Looking for help?

Find answers to your questions and get the latest guidance.

How safe is my money?

When times are tough, knowing your money's safe can be reassuring.

Growing your money

Explore ways you could make the most of your money to help reach your goals.

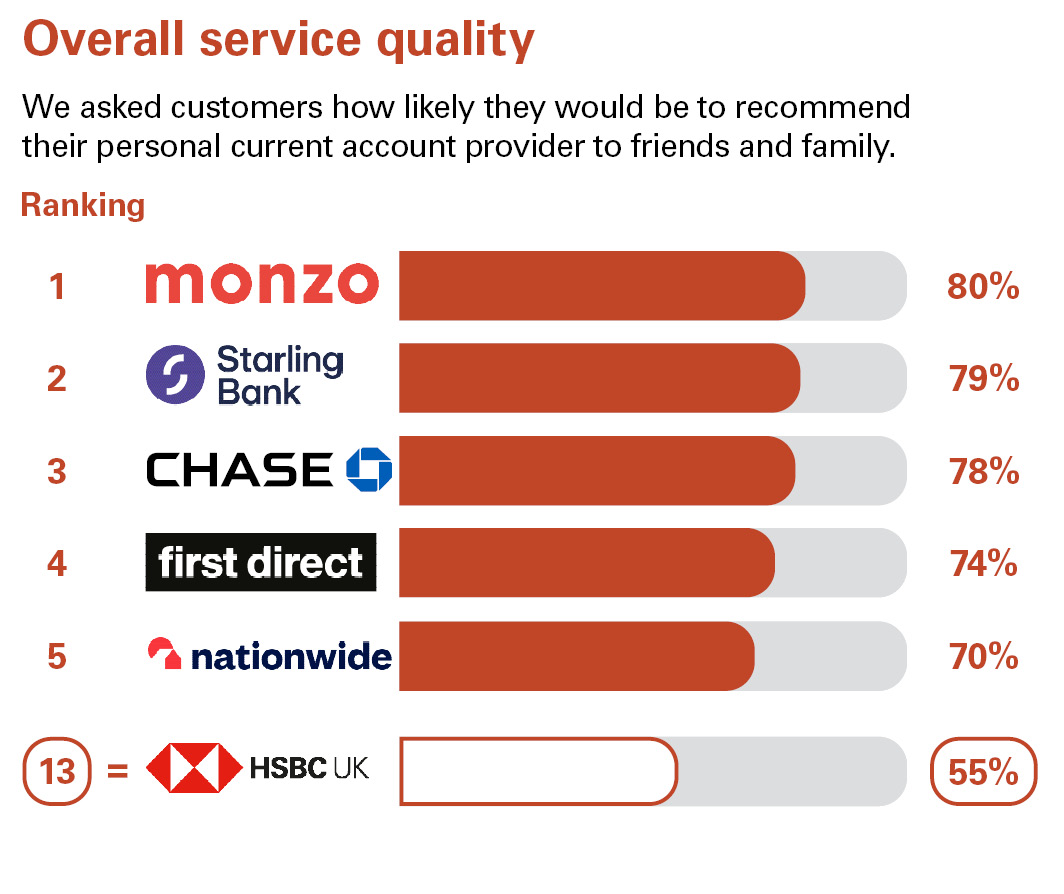

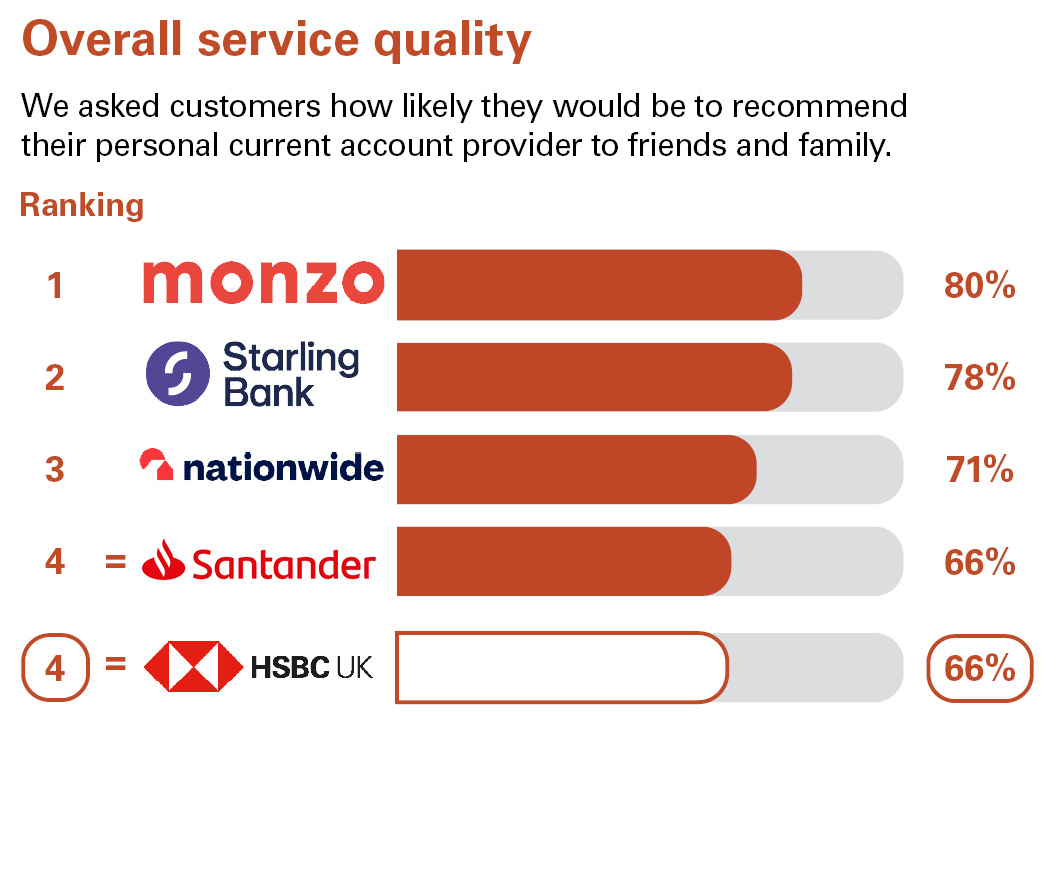

Independent service quality survey results

Personal current accounts

Published August 2024

As part of a regulatory requirement, independent surveys were conducted to ask customers of the largest personal current account providers in Great Britain and Northern Ireland if they would recommend their provider to friends and family. The results represent the view of customers who took part in the survey.

The requirement to publish the Financial Conduct Authority Service Quality Information for personal current accounts can be found on the SQI page.

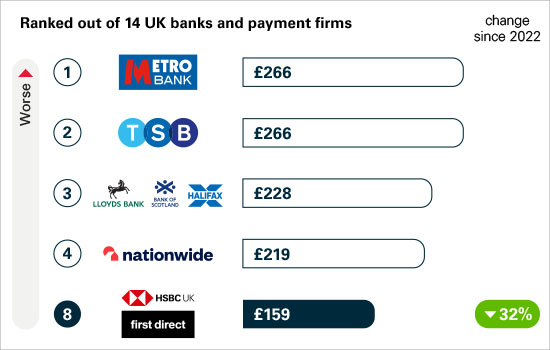

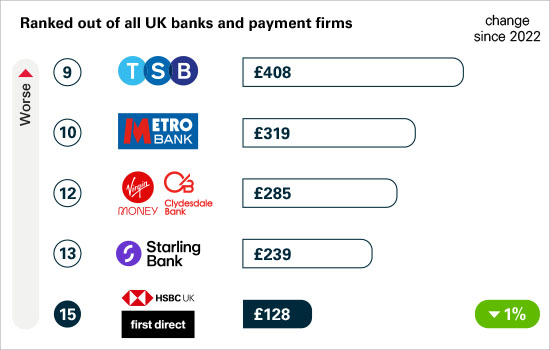

Authorised push payment (APP) scams rankings in 2023

Authorised push payment (APP) scams happen when someone is tricked into transferring money to a fraudster’s bank account.

These charts use data given to the Payment Systems Regulator by major banking groups in the UK in 2023.

You can read the full report by visiting www.psr.org.uk/app-fraud-data

Share of APP fraud refunded

This is the proportion of total APP fraud losses that were reimbursed, ranked out of 14 firms.

APP fraud sent per £million transactions

This is the amount of money sent from the victim’s account to the scammer, ranked out of 14 firms. For example, for every £1 million of HSBC UK and first direct transactions sent in 2023, £159 was lost to APP scams.

APP fraud received per £million transactions: smaller UK banks and payment firms

This is the amount of money received into the scammer’s account from the victim, ranked out of all UK banks and payment firms. For example, for every £1 million received into consumer accounts at Skrill, £18,550 of it was APP scams.

APP fraud received per £million transactions: major UK banks and building societies

This is the amount of money received into the scammer’s account from the victim, ranked out of all UK banks and payment firms. For example, for every £1 million received into consumer accounts at HSBC UK and first direct, £128 of it was APP scams.

Your eligible deposits with HSBC UK Bank plc are protected up to a total of £85,000, or up to £170,000 for joint accounts, by the Financial Services Compensation Scheme, the UK's deposit guarantee scheme.

This limit is applied to the total of any deposits you have with the following: HSBC UK Bank plc, HSBC Private Banking, and first direct.

Any total deposits you hold above the limit between these brands are unlikely to be covered.