Find out how to use our online fund platform – the Global Investment Centre (GIC).

Track your investments on the go

You can now track the performance of your investments straight through the app. Just select your 'GIC investment account' to see what's new.

Don't yet have the app? Download it now.

| Device restrictions, eligibility and fees apply. |

Using GIC with the HSBC Mobile Banking app

Using GIC with online banking

Go straight to:

- How to access your GIC account with online banking

- How to research funds

- How to buy a fund

- How to set up a regular savings plan

- How to change or cancel a regular savings plan

- How to switch funds

- How to sell funds

- How to check your account fees

- How to use your uninvested cash account (UCA)

- How to open a new GIA or ISA with online banking

- How to reactivate an ISA

- How to transfer an ISA to your account

- How to move funds from your GIA to your ISA

Other questions

Remember, when you manage your investments online, you’ll be making your own decisions without advice. Find out more about our investment advice.

Using GIC with the HSBC Mobile Banking app

What you can manage with the app vs online banking

| What would you like to do? | Mobile app | Online banking |

|---|---|---|

| Invest in a fund | Yes, but only for HSBC Global Strategy Portfolios. | |

| Create an investment goal | ||

| Track your investments | ||

| Set up regular payments | Yes, but only for HSBC Global Strategy Portfolios. | |

| Manage regular payments | ||

| Switch funds | ||

| Sell funds | Yes, but only for HSBC Global Strategy Portfolios, HSBC Global Strategy Sustainable Portfolios, and HSBC Sustainable Multi-Asset Portfolios. | |

| Transfer an ISA | ||

| Reactivate an ISA |

| What would you like to do? | Invest in a fund |

|---|---|

| Mobile app | Yes, but only for HSBC Global Strategy Portfolios. |

| Online banking | |

| What would you like to do? | Create an investment goal |

| Mobile app | |

| Online banking | |

| What would you like to do? | Track your investments |

| Mobile app | |

| Online banking | |

| What would you like to do? | Set up regular payments |

| Mobile app | Yes, but only for HSBC Global Strategy Portfolios. |

| Online banking | |

| What would you like to do? | Manage regular payments |

| Mobile app | |

| Online banking | |

| What would you like to do? | Switch funds |

| Mobile app | |

| Online banking | |

| What would you like to do? | Sell funds |

| Mobile app | Yes, but only for HSBC Global Strategy Portfolios, HSBC Global Strategy Sustainable Portfolios, and HSBC Sustainable Multi-Asset Portfolios. |

