24 April 2025

US stocks rallied further on Wednesday, fuelled by growing optimism over trade negotiations between the US and its trading partners following recent comments from officials. The S&P 500 closed 1.7% higher.

US Treasuries traded mixed, and the yield curve flattened further on a backdrop of an improved market sentiment and a solid 5-year Treasury debt auction result. 2-year yields ended 5bp higher to 3.87%, while 10-year yields were down 2bp at 4.38%.

European stock markets rose Wednesday on rising optimism of an easing of global trade tensions. The Euro Stoxx 50 rose by 2.8%. The German DAX increased 3.1%, as the French CAC was up 2.1%. In the UK, the FTSE-100 ended 0.9% higher.

European government bonds weakened (yields rose) as investors digested latest PMI surveys. 10-year German bund yields increased 6bp to 2.50%, while 10-year French bond yields ended up 3bp at 3.24%. In the UK, 10-year gilt yields edged 1bp higher at 4.55%.

Asian stock markets broadly tracked US stocks’ overnight gains on Wednesday amid easing global trade worries. Japan’s Nikkei 225 and Korea’s Kospi rallied by 1.9% and 1.6%, respectively. Hong Kong’s Hang Seng advanced by 2.4%, while China’s Shanghai Composite bucked the regional trend to remain relatively unchanged, down 0.1%. Meanwhile, India’s Sensex rose by 0.7%.

Crude oil prices fell on Wednesday as concerns about oversupply resurfaced following news reports that some OPEC+ members may seek to accelerate output increases. WTI for June delivery settled 3.2% lower at USD62.3 a barrel.

The flash Euro area composite PMI index fell to 50.1 in April, from 50.9 in March, below the market consensus.

The flash UK composite PMI index dropped to 48.2 in April compared to 51.5 in March, the first contraction since October 2023.

In the US, the composite PMI declined to 51.2 in April, from 53.5 in March. Manufacturing confidence increased, but service sector’s sentiment worsened.

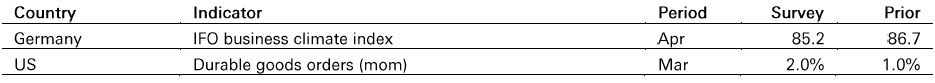

In Germany, higher US tariffs are expected to weigh on IFO business climate index in April.

US durable goods orders should rise 2% mom in March following February’s 1% mom increase.

We’re not trying to sell you any products or services, we’re just sharing information. This information isn’t tailored for you. It’s important you consider a range of factors when making investment decisions, and if you need help, speak to a financial adviser.

As with all investments, historical data shouldn’t be taken as an indication of future performance. We can’t be held responsible for any financial decisions you make because of this information. Investing comes with risks, and there’s a chance you might not get back as much as you put in.

This document provides you with information about markets or economic events. We use publicly available information, which we believe is reliable but we haven’t verified the information so we can’t guarantee its accuracy.

This document belongs to HSBC. You shouldn’t copy, store or share any information in it unless you have written permission from us.

We’ll never share this document in a country where it’s illegal.

This document is prepared by, or on behalf of, HSBC UK Bank Plc, which is owned by HSBC Holdings plc. HSBC’s corporate address is 1 Centenary Square, Birmingham BI IHQ United Kingdom. HSBC UK is governed by the laws of England and Wales. We’re authorised by the Prudential Regulation Authority (PRA) and regulated by the Financial Conduct Authority (FCA) and the PRA. Our firm reference number is 765112 and our company registration number is 9928412.