${invest-p50-and-you-could-win-p25-000:productofferSummaryInfoTitle}

${invest-p50-and-you-could-win-p25-000:productofferSummaryInfoShortDescription}

${invest-p50-and-you-could-win-p25-000:productofferSummaryInfoTermsAndConditions}

Take the hassle out of investing with a regular portfolio

New to investing, or just looking for a more convenient way to invest? Choose an HSBC regular portfolio - a fund with a mix of investments that's managed on your behalf. Each portfolio has a different level of risk and expected reward. Just select your preferred level and our team of experts will take care of the rest.

Remember the value of investments can go down as well as up, so you may not get back what you invest.

Why invest in a regular portfolio?

- Start investing with £50

- Use a stocks & shares ISA or a general investment account (GIA) for your portfolio

- Set up regular payments from £50 per month after your first investment

- Join almost 300,000 people in the UK who are already investing with us

Who can apply?

You can invest in one of our regular portfolios if:

- you’ve got an HSBC current account or savings account (excludes Online Bonus Saver and Fixed-rate Saver)

- you’re at least 18 years old

- you're a UK resident

- you’re not a US national/citizen/resident (eg a US passport or green card holder)

- you've got at least £50 to invest

Take a closer look

Invest with a stocks & shares ISA

Get the most out of your investment with a tax-efficient ISA (individual savings account). Keep in mind, tax benefits will depend on your circumstances and tax rules may change in the future.

Easy access to your money

Access your money online any time – without paying an exit fee. But, you should look to invest for at least 5 years, to give it the chance to recover from any dips.

Managed by specialists

HSBC Global Asset Management will manage your portfolio on your behalf. They'll aim to get you the best returns and make sure it stays at the same risk level.

Mix of investments

Our portfolios contain a mix of investments from over 50 different countries, giving you access to a world of opportunities.

Our portfolios

Our ready-made portfolios are an accumulation fund, which means that any income will be reinvested within the fund. This gives your investment the potential to grow. Each portfolio has a risk level rated 1 to 5, where 1 is a lower level of risk and 5 is a higher level of risk. This indicates the amount of potential return on your investment and the risk of investment loss.

The make-up of the portfolios below are correct as of 30 November 2022. Read the portfolio factsheets for the current composition and the costs and charges document to find out more about the fees involved.

How to apply

Choose the portfolio that best matches how you feel about risk, then let us know which investment account you'd like to apply for. You can choose to open a stocks & shares ISA or a general investment account (GIA).

Invest through your app

Or, if you're registered for mobile banking, you can apply and choose your investment account on the app.

