Stay on top of your money while you study

Going to uni? Our Student Bank Account helps you boss your budget while you're studying, so you can enjoy student life to the full. With no monthly account fee.

- To apply, you'll need to be 18+ and have a confirmed place on a qualifying course at a UK university or college. T&Cs and other eligibility criteria apply.

New to the UK or a non UK resident? Check out our international student account instead.

Here's what you'll get with your Student Bank Account

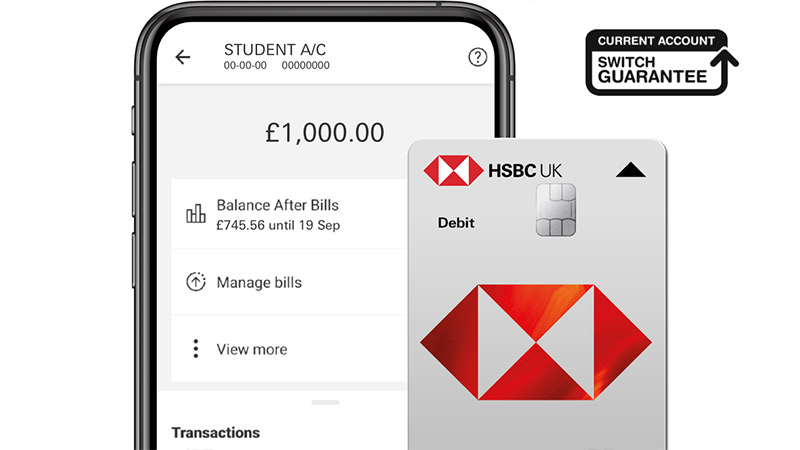

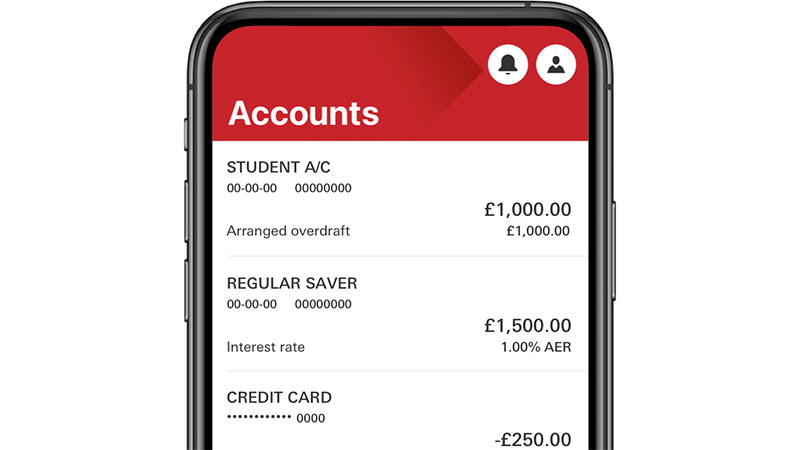

An interest-free arranged overdraft

Get a guaranteed interest-free limit of up to £1,000 when you apply for a Student Account, regardless of what year you're in, which could rise to £3,000 by year 3. Learn more about what you need to know before applying for a Student bank account.

Easy online and mobile banking

We have a range of tools to help you manage your money on your mobile. You can also bank online, by phone or in a branchFootnote link 1.

Access our 5.00% AER / gross Regular Saver

Start saving from just £25 a month with our Regular Saver. Save between £25 and £250 a month for a fixed 12-month term. Withdrawal restrictions apply.Footnote link 2

Representative example

0% EAR (variable), representative 0% APR (variable). Based on an arranged overdraft of £1,000.

How does our overdraft compare? The representative APR shows the cost of borrowing over a year, so you can use it to compare the cost of our overdraft against other overdrafts and ways of borrowing.

Our banking app puts students in control

Our app makes staying on top of your finances a breeze. Convenient, secure and in your pocket.

- Check your balance, make payments and chat to us if you need support

- Manage your arranged overdraft and regular payments like standing orders, Direct Debits and subscriptions

- Pay on the go quickly and securely with Apple Pay, Google Pay or Samsung PayFootnote link 3

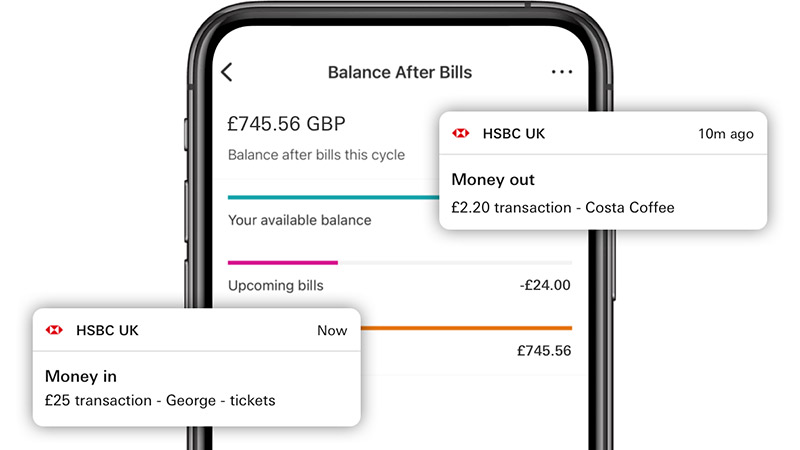

Stay in the know and in control

Keep an eye on your spending and make budgeting easier with our smart money tools.

