A tax-efficient way you could grow your investments

A stocks & shares ISA (Individual Savings Account) is an account that you can use for your investments.

It's a tax-efficient way to potentially grow your investments, because you can invest up to £20,000 in the current tax year, without paying any UK income tax or capital gains tax on any income or growth.

You can have different ISAs at the same time with multiple providers, but you must stay within the total annual limit of £20,000 across all ISAs.

You can only have one of each type of ISA with HSBC and first direct, such as one stocks & shares ISA and one cash ISA. Check the terms of the account you'd like to open to fully understand what's allowed.

Remember, investing has its downs as well as ups – so you could get back less than you invest. Plus, tax rules can change and any benefits will depend on your individual circumstances.

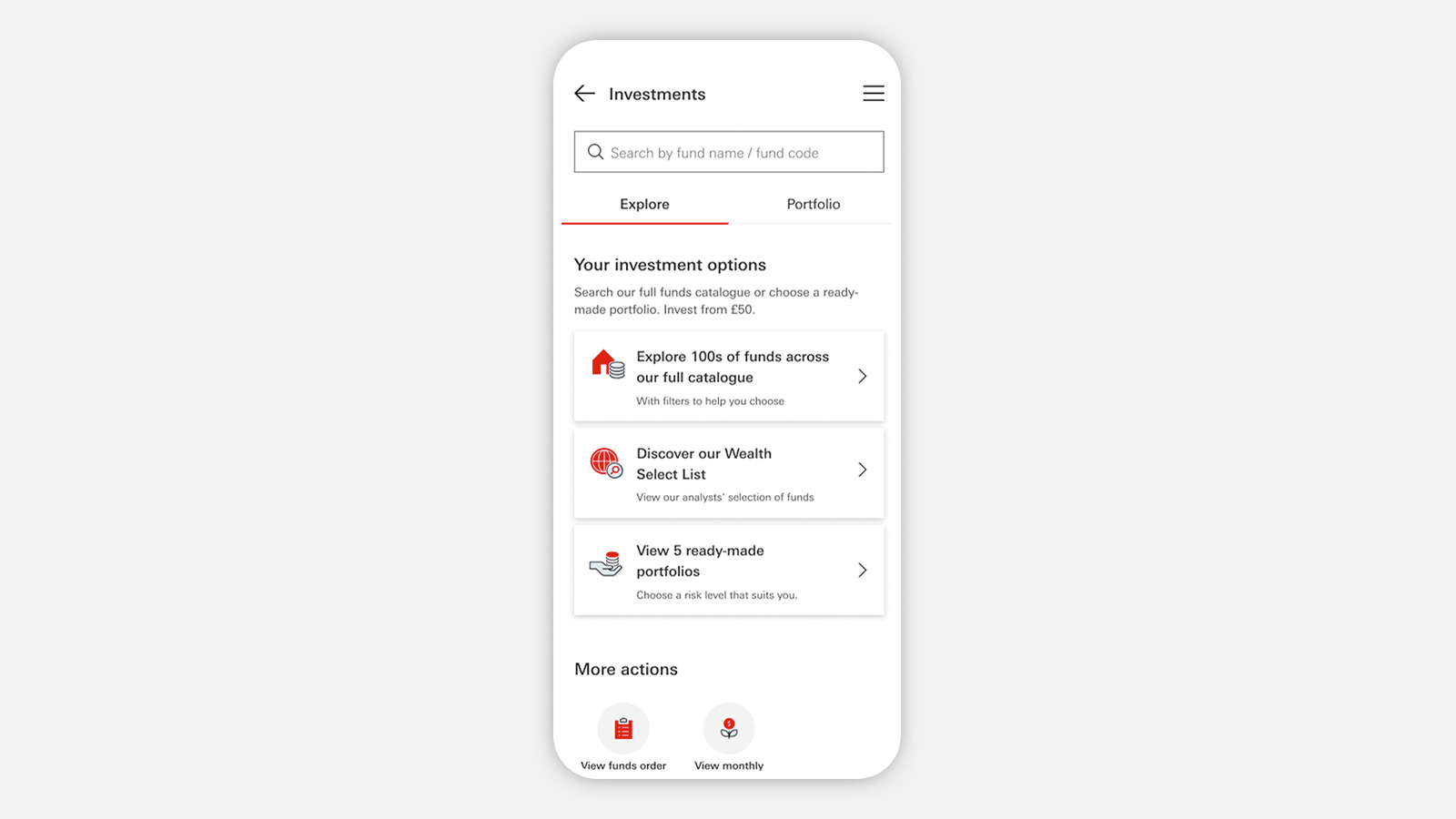

Buy and manage funds on the app

We’ve enhanced the way you manage your investments in the HSBC app, making it even easier to trade, buy and sell funds at the touch of a screen.

Why invest with HSBC?

Investments from around the world

Join over 300,000 people in the UK who already invest with HSBC. Plus, we'll connect you to opportunities around the world.

Invest in a few steps

You can invest here on the website or from your app. Then, track and manage your investment on the go in the app.

A range of options

Whether you're new to investing or more confident with your money, we've got a choice of investments for you.

Easy access to your money

You should aim to invest for at least 5 years. But your money isn't locked away – you can sell your investments and the money will usually be in your account within 4 business days.

Who can open a stocks & shares ISA with HSBC?

You can open a stocks & shares ISA with us if:

- You're at least 18 years old

- You haven’t already subscribed to another HSBC or first direct stocks & shares ISA for the current tax year (you may still have subscribed to a cash ISA with HSBC)

- You’ve not exceeded your £20,000 ISA limit for the current tax year

- You're a UK resident for tax purposes

- You can provide your National Insurance number or confirm you’re not eligible to apply for one

Before you apply

Do you need to tell us about your personal situation?

We want you to be comfortable with any investment choice you make.

So, if you might be experiencing something that could impact your decisions, from a mental or physical health condition to a change in your life at home, you can get in touch with our Wealth team who can better understand your situation and can offer support.

How to open a stocks & shares ISA

To open a stocks & shares ISA with us, you'll first need to have an HSBC current account. You'll also need to meet the eligibility criteria for the investment you'd like to apply for. Fees will apply.

1. Choose what you'd like to invest in

You can invest in one of our 5 ready-made portfolios, or choose your own investments. Plus, get started from £50.

2. Open a stocks & shares ISA

Once you've decided what to invest in, you can open a stocks & shares ISA as your investment account. And, it’ll be free from UK income tax and capital gains tax.

Ready to invest?

Get started by choosing what you'd like to invest in. Investing in a ready-made portfolio is an easy way to get started. Or, you can choose your own investments, or choose from a wide range of funds and shares.

Ready-made portfolios

Choose an HSBC Global Strategy Portfolio that's already made, for an easy way to invest. Each portfolio has a different level of risk, contains a mix of global investments and is managed on your behalf.

Online fund platform

Research, buy, sell and switch investments online with our Global Investment Centre.

Online share dealing account

InvestDirect is our online share dealing account that puts you in control of your investment decisions.

Frequently asked questions

You might also be interested in

Investment calculator

Use our calculator to see how your investment could potentially grow over time and under different market conditions.

What's a stocks & shares ISA?

Understand how an investment ISA works and what to consider.

Investing for beginners

Learn the basics of investing to work out whether it could be right for you.

Saving vs investing

Find out what the difference is between saving and investing, and which could be right for you.