An easy, quick way to send and receive money worldwide

An international money transfer is a safe, secure way to send money to a bank account in another country or region. With HSBC you can do it securely via the app or online, at any time and in local currency. Plus, we only use up-to-date exchange rates during market hours.

To send money abroad, you can:

- Use a Global Money Account in the app

- Make an international payment in online banking or the app

- Contact us or visit a branch

You can also receive money into your UK accounts via international payments (except the Global Money account, which can only receive sterling payments). Fees may apply.

International payments in online and mobile banking

Make international payments 24/7 in online banking to 150+ destinations. Fees may apply if using this option.

- Send up to £50,000 (or currency equivalent) online, and up to £10,000 (or currency equivalent) by phone (Premier customers have a higher phone limit[@premier-international-payment-limit-on-mobile])

- Make payments in local currency with real-time rates (in market hours), so you know how much you're sending or receiving

- Pay no HSBC fees for international bank transfers to another HSBC account or euro payments in the European Economic Area (EEA)[@eea-countries]

- If you're sending money in any currency outside the EEA, or to somewhere in the EEA in a currency other than euros, pay a £5 HSBC fee. This fee does not apply if you are a Premier customer, Private Banking customer, or use a Global Money account

- Receive money into your UK accounts via an international transfer

- Track your payment through online and mobile banking

Global Money Account

Make international payments via the HSBC UK Mobile Banking app with a Global Money Account with no HSBC fees.

- Send up to £50,000 per day (or currency equivalent) in 50+ currencies to 200+ countries

- See the estimated arrival time when you send a payment

- Send without HSBC or intermediary bank fees

- Buy online from international retailers

- Add your contactless debit card to your digital wallet

- Store 18 currencies in your Global Money account

- Track your payment within the app

You'll need an eligible HSBC UK current account and the mobile banking app to apply.

Make fee-free global transfers

Stay connected and get a single view of all your worldwide accounts 24/7 wherever you are with Global View[@global-view-and-global-transfers-availability]. Just register for online banking in all the destinations you have an HSBC account to get started.

- Link all your HSBC accounts just 2 days after opening your account outside the UK

- Move up to USD200,000 (or currency equivalent) per day between your global accounts

- Move money in multiple countries and regions[@global-view-and-global-transfers-availability]

- Our trusted global network guarantees secure, automated transfers

Sending and receiving money outside the UK

How do international payments work?

How much does it cost to transfer money internationally?

International payments

Make international payments online

Global Money Account

Log on to the mobile app to open a Global Money Account and start sending money abroad.

If you already have a Global Money Account, log on to the app, select 'Pay or transfer' and then 'Send money internationally' from the Global Money menu.

If you do not currently have the HSBC Mobile Banking app, you can find information on how to download it using the link below:

To apply for a Global Money account you will need to have an active HSBC UK current account (excluding Basic Bank Account, Appointee and MyAccount), a valid email address that is held on our records and have the mobile app (Global Money is only available in the HSBC Mobile Banking app).

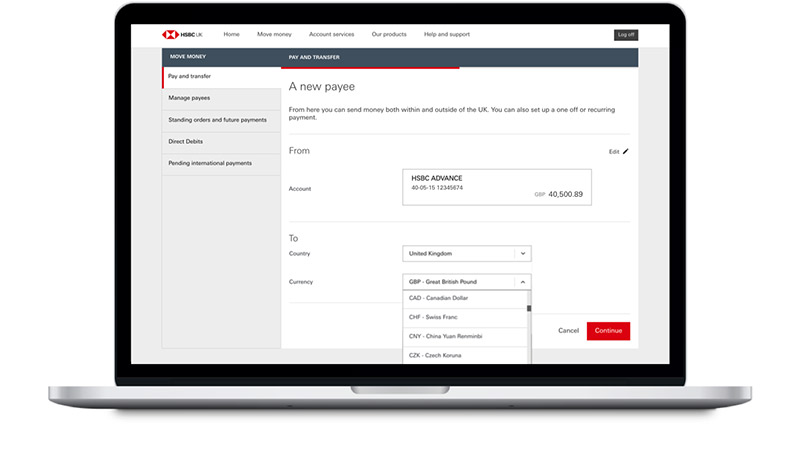

International Payments through Online Banking

If you don't wish to use Global Money, you can also send money abroad through online banking. Fees may apply. To make an international payment you will need to hold any account with HSBC (except a standalone ISA account) and be registered for online banking.

Not registered yet?

Register now to start sending and receiving money worldwide.

Have you considered a Global Money account?

Spend and send money around the world in multiple currencies, with no HSBC fees. Eligibility criteria apply. Non-HSBC fees may apply.

Frequently asked questions

You might also be interested in

Sending money outside the UK: top tips

If you are sending money outside of the UK, there are a few things to consider.

HSBC Currency Account

Send, store and receive up to 14 foreign currencies easily with our multi-currency holding account.

Global transfers

Move money between your HSBC accounts around the world securely and fee-free.