- Get instant notifications when money goes in or out of your accountFootnote link 4

- See your spending broken down into categories and set targets to help control it with Spending insights and Monthly budgets

- See how much you could have left after bills and regular payments with Balance After Bills

- View your card PIN, temporarily freeze and unfreeze your card, or quickly report it lost or stolen, all via the app

Get a bit more from your money

When you have a student account with HSBC, we'll help you save money in more ways than one.

Get discounts with our home&Away offers programme - Enjoy access to our full range of savings accounts (including some only available to HSBC current account customers)

Things to know before you apply

Ready to apply? Before you do, there are a couple of things you should check you're happy with.

About your optional arranged overdraft

When you apply for this account, you'll have the option to apply for an arranged overdraft.

An arranged overdraft allows you to borrow money (up to an agreed limit) if there’s no money left in your account. This can be useful if you're hit with an unexpected bill, for example.

If a payment would take you past your arranged limit (or if you don’t have one), we may let you borrow using an unarranged overdraft. There's a chance that payments you try to make using an unarranged overdraft may be declined.

You can apply for an arranged overdraft when you open your account, or at any time later. You can ask to increase, remove or reduce your limit at any time in online or mobile banking, by phone or in a branch. Your new limit can't be less than what you owe.

We report account activity, including overdraft usage, to credit reference agencies. An unarranged overdraft lasting more than 30 days could have a negative impact on your credit rating.

Overdrafts are designed for short-term borrowing only, and are subject to status.

Overdraft text alerts

If we’ve got your mobile number, we’ll send you an SMS text alert if you’ve gone overdrawn or we know you’re about to. These alerts are designed to help you manage your overdraft usage and avoid being charged interest.

You can opt out of overdraft text alerts by calling us or asking us in a branch – but remember you’ll be opting out for all your current accounts with us. If you opt out or we don’t have an up-to-date number for you, you could end up paying interest you might otherwise have avoided.

What are the overdraft charges for this account?

We offer an interest-free arranged overdraft of up to £1,000 when you open this account. You can ask for an increase of up to £2,000 in year 2 and £3,000 in year 3, subject to status and how your account has been used.

Representative example: 0% EAR (variable)Footnote link 5Footnote link 8, ear explanation, giving a representative annual percentage rate (APR) of 0% APR (variable)Footnote link 6. Based on arranged overdraft of £1,000.

Footnote link 9, apr explanation.dfsadsad

How does our overdraft compare? The representative APR shows the cost of borrowing over a year, so you can use it to compare the cost of our overdraft against other overdrafts and ways of borrowing.

To find out more, visit our Overdrafts page, where you can find out if you’re eligible for an arranged overdraft and use our overdraft cost calculator.

Who can apply?

You can apply for a Student Bank Account if you:

- are 18 or over

- live in the UK and have lived in the UK, Channel Islands or Isle of Man for the past 3 years

- have proof you've been accepted onto a qualifying course (eg your 16-digit UCAS code)

- have read the important account documents below

If you're returning to do a postgraduate or secondary degree of 1 year or more at a UK university, you must have completed an undergraduate course in the last 3 years.

Apply for your Student Bank Account now

You'll need your 16-digit UCAS status code to hand (if you have one).

Don't have a current account with us?

Apply for your account online in minutes.

New to the UK?

If you've been living in the UK, Channel Islands or Isle of Man for less than 3 years, please apply for an HSBC Bank Account for International Students instead.

Already got a current account with us?

Apply online and we'll upgrade your existing account to a Student Account. Any Direct Debits and standing orders you have will still be in place.

Frequently asked questions

You might also be interested in

Student Credit Card

Enjoy a purpose-built card for existing HSBC Student Bank account holders. Credit is subject to status.

Student guides

Get help on everything from prepping for university to borrowing money as a student.

Offers and discounts

Discover our range of offers on shopping, dining, travel, experiences and much more.

Additional information

- Find out more about the operating systems our app works on.

Regular Saver interest example:

- Put away between £25 and £250 a month for a fixed 12-month term. If you save £250 every month for 12 months at 5.00% AER/gross pa interest rate, you'll earn approximately £81.25 interest (gross).

- AER stands for Annual Equivalent Rate. This shows you what the rate would be if interest were paid and compounded each year. Gross is the rate of interest paid before any tax (where applicable) has been deducted. No partial withdrawals allowed. Withdrawal restrictions apply.

- Apple Pay is a trademark of Apple Inc., registered in the US and other countries. Google Pay is a trademark of Google LLC. Samsung Pay is a registered trademark of Samsung Electronics Co., Ltd.

- You'll need to opt in to receive instant notifications. You can do this in our app. This feature is currently being rolled out and may not yet be available on all devices.

- EAR stands for Effective Annual Rate. This is how all UK banks must show interest rates on their overdrafts, to make it easier for you to compare one bank’s overdraft with another. Please note that it doesn’t include any fees you might be charged in addition to interest.

- APR stands for annual percentage rate. This is the rate at which someone who is borrowing money is charged, calculated over a period of 12 months. It takes into account not just the interest, but also any other charges you may have to pay, as well as any interest-free amount.