24 June 2024

Investment markets continue to embed a positive outlook for global economic and corporate earnings growth – consistent with limited damage from the impact of high rates. Market implied measures of volatility are at rock-bottom levels, and sentiment is bullish. But geopolitics remains a key risk to this benign outcome for markets.

Heading into H2, a number of significant events in the political calendar could inject more volatility into investment markets – elections in France and the US in particular, will be watched closely. Political risks look to be stacking up.

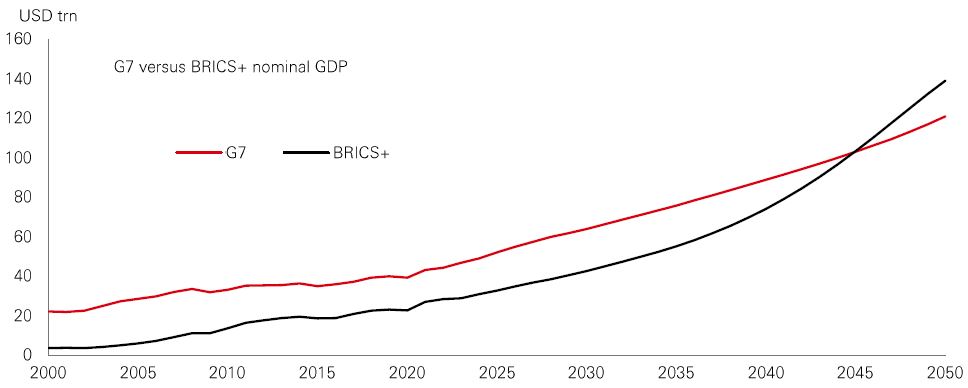

And more generally, the global economic system looks more susceptible to geopolitical shocks now. The global economy is fragmenting. Globalisation is running out of steam. This has come as economic power shifts to Asia and emerging markets – the share of world GDP from the BRICS-plus is set to accelerate in the next couple of decades – allowing them to increasingly flex their economic muscles.

There will be some ‘winners’ from this global shift. India, Mexico, and Southeast Asian economies such as Vietnam and Malaysia can benefit from the trends of ‘friend-shoring’ and ‘near-shoring’. Country-level economic performance is set to be increasingly idiosyncratic – good news for investors hoping to find diversification in their EM allocation. But the big picture consequence is a more volatile and unpredictable economic regime.

The fast-growing private credit market has been well positioned to benefit from the current high-for-longer rates environment. As a largely floating rate asset class, current yields of more than 11% are higher than many other credits, and greater than the historic returns from global equities over the last decade.

After growing rapidly for more than 10 years, new private credit fundraising fell slightly in 2023, to an expected USD200 billion. Recent data suggest that decline has continued in 2024. In part, it’s because high rates are putting pressure on some borrowers and reducing demand in areas of the market.

But credit specialists think more certainty on the timetable for rate cuts will reinvigorate the market. And while lower base rates would mean yields easing back from current highs, private credit will remain a relatively high yielding portfolio diversifier that carries an illiquidity premium. Meanwhile, the ongoing retrenchment of banks from many areas in which they were historically dominant should mean the market for private lending continues to grow.

The value of investments and any income from them can go down as well as up and investors may not get back the amount originally invested. Past performance does not predict future returns. The level of yield is not guaranteed and may rise or fall in the future.

Source: HSBC Asset Management. Macrobond, Bloomberg. Data as at 11am UK time 21 June 2024.

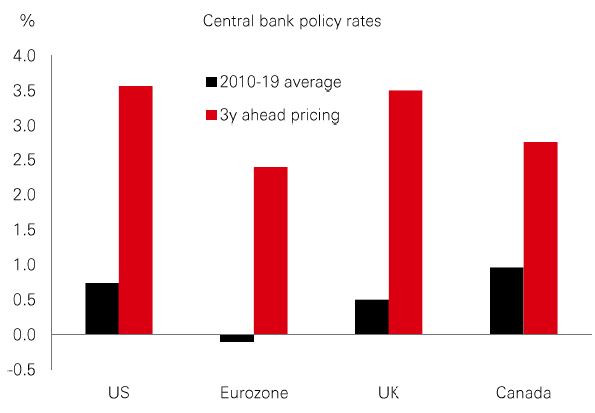

Coming into 2024, markets were pricing between five and seven rate cuts for the major western central banks. Now, they are looking for one to three, depending on the central bank in question.