| Online banking | |

| What would you like to do? | Transfer an ISA |

| Mobile app | |

| Online banking | |

| What would you like to do? | Reactivate an ISA |

| Mobile app | |

| Online banking |

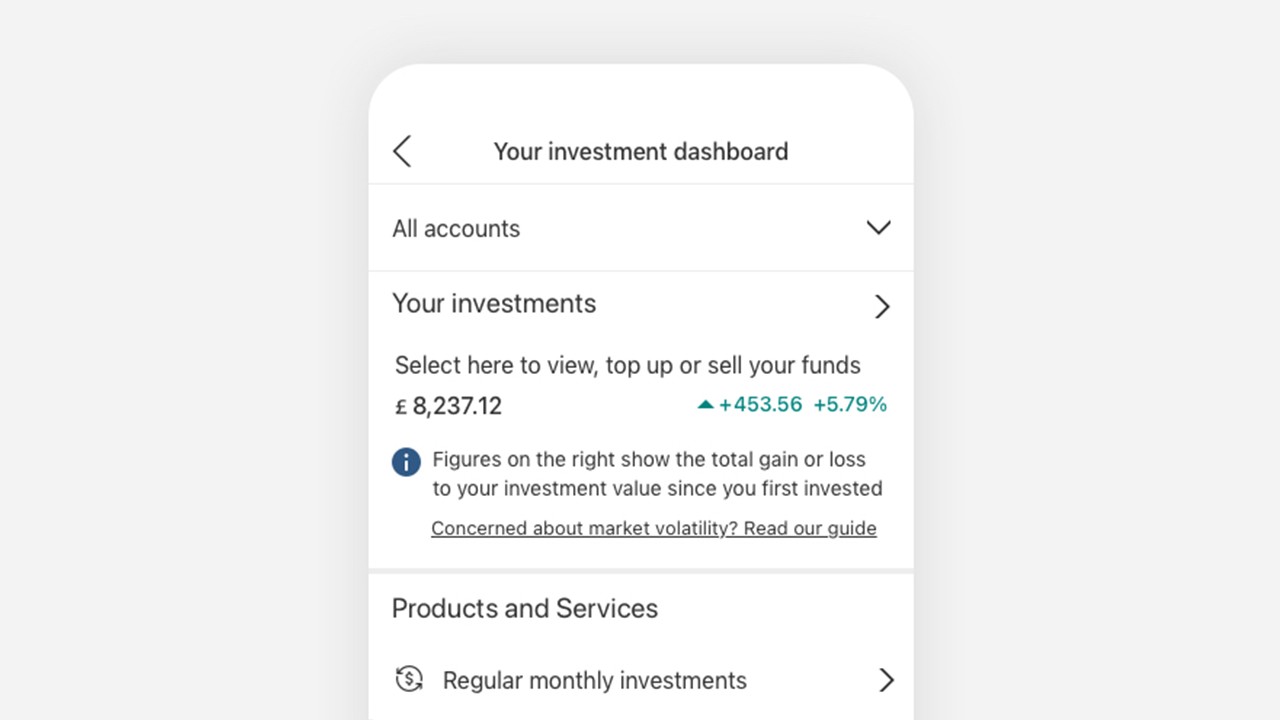

How to access your GIC account on your mobile

- Log on to your HSBC UK Mobile Banking app as normal

- Select your 'GIC Investment account' from your list of accounts on your home screen

- Once selected, you can track the performance of your investments straight through the app

How to open a new GIA or ISA through the app

If you already have a General Investment Account (GIA) and want to open an ISA, or you have an ISA and want to open a GIA, here's how to do so through the app:

- Log on to your HSBC UK Mobile Banking app as normal

- Select your 'GIC Investment account' from your list of accounts

- From 'Your investment dashboard', scroll down to select 'Invest in more funds'

- You can then choose a portfolio and we'll ask you whether you'd like to invest in your existing account or open a new GIA or ISA.

Using GIC with online banking

How to access your GIC account with online banking

- Log on to your online banking as normal

- Find 'GIC Investments' in your list of accounts

- Select 'Investment dashboard' to access your full account

How to research funds

Once you've logged on to the GIC, you can start researching our full range of funds. To do this:

- Select 'Investing’ > 'Discover funds’

To find a specific fund you can either:

- Type in a keyword, the fund name or the Stock Exchange Daily Official List code (SEDOL) in the quick search box, or

- Pick an option to refine your search

You can also search and compare the information and performance of up to 5 funds.

How to buy a fund

When you’re ready to invest, whether that's for the first time or to top-up an existing investment fund, here’s how:

1. Decide if you'd like to invest a new fund, or top-up an existing fund

2. Review fund details

You can review the fund details and find all the documents you might want to read before buying the fund.

When you're ready, select 'Buy' and you'll continue to 'Buy order details'.

3. Place a fund order

To buy a fund, you'll need to enter your:

- Order instruction – this will be selected as 'Buy'

- Chosen investment account – this is usually either your 'Stocks & shares ISA' or your 'General Investment Account'

- Payment account – select which HSBC current or savings account you’d like to make the payment from. Or, if you have money available in your uninvested cash account, you can select this instead

- Amount – enter how much you’d like to invest and select ’Preview order'

4. Review

Review the information to make sure it’s correct. Then, check the tick box at bottom of page to confirm you’ve read the documents and agree to the terms.

5. Confirmation

You’ll see a confirmation that we’ve received your buy instruction. If you’re paying for your funds from an HSBC bank account, we’ll move the amount you’re investing into your uninvested cash account while we process the purchase.

To track your order:

- Select ‘Investments transactions’

- Then 'Order status'

Within 1 business day of purchasing your funds, we’ll send you a contract note. You'll receive this either via the 'My documents' section on your online banking or by post. And within 4 business days, we’ll collect the money from your cash account to complete your purchase.

6. After your purchase is complete

After your purchase is fully complete, your shares will be shown on the 'Your holdings' page under 'Account summary'. This will be regularly updated with recent fund valuations, so you can track the performance of your shares.

