17 June 2024

US Treasuries have been knocked about by macro waves of late, with the past week no exception. The 10-year UST yield jumped c.20bp on bumper payrolls the previous Friday. Then the release of May’s inflation data last week – which came in softer-than-expected – helped pull yields back down, hitting a two-and-a-half month low. Nevertheless, investor expectations on Fed easing this year continue to flit between one or two rate cuts. This is roughly in line with the latest FOMC view, although a minority of members expect no cuts at all in 2024.

What it the latest data telling us? Payrolls likely overstate the strength of the labour market. A wider selection of indicators shows that while the labour market is not yet cool, it is cooling. Fed Chair Powell views the market as back to where it was before the pandemic: “tight but not overheated”. Equally, while May’s core CPI print overstates the pace of underlying improvement, it does at least demonstrate that although inflation has been sticky, it is not completely stuck.

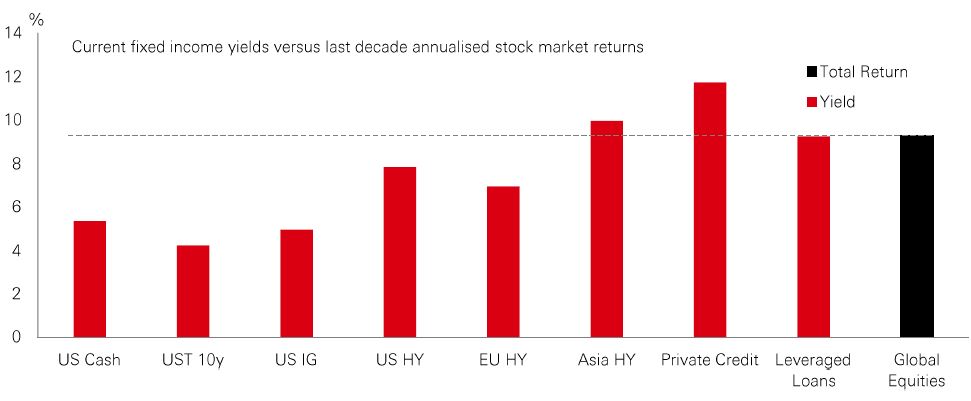

Although risk assets have been the place to be over the past 18 months, bond yields are high, with the potential for capital gains if the trend of gradual economic cooling and disinflation continues – and the Fed starts cutting rates.

Chinese stocks continue to perform relatively well, outpacing both developed and emerging markets during the second quarter. The rebound has been aided by better-than-expected macro data in Q1, especially around exports and accelerating manufacturing and infrastructure investment. Supportive policy, especially for the property sector, resilient earnings and better shareholder returns have also boosted sentiment.

A mix of undemanding equity valuations and an uptick in momentum has led to a pick-up in investor interest. Decade-low foreign allocations to China have shown signs of unwinding, with a closing of underweight gaps compared to levels seen at the start of the year.

An ailing property sector and flagging consumption remain the weak economic links. But with pragmatic policy that keeps up the recovery, international demand could continue to grow.

The value of investments and any income from them can go down as well as up and investors may not get back the amount originally invested. Past performance does not predict future returns. The level of yield is not guaranteed and may rise or fall in the future.