Importantly, this does not just represent a delay to the rate cutting cycle; longer-term policy rate expectations have also shifted up meaningfully over the past six months, from levels that were already well above the pre-Covid norm.

Ultimately, the resilience of economies in the face of high policy rates has convinced markets that the neutral interest rate has risen across economies, and we have moved decisively away from the post-GFC era of ultra-low rates.

This has left yields across a range of fixed income assets at attractive levels, allowing us to ‘put cash to work’. In addition, high quality bonds can provide some protection should any downside growth risks materialise, given central banks have ample room to cut rates if needed.

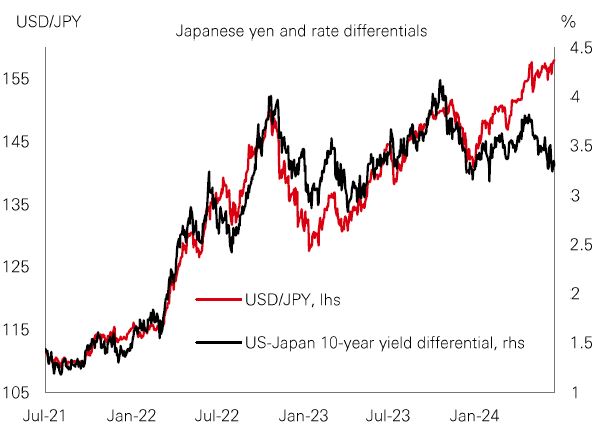

The currency is down 11% year-to-date against the US dollar – hitting a 34-year low. The rationale for a yen resurgence in 2024 was simple – Fed cuts combined with gradual Bank of Japan normalisation. But the Fed has delayed its rate cutting cycle. And the Bank of Japan has underwhelmed with its exit from ultra-accommodative policy – with previous week’s BoJ meeting disappointing investors expecting detail on the paring back of its bond buying – leaving the currency vulnerable.

H2 could see a revival in the yen’s fortunes. We have a scenario for modest dollar depreciation from here as US growth leadership wanes and the Fed tees up its first cut. The yen also looks disconnected from underlying rate differentials. But vital to a recovery of the currency will be more rapid BoJ normalisation which in turn requires greater evidence of sustained inflationary pressures.

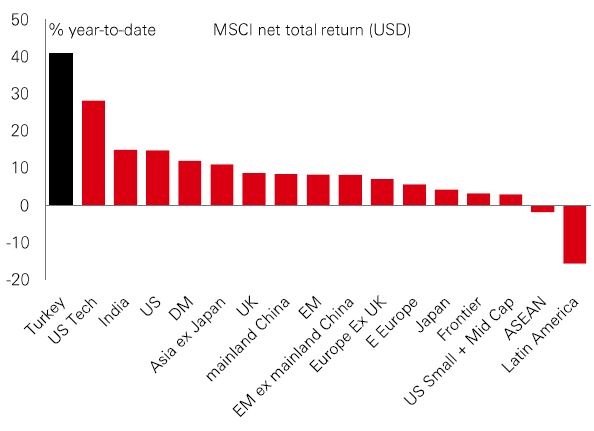

Turkey’s stock markets began 2024 on a solid footing. In early March, momentum was already building, with foreign investors enthused by a shift to more orthodox economic policymaking, and increased activity from a strong domestic retail base. Since then, the MSCI Turkey index has rallied by another 25%.

The Turkish government still seems committed to reducing inflation, with recent news flow indicating that Finance Minister Şimşek will continue to prioritise it. Analysts expect CPI inflation to begin a steep descent from here, falling from 75% in May to around 50% by year end.