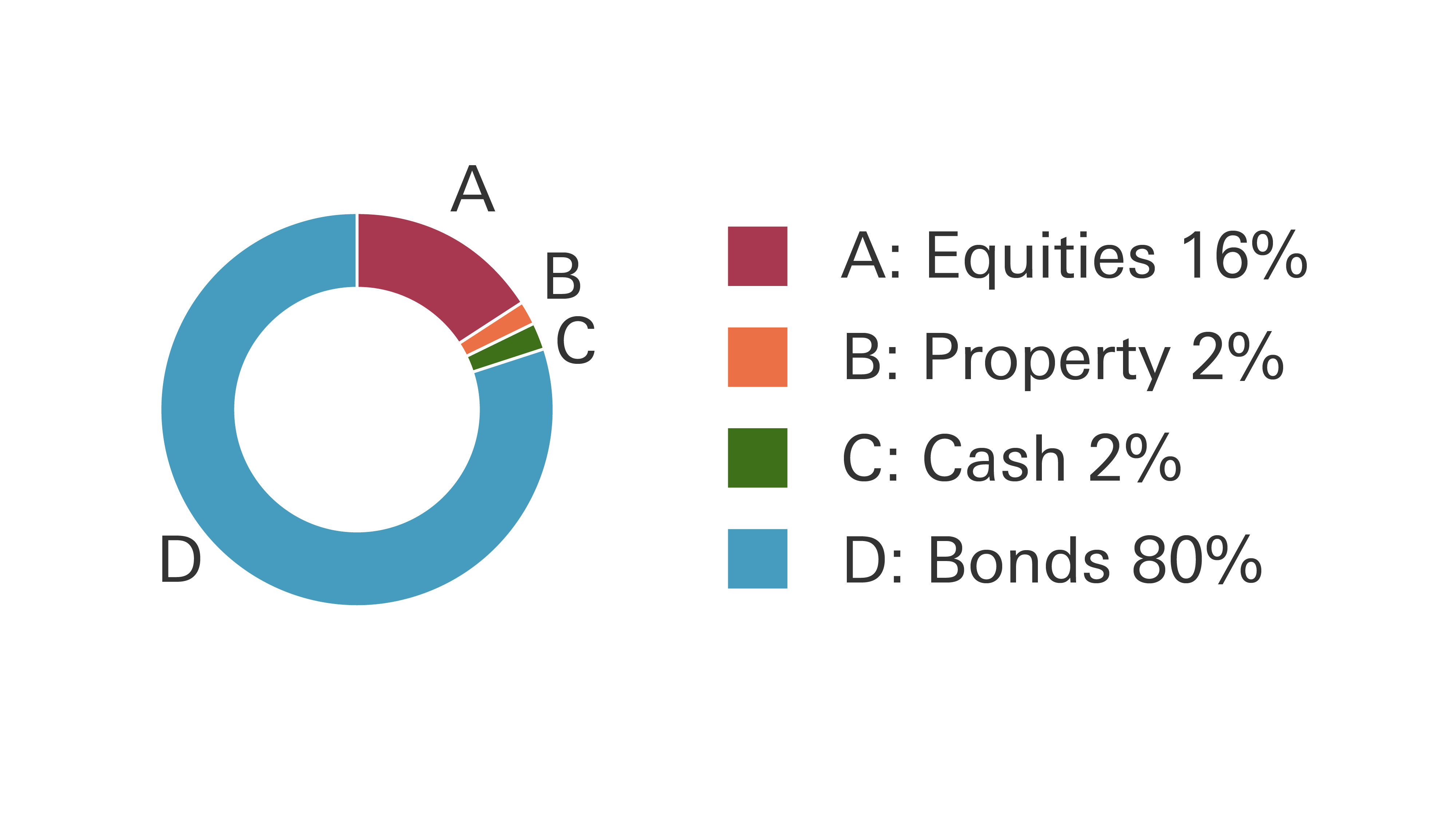

Cautious

Risk level: 1 out of 5

The Cautious fund is invested across global markets with a strong bias towards bonds.

Cautious Portfolio costs and charges

Conservative

Risk level: 2 out of 5

The Conservative fund is invested across global markets with a bias towards bonds.

Conservative Portfolio costs and charges

Balanced

Risk level: 3 out of 5

The Balanced fund is invested across global markets with a spread of asset types.

Balanced Portfolio costs and charges

Dynamic

Risk level: 4 out of 5

The Dynamic fund is invested across global markets with a bias towards equities.

Dynamic Portfolio costs and charges

Adventurous

Risk level: 5 out of 5

The Adventurous fund is invested across global markets with a strong bias towards equities.

Adventurous Portfolio costs and charges

Frequently asked questions

Investment advice

Our ready-made portfolios are offered without any advice. You choose the risk level that you're comfortable with, and HSBC Global Asset Management will manage your portfolio for you.

If you're unsure which level of risk is right for you, we also offer online investment advice for our ready-made portfolios. Fees and eligibility criteria apply.

You might also be interested in

New to investing?

Get more familiar with how to invest and some of the different options available.

Sustainable portfolios

Invest with an ISA in socially-responsible ready-made portfolio from HSBC.

Full range of funds

Open a Global Investment Centre account to browse the full range of funds, from other leading fund managers as well as HSBC.