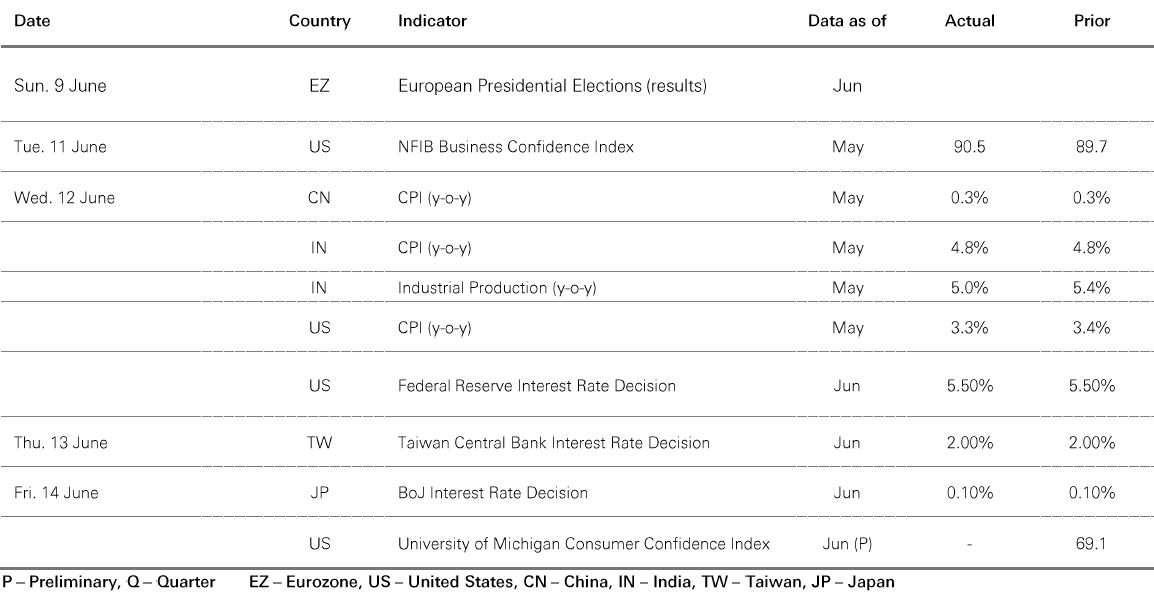

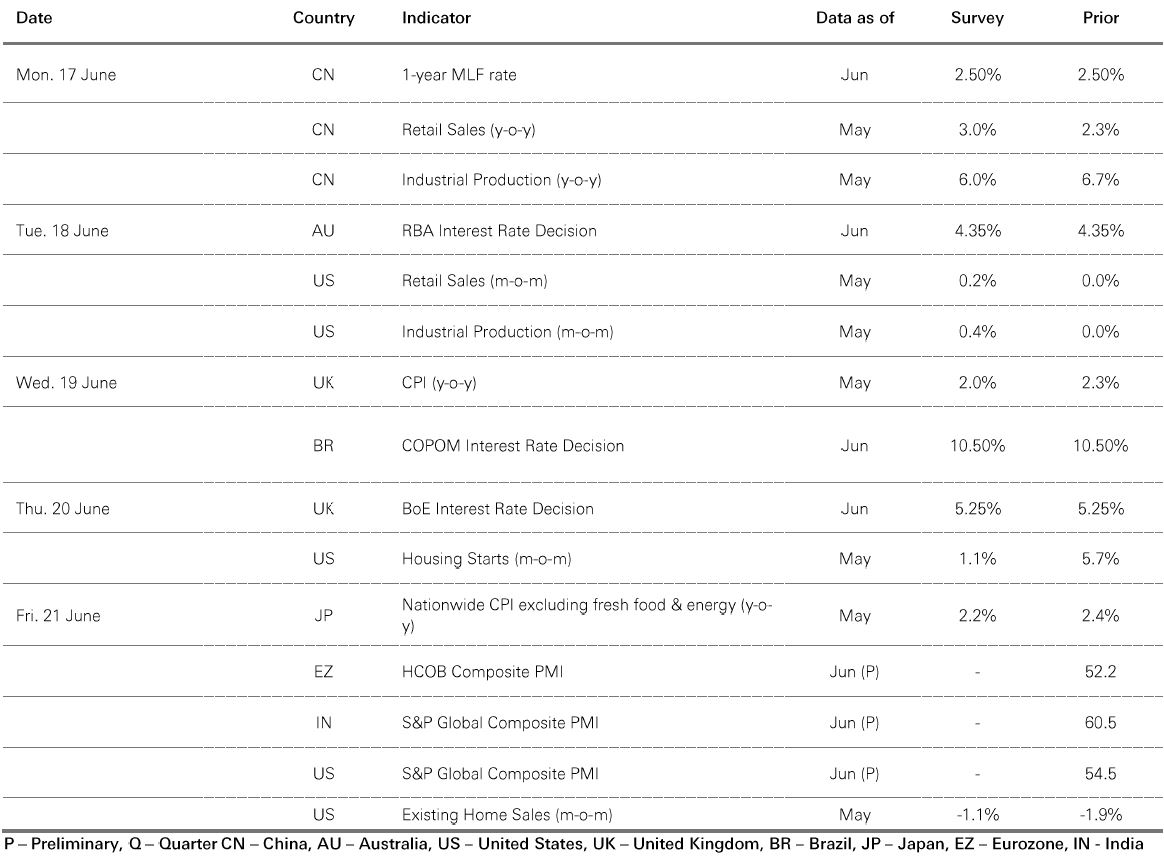

Source: HSBC Asset Management. Macrobond, Bloomberg. Data as at 11am UK time 14 June 2024.

Indian stocks broke to new highs last week, quickly recovering from fleeting election-driven volatility. Key to the rebound has been anticipation of policy continuity under the BJP-led NDA coalition.

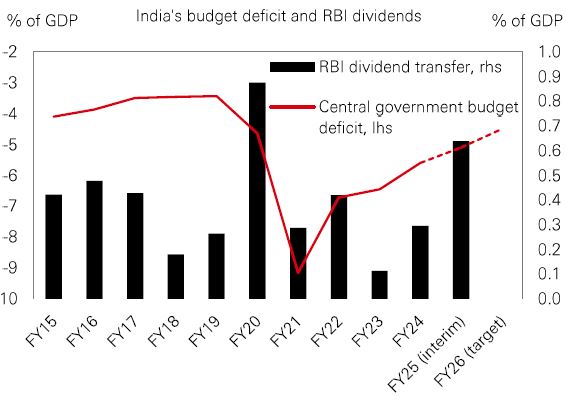

On the fiscal front, the new government has the advantage of a higher-than-budgeted dividend transfer from the Reserve Bank of India (RBI) and robust tax revenue growth. At 2.1 trillion-rupees (USD25 billion), the RBI’s recent payout was twice what was forecast. And that should give the country’s leaders more scope to cut the budget deficit and stick to a roadmap of fiscal consolidation.

For now, a little-changed macro trajectory should be supportive for Indian bonds. It comes just as they are about to get greater international exposure when they join JPMorgan’s EM government bond index later in June. For equities, attention already appears to be shifting back to medium-term fundamentals, with Indian stocks expected to deliver mid-teens earnings growth this year.