They think this can help equity multiples continue to edge higher from still-depressed levels (and well below the 10x average before 2017). They also factor in a decent 10% of earnings growth for 2024 and a stellar 38% for 2025, with financials, insurance and service sectors potentially outperforming names more sensitive to higher financing costs and a stronger lira.

Past performance does not predict future returns. The level of yield is not guaranteed and may rise or fall in the future.

Source: HSBC Asset Management. Macrobond, Bloomberg. Data as at 11am UK time 21 June 2024.

Source: HSBC Asset Management. Data as at 11am UK time 21 June 2024.

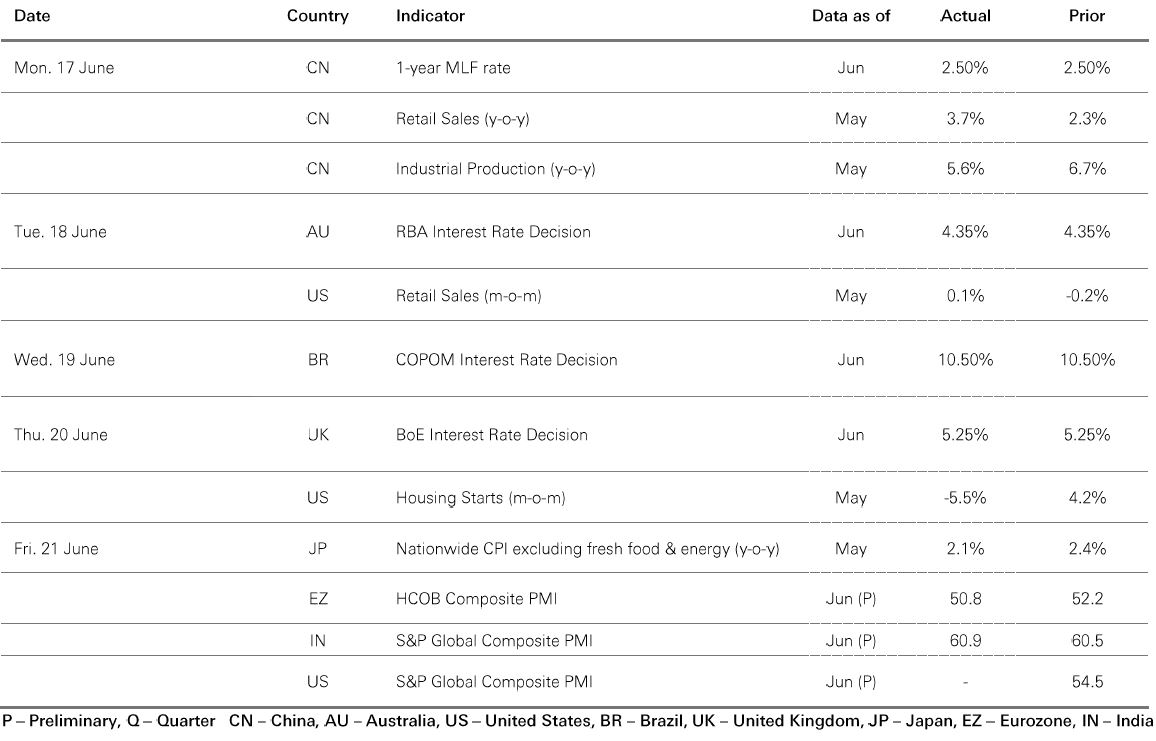

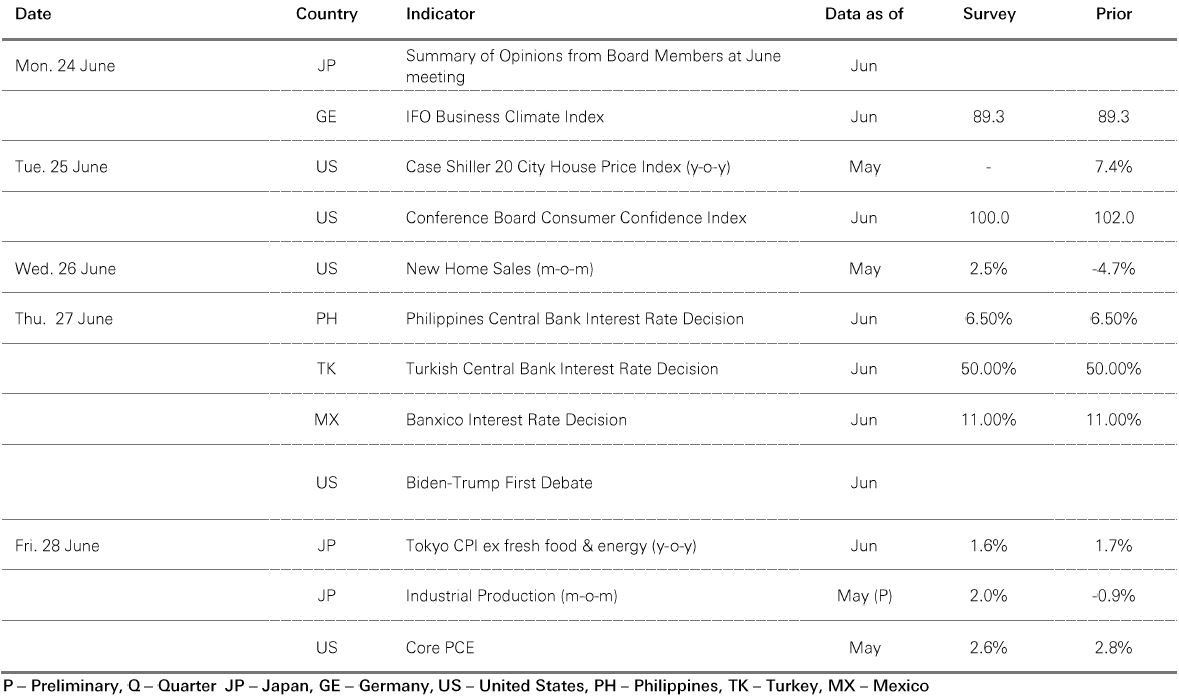

Risk appetite remained positive amid a light week for economic data, with core government bonds largely range-bound. Ten-year French sovereign yields stabilised after the recent sell-off, with the European Commission suggesting that seven EU countries should be added to the EU Excessive Deficit Procedure. In a holiday-shortened week, US equities rose modestly, with the tech-driven Nasdaq testing new highs. The Euro Stoxx 50 index rebounded, led by French stocks, whilst Japan’s Nikkei 225 weakened as the yen fell to a two-month low against the US dollar. There was a mixed performance in EM equities, with Brazilin stocks edging higher despite Banco do Brasil pausing its easing cycle. The Shanghai composite index fell modestly amid mixed Chinese data, while India’s Sensex was flat. In commodities, oil prices continued to recover on rising demand optimism. Copper and gold rose.

We’re not trying to sell you any products or services, we’re just sharing information. This information isn’t tailored for you. It’s important you consider a range of factors when making investment decisions, and if you need help, speak to a financial adviser.

As with all investments, historical data shouldn’t be taken as an indication of future performance. We can’t be held responsible for any financial decisions you make because of this information. Investing comes with risks, and there’s a chance you might not get back as much as you put in.

This document provides you with information about markets or economic events. We use publicly available information, which we believe is reliable but we haven’t verified the information so we can’t guarantee its accuracy.

This document belongs to HSBC. You shouldn’t copy, store or share any information in it unless you have written permission from us.

We’ll never share this document in a country where it’s illegal.

This document is prepared by, or on behalf of, HSBC UK Bank Plc, which is owned by HSBC Holdings plc. HSBC’s corporate address is 1 Centenary Square, Birmingham BI IHQ United Kingdom. HSBC UK is governed by the laws of England and Wales. We’re authorised by the Prudential Regulation Authority (PRA) and regulated by the Financial Conduct Authority (FCA) and the PRA. Our firm reference number is 765112 and our company registration number is 9928412.