25 July 2024

US equities sold off on Wednesday, after a disappointing start of mega tech’s earnings season led to a tumble in technology stocks. The S&P 500 ended 2.3% lower, as the tech-heavy Nasdaq dropped 3.6%.

The US Treasury yield curve steepened, amid risk-off sentiment, rising Fed rate-cut expectations, soft economic data, a lacklustre 5-year Treasury debt auction, and a Treasury buyback that accepted no offers. 2-year yields fell 6bp to 4.43%, while 10-year and 30-year yields rose 3bp and 6bp to 4.28% and 4.54% respectively.

European stock markets fell on Wednesday on some disappointing earnings results.The Euro Stoxx 50 fell 1.1%, led by losses in consumer discretionary and technology shares. The German DAX lost 0.9% and the French CAC dropped 1.1%. In the UK, the FTSE-100 fell 0.2%.

European government bonds fell (yields rose) after key PMI survey results showed activity stalling in the region. 10-year German yields flat-lined at 2.44% and 10-year French bond yields nudged higher 2bp to 3.15%. In the UK, 10-year gilt yields rose 3bp to 4.15%.

Asia stock markets traded mostly lower on Wednesday, tracking subdued US markets overnight and as investors weighed some underwhelming US major tech earnings. Japan’s Nikkei 225 dropped 1.1%, weighed down by a stronger yen amid investor nervousness ahead of next week’s Bank of Japan (BoJ) policy meeting. Elsewhere, Korea’s Kospi fell 0.6%. Hong Kong’s Hang Seng and China’s Shanghai Composite was down 0.9% and 0.5% respectively. India’s Sensex also lost 0.3% as investors continued to weigh the hike to capital gains tax from the FY25 Union Budget.

Crude oil prices rose on Wednesday, supported by large declines in US weekly crude and gasoline stockpiles. WTI crude for September delivery settled 0.8% higher at USD77.6 a barrel.

The Eurozone composite PMI came in lower than expected in July, down to 50.1 from 50.9 in June, as a slow expansion in services failed to offset a wider downturn in manufacturing.

The UK composite PMI was roughly in line with expectations, rising to 52.7 in July from 52.3 in June, pointing to a continued modest upturn.

In the US, the composite PMI edged higher to 55.0 in July from 54.8 in June. Meanwhile, new home sales fell 0.6% mom in June, after falling 11.3% mom in May.

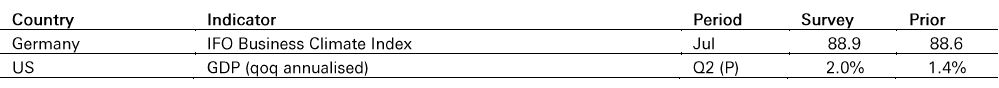

Germany’s IFO Business Climate Index is expected to improve slightly to 88.9 in July from 88.6 in June.

US GDP is forecast to edge higher to 2.0% qoq annualized in Q2 from 1.4% in Q1.

We’re not trying to sell you any products or services, we’re just sharing information. This information isn’t tailored for you. It’s important you consider a range of factors when making investment decisions, and if you need help, speak to a financial adviser.

As with all investments, historical data shouldn’t be taken as an indication of future performance. We can’t be held responsible for any financial decisions you make because of this information. Investing comes with risks, and there’s a chance you might not get back as much as you put in.

This document provides you with information about markets or economic events. We use publicly available information, which we believe is reliable but we haven’t verified the information so we can’t guarantee its accuracy.

This document belongs to HSBC. You shouldn’t copy, store or share any information in it unless you have written permission from us.

We’ll never share this document in a country where it’s illegal.

This document is prepared by, or on behalf of, HSBC UK Bank Plc, which is owned by HSBC Holdings plc. HSBC’s corporate address is 1 Centenary Square, Birmingham BI IHQ United Kingdom. HSBC UK is governed by the laws of England and Wales. We’re authorised by the Prudential Regulation Authority (PRA) and regulated by the Financial Conduct Authority (FCA) and the PRA. Our firm reference number is 765112 and our company registration number is 9928412.