How to set up a regular savings plan

You can set up automatic investments instead of logging on each month to make a trade. Follow the steps in How to buy a fund to choose if you'd like to set up automatic investments for a new or existing fund.

1. Review fund details

Once you've chosen a fund that you'd like to set up automatic investments for, review the fund details and find all the documents you might want to read before buying the fund.

When you’re ready, select 'Regular savings plan' at the top of the page.

2. Place a regular savings plan order

You'll need to enter your:

- Regular savings plan name – enter a name that you’ll recognise for example, it could be linked to your investing goal, such as, retirement fund

- Chosen investment account – this is usually either your 'Stocks & shares ISA' or your 'General Investment Account'. To set up a regular savings plan into an ISA Account, your ISA must be active. Find out how to reactivate your ISA

- Payment account – select which HSBC current or savings account you’d like to make the payment from

- Regular savings amount – enter how much you'd like to invest each month

- Regular savings date – select the date you’d like the payment to be taken from your account

- Start month – select the month you want us to collect your first payment and then select ‘Preview order’

3. Review

Review the information to make sure it’s correct. Then, check the tick box at bottom of page to confirm you’ve read the documents and agreed to the terms.

4. Confirmation

We’ll send you confirmation of your regular savings plan. You'll receive this either via the ‘My documents’ section on your online banking or by post.

Each regular savings plan payment invested will appear in your Global Investment Centre statements. You’ll also be able to see the transactions via the ‘Investments transactions’ tab in your online Global Investment Centre.

How to change or cancel a regular savings plan

You can change the amount you invest, the collection date or the account the payment is taken from for your regular savings plan.

To do this:

- Log on to the GIC

- Select ‘Manage regular savings plan' in the ‘Quick Links’

- Select the plan name you'd like to change or cancel - if you can change or cancel the plan yourself, you’ll see ‘Modify’ and ‘Cancel’ buttons

- Once you've followed the steps, you’ll see a confirmation page. We’ll also send you a confirmation either via the ‘My documents’ section on your online banking or by post.

If you don't have the option to 'Modify' or 'Cancel' your regular savings plan, this may be because your plan was set up when you received financial advice from us, or it's associated with a fund that's been discontinued. If this is the case, give us a call and we can help you over the phone instead.

How to switch funds

You can switch from one fund to another if you want to change the balance of your investments. This guide is how to switch funds you’ve chosen yourself. If you want to switch funds you’ve bought through an adviser, call us and we’ll do this for you over the phone.

1. Find the fund

- Select ‘Account summary’ > ‘Your holdings’

- Find the fund you want to switch from and choose ‘Trade’

This will take you to the 'Fund details'.

2. Place an order

Select ‘Switch’ and enter your:

- Order instruction – this will be selected as 'Switch’

- Investment account – choose your 'Stocks & shares ISA' or your 'General Investment Account'

- Amount to switch – select whether you want to ‘Switch all’ or ‘Switch part’ of it. If you'd like to switch part of it, enter how much you’d like to switch, which can be either a GBP amount or an amount of shares. Then, select ‘Continue’.

3. Select a fund to switch to

Either enter the fund code or name in the quick search box, or choose ‘See all available funds’. Then, choose ‘Preview order’.

4. Review

Review the information to make sure it’s correct. Then, check the tick box at bottom of page to confirm you’ve read the documents and agreed to the terms.

5. Confirmation

You’ll see a confirmation that we’ve received your instruction.

Switching trades normally take longer than a 'Buy trade' because we need to sell shares from the existing fund before we can purchase shares from the new fund.

Within 1 business day of switching your funds, we’ll send you a contract note. You'll receive this either via the ‘My documents’ section on your online banking or by post.

To track your switch order, select ‘Investments transactions’ > ‘Order status’.

How to sell funds

Part of managing your own investments is deciding which funds you want to sell and when, so we'll explain how to sell them.

1. Find the fund you want to sell

Select ‘Account summary’ and select ‘Your holdings’. Find the fund you want to sell and click ‘Trade’. This will take you to the 'Funds details' page.