European market volatility picked up last week after French President Emmanuel Macron called a snap legislative vote in the aftermath of the European Parliament election results.

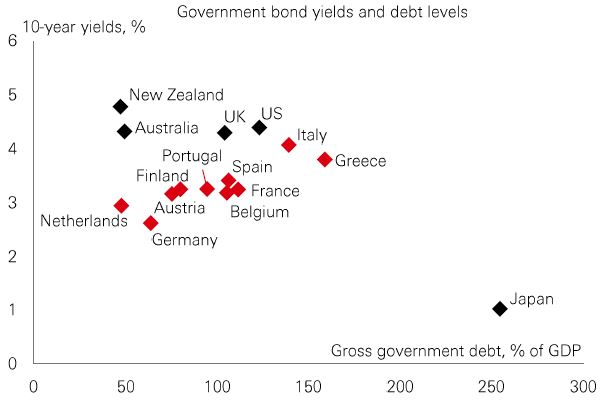

Higher political and economic uncertainty for France comes at a time when underlying fiscal measures have been deteriorating. S&P downgraded France’s sovereign rating from AA to AA- last month. The French government upgraded its 2023 budget deficit/GDP ratio to 5.5%, putting France on the EU’s Excessive Deficit Procedure List. The spread between French and German government bond yields has risen to levels last seen in 2017.

At a time when national debt levels in most Western economies have been rising, and defects are wide, governments will need to tread carefully to avoid the wrath of the bond market vigilantes. A backdrop of fiscal activism makes this all the more tricky. Positively for Europe, however, disinflation is progressing and the ECB has already cut rates, easing some of the pressure. And higher yields are a key reason why investors can put cash to work in fixed income.

