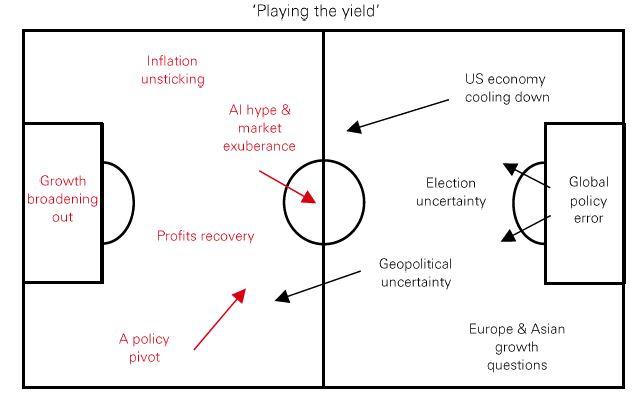

With the UEFA European Championship reaching its crucial knockout stages last weekend, some of football’s great tacticians will be looking for opportunities in attack and ways to soak up pressure in defence. This can be taken as an inspiration for some of our latest thinking on investment markets in the second half of this year.

There are a number of reasons for investors to remain optimistic in H2. As the ‘reds’ show, a solid back line of broadening growth, a return to disinflation and expected central bank policy easing offer confidence. We’re already seeing a pick-up in the global earnings outlook. And of course, some mega-themes like technology have so far delivered star performances.

But of course, the opposition, in ‘black’, must be taken seriously. Geopolitical and election uncertainty are likely to be top of mind in the coming months, and could unsettle markets. Signs of cooling in the US and an uncertain growth outlook for Asia and Europe also demand caution. And of course, any mis-steps at the policy level could put markets on the back foot too.

Past performance does not predict future returns. The level of yield is not guaranteed and may rise or fall in the future.

Source: HSBC Asset Management. Macrobond, Bloomberg. Data as at 11am UK time 28 June 2024.

Source: HSBC Asset Management. Data as at 11am UK time 28 June 2024.

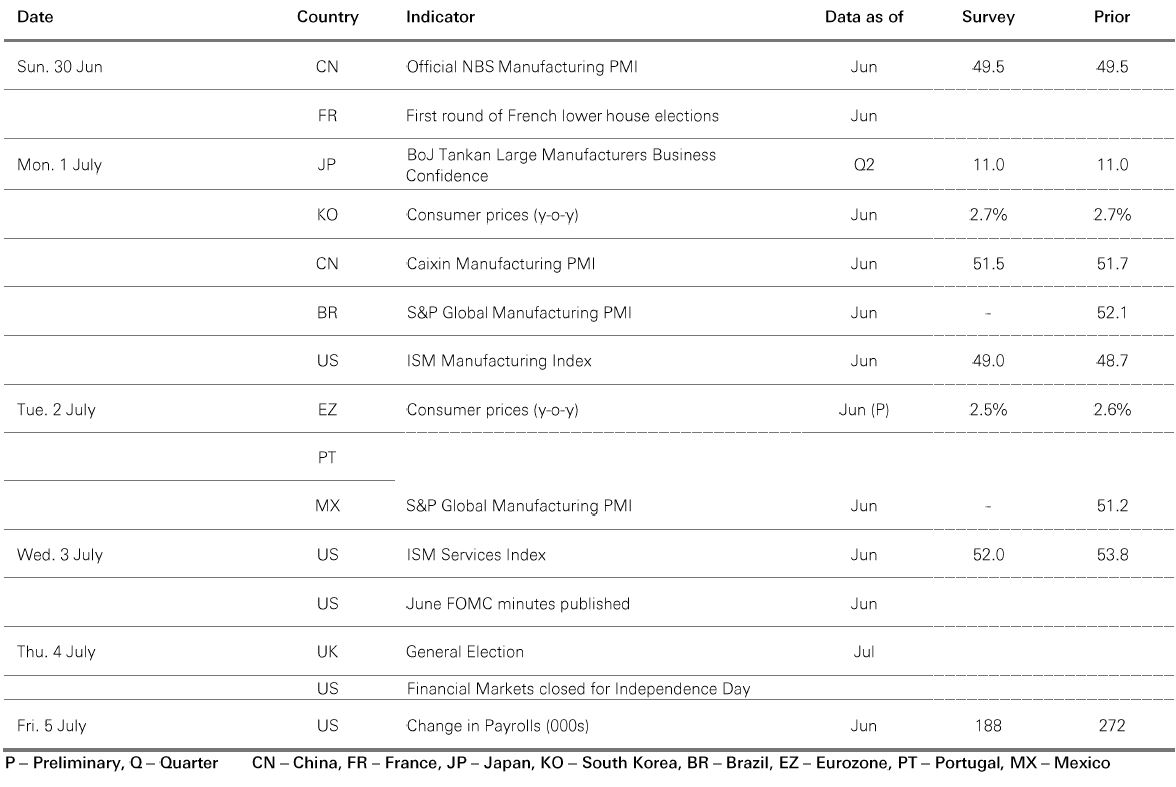

Risk assets struggled to make headway amid a quiet week for economic updates. Core government bonds consolidated as investors absorbed hawkish comments from Fed member Bowman and mixed US data. The latest inflation figures in Australia and Canada surprised on the upside. US equities were range-bound. The Euro Stoxx 50 index traded sideways ahead of the first round of French legislative elections, while the spread between 10yr French and 10yr German sovereign bonds widened. Japan’s Nikkei 225 index rallied as the yen weakened against the US dollar to new multi-decade lows, with JGB yields higher on rising rate concerns. In EM, the Shanghai Composite remained on the defensive ahead of the third plenum review in China. India’s Sensex reached another record high. In commodities, improving demand lifted oil prices amid ongoing geopolitical tensions. Gold and copper softened.

We’re not trying to sell you any products or services, we’re just sharing information. This information isn’t tailored for you. It’s important you consider a range of factors when making investment decisions, and if you need help, speak to a financial adviser.

As with all investments, historical data shouldn’t be taken as an indication of future performance. We can’t be held responsible for any financial decisions you make because of this information. Investing comes with risks, and there’s a chance you might not get back as much as you put in.

This document provides you with information about markets or economic events. We use publicly available information, which we believe is reliable but we haven’t verified the information so we can’t guarantee its accuracy.

This document belongs to HSBC. You shouldn’t copy, store or share any information in it unless you have written permission from us.

We’ll never share this document in a country where it’s illegal.

This document is prepared by, or on behalf of, HSBC UK Bank Plc, which is owned by HSBC Holdings plc. HSBC’s corporate address is 1 Centenary Square, Birmingham BI IHQ United Kingdom. HSBC UK is governed by the laws of England and Wales. We’re authorised by the Prudential Regulation Authority (PRA) and regulated by the Financial Conduct Authority (FCA) and the PRA. Our firm reference number is 765112 and our company registration number is 9928412.