Take the hassle out of investing

New to investing, or just looking for a more convenient way to invest? Choose an HSBC ready-made portfolio – a fund with a mix of investments that's managed on your behalf.

Each portfolio has a different level of risk and expected reward. Just select your preferred level of risk and our team of experts will take care of the rest.

Before you invest, you should build up 3-6 months of living costs to fall back on, so that you're less likely to dip into your investment to cover for anything unexpected.

Remember, investing has its ups and downs and – so you could get back less than you invest.

Take a closer look

Mix of global investments

Our portfolios contain a mix of investments from over 50 different countries, giving you access to a world of opportunities.

Managed by specialists

Your portfolio will be managed by our investment specialists. Just choose your preferred level of risk and they'll take care of the rest.

Easy access to your money

We recommend you aim to invest for at least 5 years. But your money isn't locked away – you can sell your investments and the money will be in your account within 5 days.

Invest in a few steps

You can invest here on the website or from your app. Then, track and manage your portfolio in the app, wherever you are.

More reasons to invest

- Start investing with £50Invest in a portfolio with £50 and choose to set up regular payments after your first investment.

- Invest with an ISAInvest up to £20,000 per tax year with a stocks & shares ISA, without paying UK income or capital gains tax on any growth.

- Join other investorsJoin almost 300,000 people in the UK who are already investing with us

Keep in mind, tax benefits will depend on your circumstances and tax rules may change in the future.

An award-winning way to invest

Invest online or straight through your app

We're delighted to have won awards for how easy it is to invest through our app and for our dedicated investment customer service.

Why not try investing with the app yourself?

Just open scroll past your accounts in the app and select 'Investments' to get started.

Who can apply?

You can invest in a ready-made portfolio if:

- you’ve got an HSBC current account or savings account (excludes Online Bonus Saver and Fixed-rate Saver)

- you’re at least 18 years old

- you're a UK resident

- you’re not a US national/citizen/resident (eg a US passport holder)

- you've got at least £50 to invest

Before you apply

Do you need to tell us about your personal situation?

We want you to be comfortable with any investment choice you make.

So, if you might be experiencing something that could impact your decisions, from a mental or physical health condition to a change in your life at home, you can get in touch with our Wealth team who can better understand your situation and can offer support.

Fees

There's no fee to open a stocks & shares ISA or a general investment account.

There's also no fee to withdraw money from your investments. But there will be ongoing charges, which we'll automatically take each quarter.

Before investing, you can read the 'Costs and Charges' PDF for an estimate of the charges that may apply for that portfolio.

Account fee

This is 0.25% of the value of the investments, taken quarterly from your nominated HSBC account. For example, a £1,000 investment would have a £2.50 account fee.

Fund management charge

This charge varies depending on the fund you choose and is calculated as a percentage of your investment. It is taken by the fund manager, which means you don't have to pay it directly, as it's reflected in the valuation of the fund.

Ready to invest?

Here's how to get started:

1. Decide how you feel about risk

Select the portfolio with the risk level you're most comfortable with. Risk level 1 is the lowest and 5 is the highest. This indicates the investment's potential risk and reward.

2. Choose which account you'd like to apply for

Decide which investment account you'd like to apply for – a stocks & shares ISA or a general investment account (GIA). Alongside your investment account, an Uninvested Cash Account (UCA) will also be opened for you.