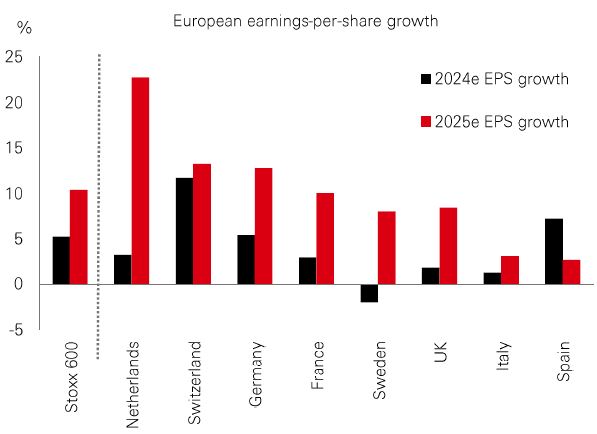

As the eurozone exits from last year’s mild recession and the ECB eases policy, there are significant implications for the outlook for European earnings growth.

In 2024, EPS growth has been fairly concentrated in markets such as Spain and Switzerland, which are relatively defensive. But for 2025, not only is EPS growth expected to double to 10% as the recovery takes hold, there should also be a broadening out of growth to more cyclically-exposed markets, especially in the north.

Next year’s earnings outperformers – markets such as Germany, France, and Sweden – also benefit from low valuations, and currently trade below their 10-year average 12m-forward price-earnings ratios. And any euro weakness should benefit the region’s exporters – with 52% of Stoxx 600 revenues generated outside of Europe. But while the economic growth trajectory looks set to improve, the outlook still depends on future Fed policy and continuing economic momentum in the US.

Past performance does not predict future returns. The level of yield is not guaranteed and may rise or fall in the future.

Source: HSBC Asset Management. Macrobond, Bloomberg. Data as at 11am UK time 14 June 2024.

Source: HSBC Asset Management. Data as at 11am UK time 14 June 2024.

Benign US CPI data boosted risk markets last week. Core government bonds rallied as investors digested comments from Fed Chair Powell. The median Fed member expects one rate cut in 2024, down from three cuts in March. There were diverging trends between US and European equities: the S&P 500 rose to a record high, powered by the Magnificent 7 technology stocks, but rising political uncertainty weighed on the Euro Stoxx 50. Japan’s Nikkei 225 was little changed as the BoJ left policy on hold. In EM, the Shanghai Composite weakened amid lingering deflation concerns, while India’s Sensex consolidated after rebounding from recent volatility. Markets in Taiwan and Korea traded higher on positive read-across from the US tech sector. In commodities, energy prices recovered on a solid demand outlook, with oil on course for its best week in two months. Gold priced also edged higher.

We’re not trying to sell you any products or services, we’re just sharing information. This information isn’t tailored for you. It’s important you consider a range of factors when making investment decisions, and if you need help, speak to a financial adviser.

As with all investments, historical data shouldn’t be taken as an indication of future performance. We can’t be held responsible for any financial decisions you make because of this information. Investing comes with risks, and there’s a chance you might not get back as much as you put in.

This document provides you with information about markets or economic events. We use publicly available information, which we believe is reliable but we haven’t verified the information so we can’t guarantee its accuracy.

This document belongs to HSBC. You shouldn’t copy, store or share any information in it unless you have written permission from us.

We’ll never share this document in a country where it’s illegal.

This document is prepared by, or on behalf of, HSBC UK Bank Plc, which is owned by HSBC Holdings plc. HSBC’s corporate address is 1 Centenary Square, Birmingham BI IHQ United Kingdom. HSBC UK is governed by the laws of England and Wales. We’re authorised by the Prudential Regulation Authority (PRA) and regulated by the Financial Conduct Authority (FCA) and the PRA. Our firm reference number is 765112 and our company registration number is 9928412.