2. Place an order

Select ‘Sell’ from the top of the page and then enter your:

- Order instruction – this will be selected as ‘Sell’

- Investment account – choose your 'Stocks & shares ISA' or your 'General Investment Account'

- Amount to sell – select whether you want to ‘Sell all’ of your current fund or ‘Sell part’ of it. If you'd like to sell a partial amount, enter how much you’d like to sell, which can be either a GBP amount or an amount of shares. Then, select ‘Continue’.

3. Review

Review the information to make sure it’s correct. Then, check the tick box at bottom of page to confirm you’ve read the documents and agreed to the terms.

4. Confirmation

You’ll see a confirmation that we’ve received your instruction.

Within 1 business day of selling your funds, we’ll send you a contract note. You'll receive this either via the ‘My documents’ section on your online banking or by post. The proceeds of the sale will be paid to your uninvested cash account within 4 business days of us receiving your sell order. Remember that uninvested cash accounts pay 0% interest so you may not wish to leave the cash uninvested for a long period of time.

To track your sell order, choose the ‘Investments transactions’ tab, then ‘Order status’.

When you sell fund shares from an ISA Account, the cash you receive in your ISA’s cash account stays within your ISA. This means it retains its tax-efficient status so you can re-invest it into another fund or funds whenever you’re ready.

But remember, if you withdraw cash from your ISA uninvested cash account, it will no longer be contained within an ISA, so any potential ISA-related tax benefits will be lost.

Or, you can transfer the cash out to another ISA, which pays interest on cash.

How to check your account fees

To view your pending and previous quarterly account fees select:

‘Investing’ > ‘Account Fee’

How to use your uninvested cash account (UCA)

Your uninvested cash account (UCA) is linked to your General Investment Account (GIA) or ISA. It's an integral part of the account, so you can’t close it without closing your GIA and/or ISA first.

If you have both a GIA and ISA, you’ll have 2 UCAs – one for each type of account. If you have funds in your ISA UCA, it will count as part of your annual ISA subscription.

Your UCA pays 0% interest, as it's not designed to hold excessive amounts of cash for long periods.

Find out more about how and when you could use your UCA(s).

How to open a new GIA or ISA with online banking

If you already have a General Investment Account (GIA) and want to open an ISA, or you have an ISA and want to open a GIA, here's how to do so with online banking:

- Log on to your online banking as normal

- Find 'GIC Investments' in your list of accounts

- Select 'Investment dashboard' to access your full account

- Select 'Open new account' from the 'Quick links'

How to reactivate an ISA

An ISA can become inactive due to:

- No subscriptions being made in the previous tax year

- A declaration to make subscriptions not being completed yet

- Your country or region of residency changing

How to transfer an ISA to your account

You can transfer any of the following ISAs or holdings from another provider to your Global Investment Centre account:

- Cash ISAs

- Matured Child Trust Funds

- Stocks & Shares ISAs with other providers – either cash or fund holdings (if we offer the same fund as your current provider)

- holdings held outside an ISA (if we offer the same fund as your current provider)

To make a transfer:

- Log on to your GIC account

- Go to ‘Your Portfolio’

- Select ‘Investing’ in the top menu

- Select ‘Transfer funds & ISAs’

- Fill in the application form

Once you've done this, you’ll be shown what to do next. In some cases you may need to print the form, sign it and return it to us by post.

If you'd prefer to receive a printed form, just call us and we’ll send one to you.

How to move funds from your GIA to your ISA

If you have funds in your general investment account (GIA), you could choose to reinvest them in your ISA to take advantage of your yearly ISA allowance. You’ll need to have an active ISA.

To move funds from your GIA to your ISA:

- Sell funds from your GIA. Find out how to sell funds

- Once the funds have sold, the proceeds will be paid into your GIA uninvested cash account within 4 business days

- Move the funds from your GIA to your ISA uninvested cash account

- Buy funds in your ISA, making sure to select ‘ISA uninvested cash account’ as the payment account. Find out how to buy funds

Any other questions?

For more information about your Global Investment Centre account, you can read the Key features or the Terms and conditions.

If you've got a question we've not covered, log on to your Global Investment Centre account and select ‘Chat’ to get in touch.

Or if you'd prefer to speak to one of our team, give us a call on:

Lines are open from 08:00 to 18:00 Monday to Friday, excluding bank holidays.