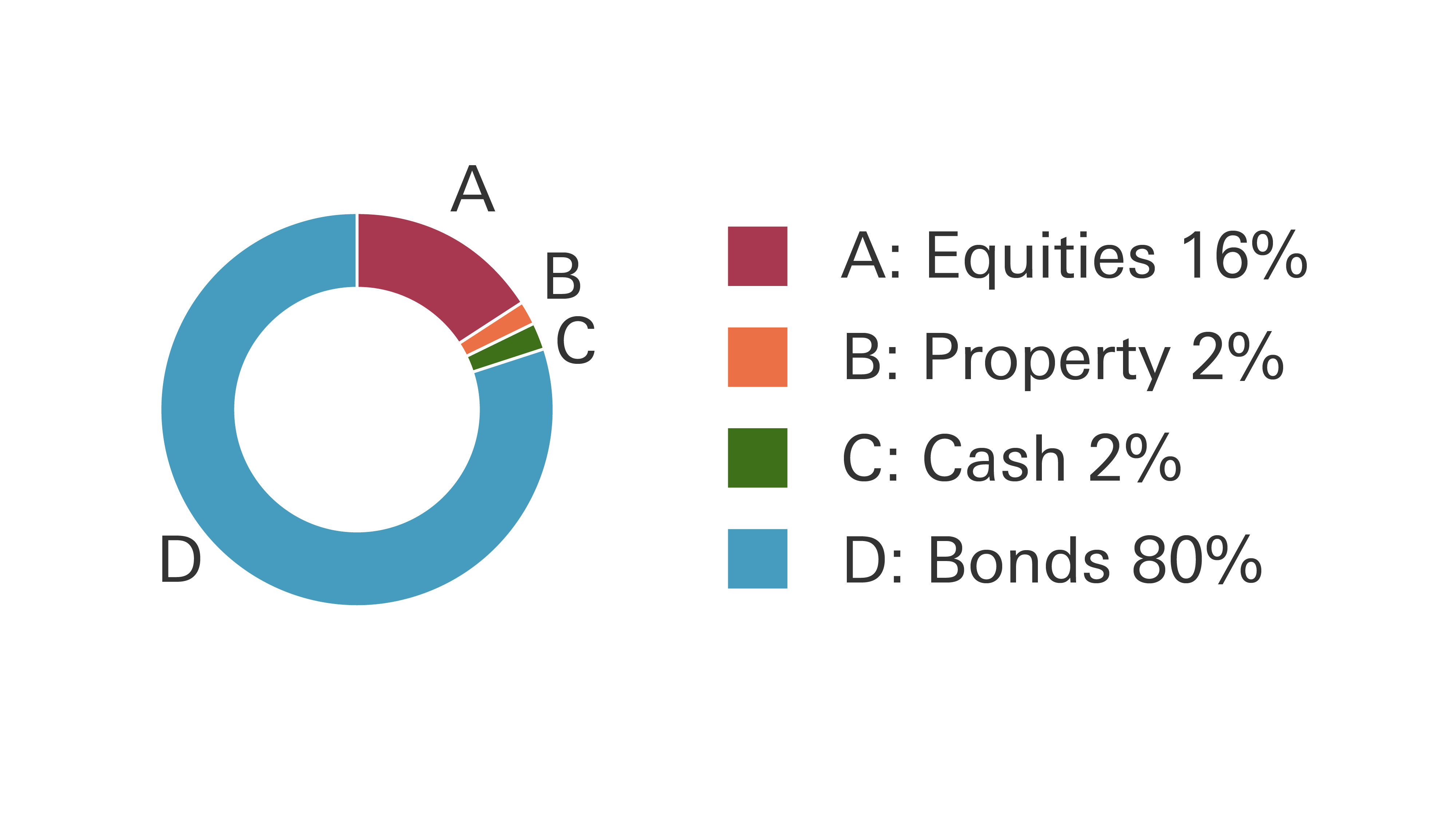

Cautious

Risk level: 1 out of 5

The Cautious fund is invested across global markets with a strong bias towards bonds.

Cautious Portfolio costs and charges

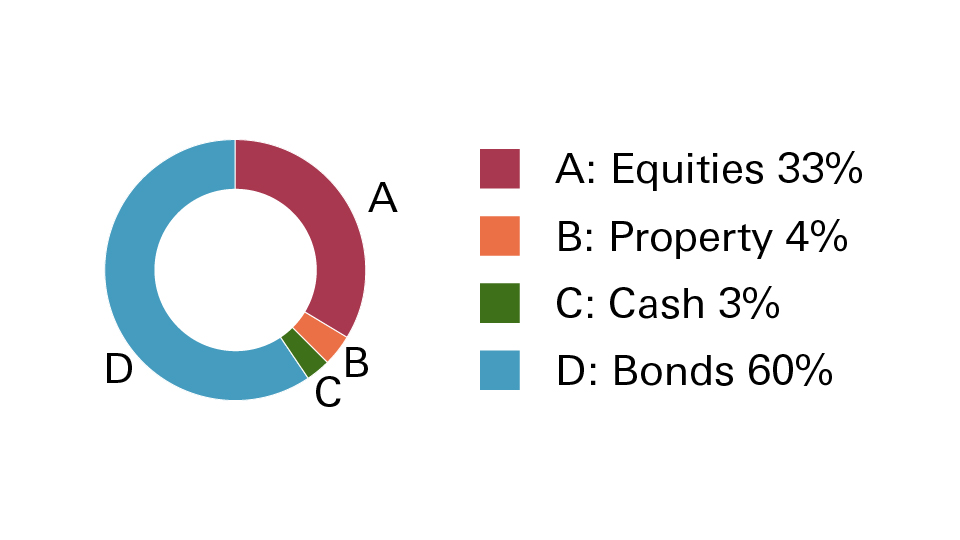

Conservative

Risk level: 2 out of 5

The Conservative fund is invested across global markets with a bias towards bonds.

Conservative Portfolio costs and charges

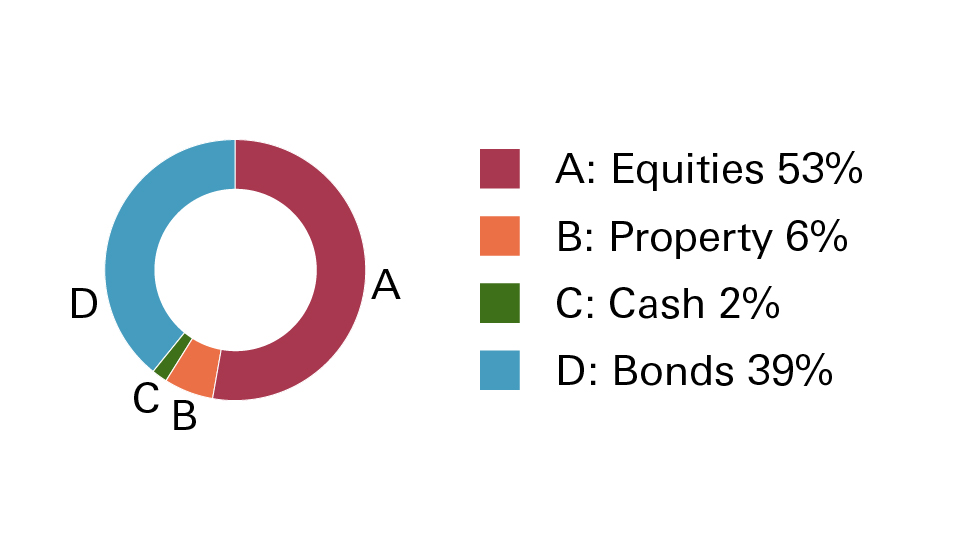

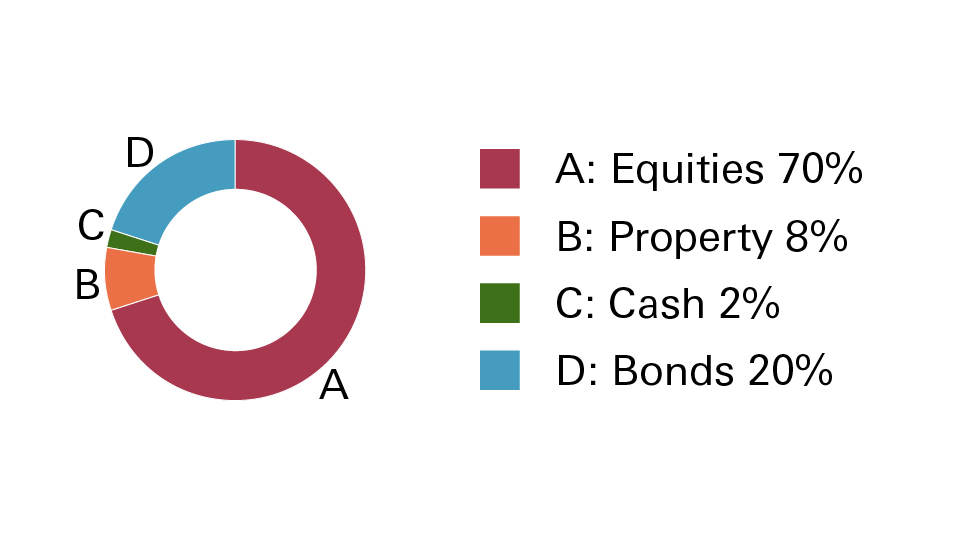

Balanced

Risk level: 3 out of 5

The Balanced fund is invested across global markets with a spread of asset types.

Balanced Portfolio costs and charges

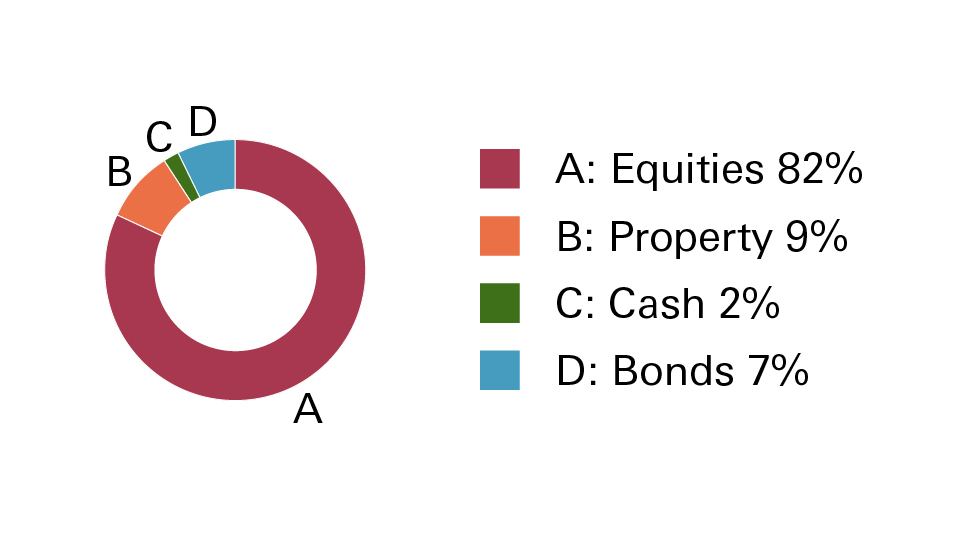

Dynamic

Risk level: 4 out of 5

The Dynamic fund is invested across global markets with a bias towards equities.

Dynamic Portfolio costs and charges

Adventurous

Risk level: 5 out of 5

The Adventurous fund is invested across global markets with a strong bias towards equities.

Adventurous Portfolio costs and charges

The charts are correct as of 30 November 2023. For more information on the latest make-up of the portfolios, you can read the relevant 'Factsheet' PDF.

Frequently asked questions

You might also be interested in

Investment goals

A smart way to invest and track your long-term goals in the latest version of the app.

Investment calculator

Use our calculator to see how your investment could potentially grow over time and under different market conditions.

Online fund platform

Research, buy, sell and switch investments online with our Global Investment Centre.

New to investing?

We're here to help you start investing from £50.